Microsoft's Services Revenue Lifts Quarterly Results

October 26 2017 - 5:27PM

Dow Jones News

By Jay Greene

Microsoft Corp. has ridden the cloud-computing wave for several

quarters, and once again its revenues surged on the strength of its

emerging business of selling web-based, on-demand computing

services.

In the fiscal first quarter, the two biggest pieces of

Microsoft's cloud-computing operations -- its Azure infrastructure

services and Office 365 online-productivity business -- saw revenue

soar 90% and 42%, respectively.

While the software giant doesn't disclose revenue figures for

those businesses, it said its commercial-cloud run-rate -- the last

month of sales of its Azure and Office 365 products, multiplied by

12 -- hit $20.4 billion.

"They crushed it again," said Stifel Nicolaus & Co. analyst

Brad Reback. "These were really strong growth rates."

Those gains continued to offset the company's Windows PC

operating-system franchise, which has slowed in recent years.

Revenue in Microsoft's More Personal Computing segment, which

includes Windows as well as the mobile-phone and gaming businesses,

stayed flat at about $9.4 billion. Microsoft doesn't break out

revenue for its Windows business. Earlier in October, International

Data Corp. reported world-wide PC shipments fell 0.5% in the third

quarter.

Overall, Microsoft posted $6.58 billion in net income, or 84

cents a share, compared with a profit of $5.67 billion, or 72 cents

a share, a year ago.

Revenue gained 12% to $24.54 billion.

Analysts surveyed by S&P Global Market Intelligence

Microsoft to report per-share earnings of 72 cents on $23.56

billion in revenue.

Shares rose 2.6% to $80.74 in after-hours trading after results

beat expectations. If Microsoft shares stay at these levels when

markets open Friday, it would be an all-time high. The stock has

gained 27% so far this year.

The engines of Microsoft's growth have been its Intelligent

Cloud segment, which includes Azure, and its Productivity and

Business Processes segment, which includes the Office franchise.

Revenue in Intelligent Cloud rose 14% to $6.92 billion, while

revenue in Productivity and Business Processes climbed 28% to $8.24

billion.

The Productivity and Business Processes unit also includes

Microsoft's Dynamics business, which sells software and services to

help sales representatives manage customer relationships and

finance departments manage corporate resources. It is a market

where Microsoft competes with Salesforce.com Inc., among others,

and one in which the company has placed growing emphasis. Dynamics

revenue grew 13%, though the company didn't disclose a revenue

figure.

Microsoft purchased LinkedIn, the professional social network,

in December for $27 billion, in part, to boost the Dynamics

business. In the quarter, LinkedIn added $1.14 billion in revenue

and posted a $294 million operating loss.

To support its growing cloud business, Microsoft is doling out

huge sums to build expensive data centers around the world. In the

quarter, Microsoft spent $2.7 billion in capital expenses, with

much of that money going toward its data-center expansion. A year

ago, Microsoft recorded $2.3 billion in capital expenses.

Microsoft launched a bevy of new Surface computers earlier this

year, including a refreshed Surface Pro tablet-laptop hybrid and a

lightweight laptop to compete with Apple's MacBook Air.

Microsoft didn't break out specific revenue figures for the

devices, but noted that Surface revenue gained 12% in the

quarter.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

October 26, 2017 17:12 ET (21:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

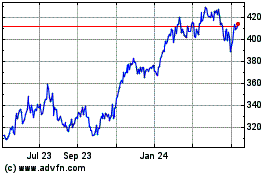

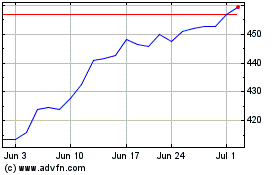

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024