By Eyk Henning and Ellen Emmerentze Jervell

FRANKFURT-- Metro AG, one of Europe's largest retailers, wants

to break itself up to boost shareholder value, but one of its

biggest investors doesn't like the deal and warns that it would

ultimately destroy value.

Dusseldorf-based Metro earlier in September presented details of

how it expects to divide into separate retailers of food and

consumer electronics. The plan entails spinning off to shareholders

a 90% stake in its food operations, which would become a

still-unnamed independent stock-listed company run by Metro's

current chief executive, Olaf Koch.

The legacy portion of Metro would focus on Media Markt Saturn,

which is Europe's largest consumer electronics retailer, with

annual revenue of roughly EUR22 billion ($24.7 billion) and more

than 1,000 stores across the continent.

Metro owns 78% of Media Markt Saturn. The other 22% is owned by

German billionaire Erich Kellerhals through his holding company,

Convergenta Invest GmbH, which is now casting a shadow on the

breakup plan.

Mr. Koch said the separation was necessary to boost sales and

profits at both units, and shareholders reacted enthusiastically

when Metro unveiled the plan in March. But skepticism has since

weighed on Metro's share price.

Now Mr. Kellerhals is threatening to upend Mr. Koch's plan

because he wants profit at Media Markt Saturn reinvested in the

chain, rather than paid to Metro. Such a move, if successful, could

jeopardize Metro's ability to pay dividends to its

shareholders.

"We estimate Media Markt Saturn needs to strengthen its equity

by at least EUR100 million to fund necessary investments,

particularly into online retail operations," Convergenta's

Executive Director Ralph Becker told The Wall Street Journal. He

said Convergenta has the legal means to ensure the electronics

retailer retains earnings.

A Metro spokesman said the company saw no reason for a capital

injection and that Media Markt Saturn was a "cash rich company with

almost no financial liabilities."

He said Mr. Kellerhals had not formally communicated any plan to

block dividend payments. Blocking payouts would "violate the

company statute" and be an "act against good faith," the Metro

spokesman said.

The fight comes at an inopportune time for Metro, which, like

all brick-and-mortar retailers is battling online rivals. In the

U.S., Best Buy Co. has only recently reversed a sales slump,

allaying concerns about its ability to lure shoppers back from

Amazon.com Inc. and other online rivals. Supermarket chains in the

U.S. and Europe have been merging and closing.

Metro's situation raises concerns among some investors. "The

ability to pay dividends is a significant aspect we would like to

see clarified before moving forward with the spinoff," said Rainer

Sachs at Shareholder Value Management, a vocal investor which is

Metro's 11th largest stockholder, with a 0.74% stake.

Messrs Kellerhals and Koch have argued publicly over recent

years. Analysts and investors have said the tensions have impeded

Media Markt Saturn's successful development and many hoped Metro's

breakup would end the spat.

"The minority shareholder issues are not new news obviously, but

at this critical stage they could be a major headache for Metro,"

said Bernstein analyst Bruno Monteyne. "Management always seem very

confident that there are no governance problems and all court cases

are settled. But the situation is far from perfect."

When Mr. Koch in March announced plans to split Metro, he said

Mr. Kellerhals "has no potential to interfere with this

transaction" because the separation would occur within Metro, where

Mr. Kellerhals isn't a major shareholder.

Now questions are emerging.

According to Media Markt Saturn's bylaws, reviewed by The Wall

Street Journal, Mr. Kellerhals' Convergenta must sign off on the

annual financial statements before a dividend can be paid out.

Joerg Meissner, an attorney with the law firm Morrison &

Foerster, said blocking the completion of annual financial

statements may not be easy unless there are questions about the

correctness of the financial statements. Denying approval for

obstruction purposes can be seen as breach of a shareholder's

fiduciary duty.

Convergenta's Mr. Becker said he has valid reasons for such a

move because of serious concerns regarding Media Markt Saturn's

financials. He said Convergenta would likely veto the completion of

its annual financial statements.

The Metro spokesman said the annual financial statement couldn't

be rejected without material cause, and that Metro had "no

knowledge" of any concerns from Convergenta. Mr. Becker's comment

was "surprising and disturbing," the spokesman said.

Mr. Becker floated a possibility of dividing Media Markt

Saturn's stores up between Convergenta and Metro. He added such a

scenario has been discussed until recently but was shelved by

Metro. The Metro spokesman said this description wasn't

correct.

"Earlier this year, we have had talks in order to find a

consensual solution on the topic," the Metro spokesman said,

adding: "These discussions failed because of the unrealistic and

unacceptable demands of Mr. Kellerhals."

Write to Eyk Henning at eyk.henning@wsj.com and Ellen Emmerentze

Jervell at ellen.jervell@wsj.com

(END) Dow Jones Newswires

September 23, 2016 04:57 ET (08:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

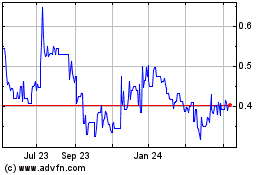

Ceconomy (PK) (USOTC:MTTRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

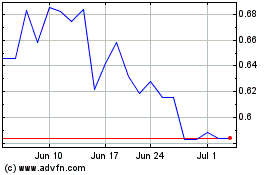

Ceconomy (PK) (USOTC:MTTRY)

Historical Stock Chart

From Apr 2023 to Apr 2024