Record Second Quarter and First Half

Revenues

- Second quarter revenues of $131.7

million, up 5% from the second quarter of 2015; first half revenues

of $258.1 million, up 15% from the same period of 2015

- GAAP net income of $0.29 per share

(diluted) for the second quarter and $0.60 per share (diluted) for

the first half of 2016; Adjusted net income of $0.35 per share

(diluted) and $0.69 per share (diluted) for the second quarter and

first half of 2016, respectively

- Board of Directors approved 7% increase

in quarterly dividend to $0.32 per share

- Strong balance sheet with $176.1

million of cash and short-term investments and no debt at

quarter-end

- Continued to execute on organic growth

strategy

- Recruited two Managing Directors in the

U.S. to enhance industry expertise in oil & gas and diversified

industrials

- Announced one Managing Director hire in

Frankfurt to advise clients in Europe’s German speaking

countries

Moelis & Company (“we” or the “Firm”) (NYSE:MC) today

reported financial results for the second quarter ended June 30,

2016. The Firm’s total revenues for the second quarter were a

record $131.7 million, representing an increase of 5% from the

prior year period. The Firm reported second quarter 2016 GAAP net

income of $26.2 million, or $0.29 per share (diluted). On an

Adjusted basis, the Firm reported net income of $19.8 million or

$0.35 per share (diluted) for the second quarter of 2016, as

compared with $20.6 million or $0.37 per share (diluted) in the

prior year period.

First half 2016 total revenues were $258.1 million as compared

with $225.3 million in the first half of 2015, representing our

largest first half of revenues on record and an increase of 15%

from the prior year period. GAAP net income for the period was

$51.8 million, or $0.60 per share (diluted). On an Adjusted basis,

the Firm reported net income of $39.5 million or $0.69 per share

(diluted) for the first half of 2016, as compared with $36.0

million or $0.65 per share (diluted) in the prior year period.

“Our record second quarter revenues represent the fourth

consecutive quarter of year over year revenue growth and

demonstrate the strength of our model against the backdrop of a

slower global M&A environment. Our M&A-related activity was

strong during the quarter, and our restructuring activity continues

to grow, contributing to a solid pipeline of clients who are

evaluating strategic alternatives,” said Ken Moelis, Chairman and

Chief Executive Officer.

“Today we announced a 7% increase in our quarterly dividend to

$0.32 per share, representing the third increase in our regular

dividend from the time of our IPO. We also invested in the firm

with the recent announcements of three new MD hires. Our model is

durable, our advisory practice is diverse, and our balance sheet is

strong. As a result, we remain confident in our ability to grow the

franchise while continuing to distribute earnings to our

shareholders.”

The Firm’s revenues and net income can fluctuate materially

depending on the number, size and timing of completed transactions

on which it advised as well as other factors. Accordingly,

financial results in any particular quarter may not be

representative of future results over a longer period of time.

Currently 38% of the operating partnership (Moelis & Company

Group LP) is owned by the corporate partner (Moelis & Company)

and is subject to corporate U.S. federal and state income tax. The

remaining 62% is owned by other partners of Moelis & Company

Group LP and is primarily subject to tax at the partner level

(except for certain state and local and foreign income taxes). The

Adjusted results included herein remove the impact of compensation

expenses specifically related to the Firm’s IPO awards, and apply

the corporate tax rate to all earnings under the assumption that

all outstanding Class A partnership units of Moelis & Company

Group LP have been exchanged into Class A common stock of Moelis

& Company.

The Firm has modified the description of its unaudited

non-generally accepted accounting principles (“non-GAAP”) measure

presented in its quarterly earnings release and other supplementary

information from “Adjusted Pro Forma” to “Adjusted.” This

modification impacted the descriptions only. The amounts and

principles used to derive the Adjusted data have been consistently

applied. We believe the Adjusted results, when presented together

with comparable GAAP results, are useful to investors to compare

our performance across periods and to better understand our

operating results. A reconciliation between our GAAP results and

our Adjusted results is presented in the Appendix to this press

release.

