Microsoft, eBay, Tencent Invest $1.4 Billion in Amazon's India Rival -- Update

April 10 2017 - 9:10AM

Dow Jones News

By Newley Purnell

NEW DELHI -- Indian e-commerce startup Flipkart Group has raised

$1.4 billion from Microsoft Corp., eBay Inc. and Tencent Holdings

Ltd., taking a hit to its valuation to raise the cash it needs to

defend its home market from Amazon.com Inc.

Flipkart -- which was started in 2007 by two former Amazon

employees -- said in a statement Monday that the new investment

values the Bangalore company at $11.6 billion. That allows Flipkart

to retain its title as India's most valuable startup but is still a

step down from the $15 billion valuation it received during

fundraising in 2015.

"This is a landmark deal for Flipkart and for India," Flipkart

founders Sachin Bansal and Binny Bansal said in the statement,

calling it the company's biggest fundraising round ever.

Flipkart said Chinese internet firm Tencent led the round, but a

Flipkart spokeswoman declined to provide a breakdown of investments

by company.

Separately eBay Inc. announced Monday that it is selling its

Indian business to Flipkart and making a $500 million cash

investment in the startup for an equity stake.

While it is impressive Flipkart could raise more than $1 billion

at a time when investors are increasingly concerned about startup

valuations, analysts said the fact that it had to take a "down

round" shows the challenge it is facing from Amazon and difficult

market conditions.

"Flipkart needs more money to survive and become profitable,"

said Satish Meena, an analyst at research firm Forrester. When

Flipkart raised money at a higher valuation in 2015, there was a

"mismatch between expectation and the growth of market," he

said.

India's e-commerce market was worth about $16 billion last year,

but should grow to $48 billion by 2021, Mr. Meena said.

Amazon has pledged to spend $5 billion in its rapid roll out in

India, which started in 2013. It has used its massive war chest and

tech and logistics know-how to gobble up market share, already

reaching the number two spot behind Flipkart in terms of sales,

analysts say.

In addition to girding Flipkart against Amazon, Tencent's

investment shows that it has opened another front in its war with

its Chinese rival Alibaba Group Holding Ltd.

Tencent, whose WeChat messaging service is China's largest with

more than 889 million monthly active users, already completes head

on in China against Alibaba in sectors such as mobile payments,

online video and cloud computing.

Alibaba, which runs China's most popular e-commerce website

Taobao, led a $200 million round of funding in Indian company

Paytm's new e-commerce arm last month. Tencent last year led a $175

million fundraising round in New Delhi-based messaging app Hike

Ltd. Both companies are chasing growth abroad as their businesses

mature at home.

India represents one of the world's last great untapped internet

economies, with millions of users connecting to the web for the

first time via low-cost smartphones.

Still, it is a challenging market given low incomes and

difficulties such as poor infrastructure and a lack of credit

cards. While the South Asian nation is home to more than 1.2

billion people, it only has about 40 million online shoppers,

according to Credit Suisse.

Write to Newley Purnell at newley.purnell @wsj.com

(END) Dow Jones Newswires

April 10, 2017 08:55 ET (12:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

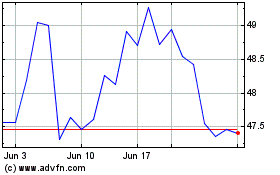

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

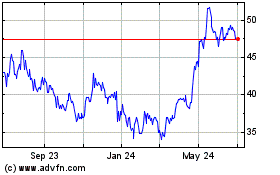

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024