By Jay Greene and Matthias Verbergt

Ten months after writing down much of its disastrous acquisition

of Nokia Corp.'s handset business, Microsoft Corp. took another

step to unwind the deal.

Microsoft on Wednesday agreed to unload its low-end phone

business, acquired from Nokia, to FIH Mobile Ltd., a subsidiary of

Hon Hai/Foxconn Technology Group, and HMD Global Oy for $350

million. In a separate but related transaction, Nokia entered into

licensing pacts with FIH Mobile and HMD Global to put its brand

once again on mobile handsets.

The deal highlights how sharply Microsoft Chief Executive Satya

Nadella has shifted the company's mobile strategy since his

predecessor, Steve Ballmer, championed the Nokia deal, which closed

in 2014. Last summer, Microsoft wrote down about 80% of the $9.4

billion deal, cutting 7,800 workers, mostly in its mobile-phone

business. The software giant hasn't given up on phones. But its

latest strategy revolves around Windows 10, the most recent version

of its flagship operating system that runs on various devices

including smartphones, PCs, tablets, and game consoles.

Microsoft also is developing services that behave intelligently

based on data gathered by smartphones and other devices. At a

conference for software developers in March, the company showed how

its voice-activated digital assistant, Cortana, could book a hotel

room or order a pizza proactively based on a user's personal data

and preferences.

The low-end phone business that Microsoft sold on Wednesday

doesn't fit with that strategy. The entry-level phones known as

feature phones lack the computing horsepower to run Windows 10.

"The future [of Microsoft's mobile business] has to lie with

Windows 10," said J.P. Gownder, a Forrester Research Inc.

analyst.

A Microsoft spokesman said the company is "committed to a

vibrant Windows Phone market" and that it will continue to develop

Windows 10 for mobile devices. The company also will invest in

mobile security and management features.

Feature phones, though, are the one area of the mobile-device

market that Microsoft leads. The company shipped 15.7 million

feature phones world-wide in the first quarter of 2016, ahead of

Samsung Electronics Co., which shipped 13.1 million entry-level

phones, according to IDC Research Inc.

But Microsoft isn't well suited to squeeze profit from feature

phones, which produce thin margins, Mr. Gownder said. Foxconn, by

contrast, has the manufacturing scale to eke more efficiency from

the business.

For Nokia, the deal is a re-entry into the handset market after

the company, once the leader in mobile phones, refashioned itself

into a maker of wireless and Internet network equipment. The

Finnish company said it is hoping to capitalize on its brand name

in developing countries starting with entry-level phones.

It plans to offer higher-end smartphones and tablets later.

Nokia said it had granted patent and design rights to HMD

Global, a newly created company based in Finland that will be in

charge of global marketing through a 10-year exclusive agreement.

HMD is majority-owned by a private- equity fund managed by

Jean-François Baril, a former Nokia executive. Nokia said it had

signed manufacturing agreements with a subsidiary of Foxconn, the

Taiwanese company and main assembler of Apple Inc.'s iPhones.

Microsoft's sale of the feature phone business is Mr. Nadella's

latest retrenchment after the failure of Mr. Ballmer's repeated

efforts to build a smartphone business.

The company's effort was launched in 2003 under the banner of

Windows Mobile, a mobile-operating system designed for business

customers.

That campaign sputtered as BlackBerry Ltd., and later Apple's

iPhone and phones running the Android operating system, seized the

market.

Microsoft shifted its focus to consumers in 2010, debuting the

Windows Phone operating system. However, that initiative failed to

gain a significant share of burgeoning smartphone sales.

Since becoming chief executive, Mr. Nadella has trimmed the

company's device lineup, released versions of popular Microsoft

applications for Android and iPhones, and reverted Microsoft's

focus in phones to business users.

Nonetheless, Microsoft's share of the world-wide smartphone

market slid to 1.1% in the fourth quarter of 2015, according to

Gartner Inc.

Its success in raising that number will depend on putting

Windows 10 on as many devices as possible, including smartphones,

personal computers, laptops, and its Xbox game consoles.

Microsoft is betting that a huge base of Windows 10 users will

convince developers to create must-have apps and lure mobile

customers to the platform. The operating system, released last

summer, runs on 300 million active devices by the latest count.

As part of Wednesday's sale, FIH Mobile also will acquire

Microsoft Mobile Vietnam, which runs the company's Hanoi, Vietnam,

manufacturing facility. The operation's roughly 4,500 employees

will transfer to, or have the opportunity to join, FIH Mobile or

HMD Global, according to Microsoft.

Write to Jay Greene at Jay.Greene@wsj.com and Matthias Verbergt

at Matthias.Verbergt@wsj.com

(END) Dow Jones Newswires

May 19, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

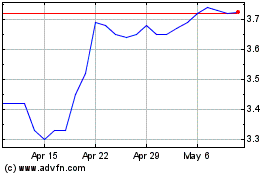

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024