GAAP and Adjusted

(non-GAAP) Selected Financial Data (Unaudited)

U.S. GAAP Adjusted (non-GAAP)* Three

Months Ended June 30, ($ in thousands except per share

data) 2016 2015

2016 vs. 2015

Variance

2016 2015

2016 vs. 2015

Variance

Revenues $ 131,725 $ 125,873 5 % $ 131,725 $ 125,873 5 %

Income (loss) before income taxes 30,926 32,934 -6 % 32,788

34,321 -4 % Provision for income taxes 4,721 6,079

-22 % 12,951 13,729 -6 %

Net income (loss)

26,205 26,855 -2 % 19,837 20,592 -4 % Net income (loss)

attributable to noncontrolling interests 19,312

19,724 -2 % - - N/M Net income (loss)

attributable to Moelis & Company $ 6,893 $ 7,131 -3 % $ 19,837

$ 20,592 -4 % Diluted earnings per share $ 0.29 $ 0.34 -15 %

$ 0.35 $ 0.37 -5 % N/M = not meaningful * See Appendix for a

reconciliation of GAAP to Adjusted (non-GAAP)

U.S.

GAAP Adjusted (non-GAAP)* Six Months Ended June

30, ($ in thousands except per share data) 2016

2015

2016 vs. 2015

Variance

2016 2015

2016 vs. 2015

Variance

Revenues $ 258,089 $ 225,285 15 % $ 258,089 $ 225,285 15 %

Income (loss) before income taxes 61,989 57,195 8 % 65,225

60,042 9 % Provision for income taxes 10,165 10,379

-2 % 25,764 24,017 7 %

Net income (loss)

51,824 46,816 11 % 39,461 36,025 10 % Net income (loss)

attributable to noncontrolling interests 37,961

34,349 11 % - - N/M Net income (loss)

attributable to Moelis & Company $ 13,863 $ 12,467 11 % $

39,461 $ 36,025 10 % Diluted earnings per share $ 0.60 $

0.59 2 % $ 0.69 $ 0.65 6 % N/M = not meaningful * See

Appendix for a reconciliation of GAAP to Adjusted (non-GAAP)

Revenues

For the second quarter of 2016, revenues were $131.7 million as

compared with $125.9 million in the second quarter of 2015,

representing an increase of 5%. This compares favorably with a 23%

decrease in the number of global completed M&A transactions in

the same period1. The increase in revenues was primarily driven by

strong M&A activity, including higher average fees earned per

completed M&A transaction.

For the first half of 2016, revenues were $258.1 million as

compared with $225.3 million in the same period in 2015,

representing an increase of 15%. We advised 184 total clients in

the first half of 2016 as compared with 168 clients during the same

period in the prior year.

We continued to execute on our strategy of profitable expansion.

Since our last earnings release, we hired two Managing Directors in

the U.S. who will strengthen our industry expertise in oil &

gas and diversified industrials. We also strengthened our regional

coverage with a senior hire in Frankfurt who will provide financial

and strategic advice to clients across the German-speaking region

and the rest of Europe. These individuals will join the Firm in the

third quarter of 2016.

1 Source: Thomson Financial as of July 6, 2016; includes all

transactions greater than $100 million in value

Expenses

The following tables set forth information relating to the

Firm’s operating expenses, which are reported net of client expense

reimbursements.

U.S. GAAP Adjusted (non-GAAP)* Three

Months Ended June 30, ($ in thousands) 2016

2015

2016 vs. 2015Variance

2016 2015

2016 vs. 2015Variance

Expenses Compensation and benefits $ 78,198 $ 69,663

12% $ 76,336 $ 68,276 12% % of revenues 59% 55% 58% 54%

Non-compensation expenses $ 22,968 $ 23,438 -2% $ 22,968 $ 23,438

-2% % of revenues 17% 19% 17% 19% Total operating expenses $

101,166 $ 93,101 9% $ 99,304 $ 91,714 8% % of revenues 77% 74% 75%

73% * See Appendix for a reconciliation of GAAP to Adjusted

(non-GAAP)

U.S. GAAP Adjusted

(non-GAAP)* Six Months Ended June 30, ($ in

thousands) 2016 2015

2016 vs. 2015Variance

2016 2015

2016 vs. 2015Variance

Expenses Compensation and benefits $ 152,866 $

125,056 22% $ 149,630 $ 122,209 22% % of revenues 59% 56% 58% 54%

Non-compensation expenses $ 45,773 $ 46,076 -1% $ 45,773 $ 46,076

-1% % of revenues 18% 20% 18% 20% Total operating expenses $

198,639 $ 171,132 16% $ 195,403 $ 168,285 16% % of revenues 77% 76%

76% 75% * See Appendix for a reconciliation of GAAP to

Adjusted (non-GAAP)

Total operating expenses on a GAAP basis were $101.2 million for

the second quarter and $198.6 million for the first half of 2016.

