Metals: Copper Pulls Back as Mine Strike Ends in Chile

March 24 2017 - 10:41AM

Dow Jones News

By Katherine Dunn and Ryan Dube

LONDON -- Copper prices fell on Friday, as the end of a strike

at the world's largest copper mine eased supply worries.

Copper for May delivery fell 0.4% to $2.6350 a pound on the

Comex division of the New York Mercantile Exchange.

Gold for April delivery was 0.2% lower at $1,244.20 a troy

ounce. The precious metal's pullback came ahead of the vote in the

U.S. House of Representatives on health care reform, which is being

viewed by some investors as a test of the Trump administration's

ability to enact its agenda.

On Thursday, workers at the Escondida copper mine in northern

Chile said they would end a strike at the mine, which is

majority-owned by BHP Billiton Ltd.

The leader of the mine's largest union, Union No. 1, said

workers would return to work on Saturday. The workers had agreed to

implement an article that will allow them to return to work with

their current collective agreement for 18 months.

On Friday, the agreement to end the strike, which began Feb. 9,

was pushing prices down, but the size of the decline was muted,

noted Nitesh Shah, a commodities strategist at ETF Securities in

London, as the agreement hasn't resolved the underlying issues

behind the strike.

"It is sort of kicking the can down the road a bit," said Mr.

Shah.

The mine produces about 5% of the world's copper, and the

six-week strike took out about 1% of the world's annual copper

production, he estimated.

Other supply disruptions, at Freeport-McMoRan Inc.'s Grasberg

copper mine in Indonesia, which is stalled over an export dispute

with the government, and a strike at the Cerro Verde copper mine in

Peru, are continuing.

The decline in copper's price was likely muted by a lingering

expectation of better demand prospects for industrial metals on the

back of President Donald Trump's campaign promises to fuel

infrastructure spending and overhaul tax reform, Commerzbank said

in a note.

"This could turn out to be a mistake, however, especially if

U.S. President Trump loses the U.S. House of Representatives health

care reform vote that was postponed until today -- as this would

also jeopardize the planned tax reform," the German bank said.

Restrictions in Chinese cities on new real-estate buying could

also damp demand from China, the world's top consumer of copper,

the bank said. Chinese appetite for the metal far outstrips U.S.

demand, which is around 8%, and so any change in demand from China

is likely to have a far bigger impact on the supply balance than

Mr. Trump's policies, analysts have said.

Write to Katherine Dunn at Katherine.Dunn@wsj.com and Ryan Dube

at ryan.dube@dowjones.com

(END) Dow Jones Newswires

March 24, 2017 10:26 ET (14:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

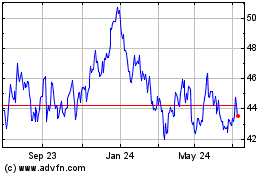

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024