Medtronic Profit Rises, Helped by Lower Expenses

August 25 2016 - 8:30AM

Dow Jones News

Medtronic PLC on Thursday said quarterly sales fell across most

of its segments, though the medical-device maker's profit grew

thanks to a drop in expenses, including a lower tax burden.

Medtronic reported a fiscal first-quarter profit of $929

million, or 66 cents a share, compared with $820 million, or 57

cents a share, a year ago. Excluding items, the company earned

$1.03 a share, compared with $1.02 a year ago. Analysts polled by

Thomson Reuters expected earnings of $1.01 a share.

Revenue fell 1% to $7.17 billion, in line with expectations. The

company blamed the decline on an extra week included in the

prior-year period. Excluding the extra week and currency effects,

revenue rose 5%, the company said.

Medtronic's results come as its competitors have seen revenue

bolstered as demand shores up at home and abroad. In July,

competitor Boston Scientific Corp. raised its profit outlook for

the year after reporting better-than-expected quarterly revenue,

helped in part by cardiovascular, and St. Jude Medical Inc. posted

double-digit revenue growth as it launched new products. St. Jude

recently agreed to a $25 billion tie up with Abbott

Laboratories.

Medical-device makers are operating in an increasingly

competitive market, with hospital customers that have grown in size

and are pushing back on the prices they are willing to pay. But

like many firms across the health-care sector, medical-device

makers have responded to cost pressures by trying to beef up to

increase their negotiating leverage and pricing power.

In late June, Medtronic said it would buy HeartWare

International Inc. for $1.1 billion, adding more products that

treat heart failure to its portfolio. Medtronic's results have been

buoyed in recent quarters from its acquisition of Covidien, which

closed in early 2015.

In the latest quarter, Medtronic's minimally-invasive therapies

group, formerly the Covidien Group, posted a sales decrease of 1%

to $2.42 billion, or a mid-single digit increase on an adjusted

basis, helped by "above-market growth" in surgical solutions. Sales

for the cardiac and vascular segment fell 2% to $2.52 billion, but

they rose in the mid-single digits on an adjusted basis.

The restorative-therapies group's revenue fell 2%, while sales

in the diabetes group rose 2%.

Medtronic's bottom line was helped by a lower income-tax

provision and effective tax rate in the quarter, while its net

interest expense fell 6.2%.

Medtronic shares, inactive premarket, have added 6.9% over the

past three months.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

August 25, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

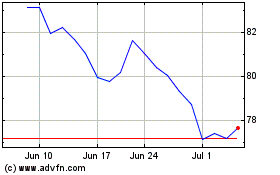

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

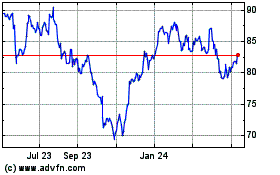

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024