On an Adjusted basis, operating expenses were $99.3 million for the

second quarter of 2016 as compared with $91.7 million for the

second quarter of 2015, and $195.4 million for the first half as

compared with $168.3 million in the prior year period. The increase

in operating expenses in 2016 resulted from increased compensation

and benefits expenses.

Compensation and benefits expenses were $78.2 million on a GAAP

basis in the second quarter and $152.9 million for the first half

of 2016. Adjusted compensation and benefits expenses (which exclude

the amortization of IPO awards for both 2015 and 2016) were $76.3

million and $149.6 million for the second quarter and first half of

2016, respectively, as compared with $68.3 million and $122.2

million for the second quarter and first half of 2015,

respectively. The Adjusted compensation and benefits ratio

increased from 54% in the second quarter and first half of 2015 to

58% of revenues in the current year periods. The increased

compensation ratio reflects an additional tranche of equity

amortization expense arising from the 2015 equity incentive grants

made in early 2016 as well as modified vesting terms associated

with that equity. We remain committed to our targeted long-term

compensation ratio level of 58% of revenues.

Non-compensation expenses on a GAAP and Adjusted basis were

$23.0 million for the second quarter of 2016 as compared with $23.4

million for the second quarter of 2015. Our non-compensation

expense ratio decreased to 17% from 19% in the same period of the

prior year. For the first half of 2016, GAAP and Adjusted

non-compensation expenses were $45.8 million as compared with $46.1

million for the same period of the prior year, and the

non-compensation expense ratio decreased to 18% from 20%, driven by

increased revenues.

Provision for Income Taxes

The corporate partner (Moelis & Company) currently owns 38%

of the operating partnership (Moelis & Company Group LP) and is

subject to corporate U.S. federal and state income tax. Income on

the remaining 62% continues to be subject to New York City

unincorporated business tax and certain foreign income taxes and is

accounted for at the partner level through the non-controlling

interests line item. For Adjusted purposes, we have assumed all

outstanding Class A partnership units of Moelis & Company Group

LP to have been exchanged into Class A common stock of Moelis &

Company such that 100% of the Firm’s second quarter 2016 income was

taxed at our corporate effective tax rate of 39.5%, versus 40.0% in

the prior year period.

Capital Management and Balance Sheet

Moelis & Company continues to maintain a strong financial

position, and as of June 30, 2016, we held cash and short term

investments of $176.1 million and had no debt or goodwill on our

balance sheet.

The Board of Directors of Moelis & Company has declared a

quarterly dividend of $0.32 per share to be paid on September 6,

2016 to common stockholders of record on August 22, 2016.

Earnings Call

We will host a conference call beginning at 5:00pm ET on

Wednesday, August 3, 2016, accessible via telephone and the

internet. Ken Moelis, Chairman and Chief Executive Officer, and Joe

Simon, Chief Financial Officer, will review our second quarter 2016

financial results. Following the review, there will be a question

and answer session.

Investors and analysts may participate in the live conference

call by dialing 1-877-510-3938 (domestic) or 1-412-902-4137

(international) and referencing the Moelis & Company Second

Quarter 2016 Earnings Call. Please dial in 15 minutes before the

conference call begins. The conference call will also be accessible

as a listen-only audio webcast through the Investor Relations

section of the Moelis & Company website at www.moelis.com.

For those unable to listen to the live broadcast, a replay of

the call will be available for one month via telephone starting

approximately one hour after the live call ends. The replay can be

accessed at 1-877-344-7529 (domestic) or 1-412-317-0088

(international); the conference number is 10088331.

About Moelis &

Company

Moelis & Company is a leading global independent investment

bank that provides innovative strategic advice and solutions to a

diverse client base, including corporations, governments and

financial sponsors. The Firm assists its clients in achieving their

strategic goals by offering comprehensive integrated financial

advisory services across all major industry sectors. Moelis &

Company’s experienced professionals advise clients on their most

critical decisions, including mergers and acquisitions,

recapitalizations and restructurings, capital markets transactions

and other corporate finance matters. The Firm serves its clients

with about 650 employees based in 17 offices in North and South

America, Europe, the Middle East, Asia and Australia. For further

information about Moelis & Company, please visit

www.moelis.com.

Forward-Looking

Statements

This press release contains forward-looking statements, which

reflect the Firm’s current views with respect to, among other

things, its operations and financial performance. You can identify

these forward-looking statements by the use of words such as

“outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “seeks,” “target,” “approximately,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates” or the negative

version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. For a further discussion

of such factors, you should read the Firm’s filings with the

Securities and Exchange Commission. The Firm undertakes no

obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise.

