Millennials Change the Complexion of the Beauty Business

May 03 2016 - 7:45PM

Dow Jones News

By Sharon Terlep

The latest results from Estée Lauder Cos. and Coty Inc. exposed

a shift in the beauty business: Millennials aren't willing to

invest in expensive skin creams that have been big profit drivers.

Instead, younger consumers want products that provide more

immediate results.

"Millennials are much more about immediate results than saving

for the future," Estée Lauder CEO Fabrizio Freda said in an

interview. "The 30-year-old today gets more photographs of

themselves in a day than their mother did in a year, so they care

about what their skin looks like now, not when they are 40."

The shift threatens revenues of companies that have long

depended on anti-aging products with names like "Hope in a Jar" and

"Repairwear Laser Focus" to drive sales. "There is nothing in the

industry more profitable than skin care," said Deutsche Bank

analyst William Schmitz.

Shares of Estée Lauder fell 4% to $93.29, while Coty tumbled

8.7% to $28.35 at the end of trading on Tuesday in New York.

Millennials, people born in the 1980s and 1990s, are an

important demographic that consumer-products companies are trying

to figure out. The group comprises about one-quarter of the U.S.

population and last year eclipsed baby boomers as the largest

generation.

In the U.S., sales of anti-aging products such as serums and

face creams rose just 2% last year to $3.6 billion, according to

Euromonitor. Meanwhile, makeup sales climbed 8% to $5.1

billion.

The trend weighed on Estée Lauder's financial results for its

fiscal third quarter, the company said Tuesday. Sales of skin-care

products, particularly its Estée Lauder and Clinique brands, fell

2.5%, while the rest of the business notched gains. Makeup sales

rose 7.3%, driven by growth in MAC, Smashbox and Tom Ford. Currency

fluctuations offset gains throughout the company.

Overall, revenue at Estée Lauder fell 9% in the three months

ended March 31 to $4.9 billion. Earnings dropped 62% to $369

million because the results didn't includes gains from

divestitures.

Coty, whose brands include OPI and Philosophy, on Tuesday

reported that sales fell 9% for its skin and body-care unit, while

cosmetic sales rose 11%. The company posted a $26.8 million

quarterly loss as acquisition-related expenses offset a 1.8%

increase in sales to $950.7 million.

The company spent $1 billion to buy a Brazilian beauty products

business in February. It also has agreed to pay $13 billion for

CoverGirl and dozens of beauty brands from Procter & Gamble

Co.

Coty interim Chief Executive Bart Becht said younger buyers also

have different shopping patterns preferring to buy beauty products

online, as well as being more drawn to less mainstream brands.

"Generally they are looking for more natural products and more

authentic brands," he said.

Procter & Gamble has struggled to revitalize its sagging

Olay skin-care brand. The company recently eliminated a sixth of

its Olay products, discontinuing items such as acne washes, facial

scrubs and skin treatments that didn't fit with the brand's

antiaging message or weren't selling well.

Despite the tweaks, Olay sales fell again in the March quarter,

the company said last week.

"Instead of trying to fix it, they are saying, 'I'll just cover

it up,'" Deutsche Bank's Mr. Schmitz said of younger shoppers.

He said millennials favor makeup, such as concealers and

flesh-toned powders and creams, which give the appearance of

sculpted cheekbones, nose and chin.

(END) Dow Jones Newswires

May 03, 2016 19:30 ET (23:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

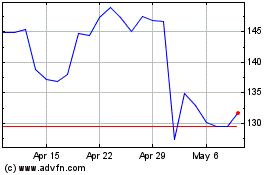

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024