Microsoft's Expensive Cloud Bet Is Paying Off -- Ahead of the Tape

October 19 2016 - 3:56PM

Dow Jones News

By Steven Russolillo

Unlike Bill Belichick, there is plenty for Microsoft Corp.

shareholders to like beneath the surface.

The grouchy New England Patriots head coach went on a

five-minute tirade this week saying he would no longer use the

company's tablets. That followed a video from a game earlier this

month showing him slamming a Surface tablet in frustration.

Microsoft defended the tablet's reliability.

While Surfacegate became an internet meme, it won't overshadow

what should be decent quarterly results for Microsoft on Thursday.

Analysts polled by FactSet predict fiscal first-quarter earnings of

68 cents a share, up a penny from a year ago. Revenue for the

period ended in September is expected to tick slightly higher to

$21.7 billion. All eyes will be on the company's continued shift to

the cloud.

Microsoft's cloud services have been a bright spot, helping

offset weakness in its businesses tied personal computers. Like

rivals Amazon.com Inc. and Alphabet Inc.'s Google, Microsoft has

been spending heavily on new data centers and infrastructure. The

cloud formed a large part of Microsoft's $8.3 billion in capital

expenditures last year, which were 40% higher than a year ago.

That expensive bet has yielded promising results so far.

Microsoft's "Intelligent Cloud" segment made up nearly 30% of total

revenue in fiscal 2016, up from 25% in 2014. It also experienced

the strongest growth on a year-over-year basis of Microsoft's main

segments, underscoring Microsoft's key transition from selling

software licenses to selling on-demand computing services.

The cloud has also recently dictated how the stock has performed

immediately following earnings. In April, when Microsoft's cloud

business missed expectations, the stock suffered its worst one-day

drop of the year. In July, when its cloud business was surprisingly

strong, shares jumped. The stock has added to gains ever since,

leaving it within about 3% from its December 1999 record.

One roadblock to further gains could be valuation. Fetching 19

times projected earnings over the next 12 months, Microsoft's

multiple sits at around a nine-year high and about 25% richer than

a basket of five competitors. But that valuation is much more

reasonable than in its dot-com heyday.

Unless something goes seriously haywire, neither Mr. Belichick's

ire nor cloud results will deflate that multiple.

(END) Dow Jones Newswires

October 19, 2016 15:41 ET (19:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

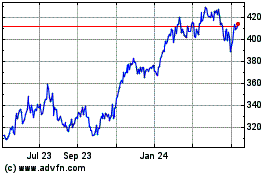

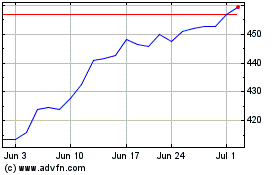

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024