Non-GAAP Financial

Measures

Adjusted results are a non-GAAP measure which better reflect

management’s view of operating results. We believe that the

disclosed Adjusted measures and any adjustments thereto, when

presented in conjunction with comparable GAAP measures, are useful

to investors to understand the Firm’s operating results by removing

the significant accounting impact of one-time charges associated

with the Firm’s IPO and assuming all Class A partnership units have

been exchanged into Class A common stock. These measures should not

be considered a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. A

reconciliation of GAAP results to Adjusted results is presented in

the Appendix.

Appendix

GAAP Consolidated Statement of Operations (Unaudited)

GAAP Reconciliation to Adjusted (non-GAAP) Financial Information

(Unaudited)

Moelis & Company

GAAP Consolidated Statement of

Operations

Unaudited

(dollars in thousands, except for share

and per share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2016 2015 2016 2015

Revenues $ 131,725 $ 125,873 $ 258,089 $ 225,285

Expenses Compensation and benefits 78,198 69,663

152,866 125,056 Occupancy 6,287 3,715 10,845 7,392 Professional

fees 2,511 4,143 4,747 7,697 Communication, technology and

information services 5,309 4,440 10,605 8,541 Travel and related

expenses 5,831 5,131 11,962 10,744 Depreciation and amortization

806 688 1,542 1,308 Other expenses 2,224 5,321

6,072 10,394 Total expenses 101,166

93,101 198,639 171,132

Operating income (loss) 30,559 32,772 59,450 54,153 Other

income (expenses) 101 (33 ) 204 (18 ) Income (loss) from equity

method investments 266 195 2,335

3,060

Income (loss) before income taxes 30,926 32,934

61,989 57,195 Provision for income taxes 4,721 6,079

10,165 10,379

Net income (loss)

26,205 26,855 51,824 46,816 Net income (loss) attributable

to noncontrolling interests 19,312 19,724

37,961 34,349 Net income (loss) attributable

to Moelis & Company $ 6,893 $ 7,131 $ 13,863 $ 12,467

Weighted-average shares of Class A common

stock outstanding

Basic 20,745,043 19,978,108 20,654,657

19,961,286 Diluted 23,618,093

21,088,220 23,052,255 21,144,161 Net

income (loss) attributable to holders of shares of Class A common

stock per share Basic $ 0.33 $ 0.36 $ 0.67 $ 0.62

Diluted $ 0.29 $ 0.34 $ 0.60 $ 0.59

Moelis & Company

Reconciliation of GAAP to Adjusted

(non-GAAP) Financial Information

Unaudited

(dollars in thousands, except share and

per share data)

Three Months Ended June 30, 2016 Adjusted

Items GAAP Adjustments Adjusted

(non-GAAP)

Compensation and benefits $ 78,198 ($1,862 ) (a) $ 76,336

Income (loss) before income taxes 30,926 1,862 32,788

Provision for income taxes 4,721 8,230 (b)

12,951

Net income (loss) 26,205 (6,368 ) 19,837

Net income (loss) attributable to noncontrolling interests

19,312 (19,312 ) - Net income (loss)

attributable to Moelis & Company $ 6,893 $ 12,944 $

19,837

Weighted-average shares of Class A common

stock outstanding

Basic 20,745,043 33,768,672 (b)

54,513,715 Diluted 23,618,093 33,768,672 (b)

57,386,765 Net income (loss) attributable to holders of

shares of Class A

common stock per share

Basic $ 0.33 $ 0.36 Diluted $ 0.29 $ 0.35 (a) Expense

associated with the amortization of Restricted Stock Units (“RSUs”)

and stock options granted in connection with the IPO. In accordance

with GAAP, amortization expense of RSUs and stock options granted

in connection with the IPO will be recognized over the five year

vesting period; we will continue to adjust for this expense due to

the one-time nature of the grant. (b) Assumes all

outstanding Class A partnership units have been exchanged into

Class A common stock. Accordingly, an adjustment has been made such

that 100% of the Firm’s income is taxed at the corporate effective

tax rate of 39.5% for the period presented.

