Mexico Secures Even Lower Prices for Clean Energy in Auction -- Update

November 16 2017 - 5:46PM

Dow Jones News

By Anthony Harrup

MEXICO CITY -- Mexico expects investment of around $2.4 billion

in the next three years in new electricity generation projects as a

result of its third long-term power auction, which saw prices for

clean energy continue to fall.

Sixteen projects won with bids to supply renewable energy under

long-term contracts to state utility Comisión Federal de

Electricidad, or CFE, and two private buyers, the Energy Ministry

said Thursday. Contracts are expected to be awarded next week after

the preliminary results are validated.

The winners will provide around 5.5 million megawatt hours per

year of clean energy, 55% of which is solar power and 45%

wind-generated electricity, and 593 megawatts in capacity, most of

it conventional energy from a gas-fueled plant. A megawatt is

enough power to supply about 1,000 homes.

"This shows the continued trend of the diversification of power

sources, " said Dan Bartfeld, a partner at Milbank, Tweed, Hadley

& McCloy, which represented clients in this and previous

auctions. "The mix is moving much more significantly towards

renewable power."

The auction was Mexico's third since the creation of the

wholesale power market under a 2013 energy sector overhaul. The

average price per megawatt hour for renewable energy plus a

corresponding clean energy certificate was $20.57, down sharply

from $33.47 in September 2016 and $41.80 in the first auction held

in March of last year.

Prices were already surprisingly low at the previous auction,

and with the latest drop, "you've got to wonder a bit about where

people are getting their returns," Mr. Bartfeld said.

"I think it's a combination really of the [solar] panel prices

coming down, which is significant -- technology resulting in

cheaper panels -- coupled with companies looking for growing

markets where they can invest, and Mexico is certainly top of the

list," he added.

The $2.4 billion in expected investment is in addition to $6.6

billion in projects gained in earlier auctions, as Mexico aims to

generate 35% of its electricity from clean sources by 2024.

Mexico has about 60 gigawatts of installed generating capacity

and plans to add another 55 gigawatts in the next 15 years. Much of

the new capacity will displace plants that are old and inefficient

and won't be able to survive in the new competitive environment,

said César Hernández, Mexico's under secretary for electricity, in

a recent interview.

Mexico overhauled its electricity laws in 2013 along with

changes that allowed for foreign and private investment in oil and

gas exploration and production for the first time in nearly eight

decades, with the goal of lowering costs to consumers.

"The Mexican system was not in bad shape even before the

reform," Mr. Hernández said. "Basically, its big problem was high

costs. Part of it was embedded in the fact that it was a public

monopoly that had to buy expensive fuel from another public

monopoly, which was Pemex."

On average, electricity rates were about 25% higher than in the

U.S. when the changes were being planned. They fell to U.S. levels

in early 2016 when oil and gas prices hit bottom, but have since

risen somewhat, he said.

"But if you introduce investment, if you introduce

new-generation facilities, new transmission lines, and if you

introduce competition, competition should drive prices down," he

said.

For the first time, two companies other than state-run CFE

participated as buyers in the auction. They were a unit of Spain's

Iberdrola, which is the biggest private power generator in Mexico,

and a unit of cement giant Cemex SAB.

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

November 16, 2017 17:31 ET (22:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

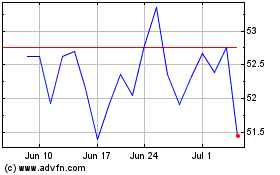

Iberdrola (PK) (USOTC:IBDRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

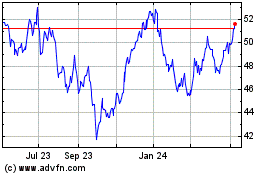

Iberdrola (PK) (USOTC:IBDRY)

Historical Stock Chart

From Apr 2023 to Apr 2024