After an initial wobble, financial markets mainly shrugged off

the effects of Friday's terrorist attacks in Paris, underscoring

how investors increasingly look beyond the individual atrocities

that are hitting their cities.

With investors focusing on central banks and Chinese growth,

markets, from equity to bonds and gold, were little disrupted by

the killing of at least 129 people in Paris. Financial markets have

recovered in comparable terror attacks in Madrid in 2004 and London

a year later, but the speed with which these assets regrouped on

Monday suggests investors have become more used to terror on their

own streets.

"Sadly, there's an understanding this is part of the world we

live in," said David Vickers, a senior portfolio manager at Russell

Investments, which has around $237 billion in assets under

management.

After a brief dip in early trade, the Stoxx Europe 600 was 0.3%

higher midway through the session. France's CAC 40, which fell more

than 1% in early trade, was up 0.1%.

Among traditional safe-haven investments, gold initially gained

and government bonds benefited, with the yield on German 10-year

debt 0.01 percentage point lower at 0.55%. But these moves were

seen as muted.

The negative impact on stock markets has diminished with every

major terrorist attack after the Sept. 11, 2001 attacks, including

the bombings in Madrid and London and the Boston marathon bombings

in 2013, according to research by the University of Cisneros in

Madrid.

After the Sept. 11, the New York Stock Exchange fell 7.1% on its

first day of trading and ended the week down 14%. Investors jumped

into safe haven assets such as government debt and gold, with that

metal gaining by 6.5% its first post-attack trading day.

After explosions on trains in Madrid left around 191 people dead

in 2004, Spain's IBEX35 share index closed 2.2% lower, while the

10-year German bund fell two basis points to 3.90%.

After the London bombings in July 2005, the FTSE 100 closed down

1.4% and crude prices on the New York Mercantile Exchange fell

almost 4%.

In both Madrid and London, however, markets soon recovered, and

their currencies were little affected.

Investors say reactions to terrorist attacks are increasingly

fleeting, because of their frequency and as markets conclude that

such atrocities have relatively little economic impact.

Consumer spending in the U.K. and Spain, for instance, even

climbed in the wake of the bombings in their countries, according

to Germany's Berenberg Bank.

Terrorist attacks on developing countries have also done little

to shake investors, who have now become used to such mayhem. After

two bombs killed at least 97 people outside Ankara's central rail

station in October, the Turkish BIST 100 index closed down 0.1% and

the lira edged down only 0.45% against the dollar.

Kit Juckes, a strategist at Societe Generale, remembers his

reaction to the attacks on Sept. 11.

"Then, we stood and stared, in shock," he said. "But we've moved

on (and are now) more appalled than shocked."

Investors say that the sheer scale of the Sept. 11 attacks

single them out. But they also believe that the relatively

short-lived market impact of terror attacks since 2001 means that

they were reluctant to make shifts in their portfolios on

Monday.

After a number of meetings this morning, Mr. Vickers said

investors at the firm were "coming up light" on ideas for potential

portfolio changes.

Instead, the main drivers for stock markets remain the slowing

Chinese economy coupled with anticipated shifts in eurozone and

U.S. monetary policy, he said.

Such economic fundamentals are even crowding out traditional

safe-haven flows. Gold gained 1% in London in early morning trade

but was up only 0.21% by mid-afternoon. Instead, the metal

continues to be swayed by a growing anticipation that the Federal

Reserve will raise rates this year, a move that would make gold

less competitive with yield bearing assets.

On Monday, oil also lost its early gains. Brent, the global oil

benchmark, gained 1% to $44.93 a barrel as France escalated its air

campaign against Islamic State, increasing uncertainties in the

Middle East. But by early afternoon, Brent had fallen as investors

refocused on fundamentals, in particular the effect of oversupply

in this market.

Of course, were Friday to herald a speedy escalation of attacks

in western countries, then most analysts agree the impact could be

more severe as it hits travel, government spending and consumer

confidence.

Longer terms effects from Friday's attack may come from its

impact on current debates over the structure of the European Union.

Amid security concerns, governments may begin looking at

re-erecting national boundaries, something several have already

done during the current rise of immigration into the region.

"The more problems we have related to borderless countries, the

more pressure will come for change, and that has long-term

implications for Europe," said Derek Halpenny, European Head of

Global Markets Research, Bank of Tokyo-Mitsubishi.

Neanda Salvaterra and Riva Gold also contributed to this

article.

Write to Tommy Stubbington at tommy.stubbington@wsj.com, Chiara

Albanese at chiara.albanese@wsj.com and Georgi Kantchev at

georgi.kantchev@wsj.com

Access Investor Kit for "London Stock Exchange Group Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B0SWJX34

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 16, 2015 11:15 ET (16:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

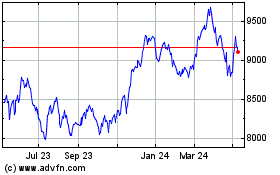

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

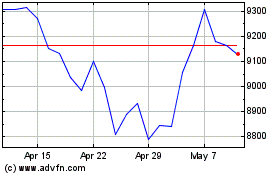

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024