Three Months Ended June 30, 2015 Adjusted

Items GAAP Adjustments Adjusted

(non-GAAP)

Compensation and benefits $ 69,663 ($1,387 ) (a) $ 68,276

Income (loss) before income taxes 32,934 1,387 34,321

Provision for income taxes 6,079

7,650

(b) 13,729

Net income (loss)

26,855

(6,263)

20,592 Net income (loss) attributable to noncontrolling

interests 19,724

(19,724)

- Net income (loss) attributable to Moelis &

Company $ 7,131 $

13,461

$ 20,592

Weighted-average shares of Class A common

stock outstanding

Basic 19,978,108 34,160,239 (b)

54,138,347 Diluted 21,088,220 34,160,239 (b)

55,248,459 Net income (loss) attributable to holders of

shares of Class A

common stock per share

Basic $ 0.36 $ 0.38 Diluted $ 0.34 $ 0.37 (a) Expense

associated with the amortization of RSUs and stock options granted

in connection with the IPO. In accordance with GAAP, amortization

expense of RSUs and stock options granted in connection with the

IPO will be recognized over the five year vesting period; we will

continue to adjust for this expense due to the one-time nature of

the grant. (b) Assumes all outstanding Class A partnership

units have been exchanged into Class A common stock. Accordingly,

an adjustment has been made such that 100% of the Firm’s income is

taxed at the corporate effective tax rate of 40.0% for the period

presented.

Six Months Ended June 30,

2016 Adjusted Items GAAP

Adjustments Adjusted

(non-GAAP)

Compensation and benefits $ 152,866 ($3,236 ) (a) $ 149,630

Income (loss) before income taxes 61,989 3,236 65,225

Provision for income taxes 10,165 15,599 (b)

25,764

Net income (loss) 51,824 (12,363 ) 39,461

Net income (loss) attributable to noncontrolling interests

37,961 (37,961 ) - Net income (loss)

attributable to Moelis & Company $ 13,863 $ 25,598 $

39,461

Weighted-average shares of Class A common

stock outstanding

Basic 20,654,657 33,859,058 (b)

54,513,715 Diluted 23,052,255 33,859,058 (b)

56,911,313 Net income (loss) attributable to holders of

shares of Class A

common stock per share

Basic $ 0.67 $ 0.72 Diluted $ 0.60 $ 0.69 (a) Expense

associated with the amortization of RSUs and stock options granted

in connection with the IPO. In accordance with GAAP, amortization

expense of RSUs and stock options granted in connection with the

IPO will be recognized over the five year vesting period; we will

continue to adjust for this expense due to the one-time nature of

the grant. (b) Assumes all outstanding Class A partnership

units have been exchanged into Class A common stock. Accordingly,

an adjustment has been made such that 100% of the Firm’s income is

taxed at the corporate effective tax rate of 39.5% for the period

presented.

Six Months Ended June 30,

2015 Adjusted Items GAAP

Adjustments Adjusted

(non-GAAP)

Compensation and benefits $ 125,056 ($2,847 ) (a) $ 122,209

Income (loss) before income taxes 57,195 2,847 60,042

Provision for income taxes 10,379 13,638 (b)

24,017

Net income (loss) 46,816 (10,791 ) 36,025

Net income (loss) attributable to noncontrolling interests

34,349 (34,349 ) - Net income (loss)

attributable to Moelis & Company $ 12,467 $ 23,558 $

36,025

Weighted-average shares of Class A common

stock outstanding

Basic 19,961,286 34,177,061 (b)

54,138,347 Diluted 21,144,161 34,177,061 (b)

55,321,222 Net income (loss) attributable to holders of

shares of Class A

common stock per share

Basic $ 0.62 $ 0.67 Diluted $ 0.59 $ 0.65 (a) Expense

associated with the amortization of RSUs and stock options granted

in connection with the IPO. In accordance with GAAP, amortization

expense of RSUs and stock options granted in connection with the

IPO will be recognized over the five year vesting period; we will

continue to adjust for this expense due to the one-time nature of

the grant. (b) Assumes all outstanding Class A partnership

units have been exchanged into Class A common stock. Accordingly,

an adjustment has been made such that 100% of the Firm’s income is

taxed at the corporate effective tax rate of 40.0% for the period

presented.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160803006612/en/

Moelis & CompanyInvestor Relations:Michele Miyakawa, + 1 310

443 2344michele.miyakawa@moelis.comorMedia:Andrea Hurst, + 1 212

883 3666m: +1 347 583 9705andrea.hurst@moelis.com

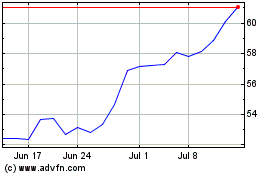

Moelis (NYSE:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

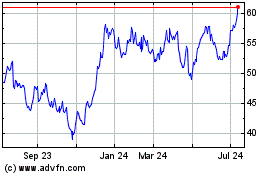

Moelis (NYSE:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024