McDonald's, Slow to Industry Trends, Cooks Up Changes

January 12 2017 - 1:07PM

Dow Jones News

By Julie Jargon

McDonald's Corp. is in the business of selling food quickly, but

it has been slow to many industry trends, including transferring

ownership of its restaurants to independent operators -- an easy

way to derive stable revenue.

The burger giant, which just announced plans to sell a stake in

its China business and is inviting bids for a stake in its Japan

business, is playing catch-up with other restaurant companies that

began shedding assets years ago.

It wasn't until November 2015, when the company was under

pressure from investors to do something dramatic to boost its

balance sheet such as spin off its real estate holdings, that it

increased the number of restaurants it plans to sell to 4,000 by

the end of 2018 from an earlier target of 3,500. McDonald's has set

a long-term target of being 95% franchise-owned from 83% now.

The model is attractive because it allows a restaurant company

to expand into new markets without having to put up the capital. It

reduces the company's exposure to wage-related pressure and

employee organizing efforts and provides a stable revenue stream

through the royalties it collects from franchisees.

McDonald's is two years into a turnaround plan that was

instituted following its longest sales slump -- and subsequent

share decline -- in a decade that was caused in part by the

migration of customers to rivals serving healthier food. If

McDonald's had handed over ownership of more restaurants to

franchisees sooner, it could have helped solidify its finances and

kept shareholders happy while it worked on improving other aspects

of the business.

Changing restaurant ownership at a company as large as

McDonald's, which has 37,000 restaurants around the world, is hard

to do.

However, sandwich chain Subway, owned by Doctor's Associates

Inc., has nearly 45,000 restaurants around the world and all of

them are franchised.

Meanwhile, direct competitor Burger King, a unit of Restaurant

Brands Inc., began an aggressive push to sell off company-owned

restaurants after Brazilian investment firm 3G Capital Partners LP

bought it in 2010. The mostly franchised model of Canadian doughnut

maker Tim Hortons made that company an attractive target and Burger

King bought it in 2014.

CKE Restaurants Inc., owner of Carl's Jr. and Hardee's, was also

an early adopter of the so-called "asset-light" business model.

Nearly 95% of its more than 3,700 restaurants are now owned by

franchisees. Dunkin Brands Group Inc. has long been nearly 100%

franchise-owned.

Experts say that McDonald's has been slow to change in various

other ways. The company hasn't updated its menu quickly enough to

be in line with changing consumer tastes. For example, it added

Angus burgers and sandwiches made with Sriracha sauce long after

those ingredients were popular.

A McDonald's spokeswoman said that since Steve Easterbrook took

over as chief executive, the company has been focusing on "taking

immediate steps" to help growth and strengthen the bottom line,

which includes restructuring the business and finding strategic

partners.

At times, McDonald's has read consumer demand relatively well.

The chain instituted all-day breakfast in October 2015 after just

six months of testing it. And it was an industry leader on

switching to cage-free eggs.

But there haven't been any new major menu items in a while and

the company has been slow to address problems with its burger

quality.

The company only recently began testing an app that will allow

customers to order and pay for food with their phone, lagging many

others in the industry, and it was late to become involved in

social media -- years behind other major restaurant chains and

retailers.

McDonald's has digital media hubs in Singapore, London, and Oak

Brook, Ill., but as recently as two years ago, McDonald's had no

way to consistently track and respond to what is being said about

it online, a lost opportunity for a brand that gets mentioned on

social media every one to two seconds.

"Their philosophy has been to be more of a follower than a

leader," said David Tarantino, a restaurant analyst at R.W. Baird

& Co. "In the past the organization had a lot of layers of

management and decision making that may have impeded the speed at

which they could have implemented new ideas."

Mr. Easterbrook, who is approaching his second anniversary at

the helm, has been trying to change that.

The company has eliminated many corporate positions as part of a

plan to reduce administrative expenses by $500 million by the end

of 2017, and he has been pushing management to let go of what he

calls "legacy thinking." He has hired an outsider to run the U.S.

business. Mr. Easterbrook told investors in June that "when the

pace of change in the world outside is quicker than the pace of

change within, you start to get left behind."

Write to Julie Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

January 12, 2017 12:52 ET (17:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

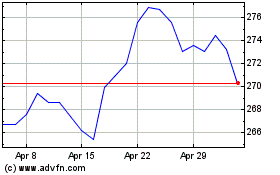

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

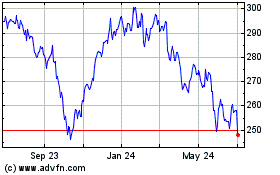

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024