Macquarie Can't Skirt Bond Insurer's $496 Million Toll Road Suit

February 15 2017 - 1:09PM

Dow Jones News

By Andrew Scurria

A New York judge rejected Macquarie Capital (USA) LLC's bid to

toss a lawsuit from bond insurer Syncora Guarantee Inc. over $496

million in soured toll-road debt.

Judge Anil C. Singh of the Supreme Court of New York County on

Tuesday refused to dismiss the bulk of Syncora's lawsuit, which

accuses the U.S. advisory arm of Australia's Macquarie Group Ltd.

of providing misleading information around the financial viability

of four toll bridges in Alabama and a toll tunnel in Michigan.

Syncora has been covering payments on revenue bonds and

interest-rate swaps backed by those tolls since their operator,

American Roads LLC, filed for bankruptcy in 2013. By that time,

Syncora had already sued Macquarie for allegedly providing bogus

traffic projections when the projects were refinanced in 2006.

"Syncora's complaint adequately alleges that Macquarie's

misrepresentations were a direct and proximate cause of Syncora's

actual losses," the judge said.

A Macquarie spokesman declined to comment on the ruling.

The collapse of American Roads, which Macquarie formed in 2005

and sold to private investment firm Alinda Capital Partners LLC the

following year, was one of a series of soured wagers on U.S. toll

roads in the years before the financial crisis.

Investors piled into toll-road deals in the 2000s that often

involved state or local governments eager to shift costs and risks

to the private sector. Global investment firms like Macquarie and

Spain's Ferrovial SA assembled many deals with heavy debt loads on

the assumption that toll revenue would only increase as Americans

drove more miles.

In court filings, Macquarie blamed American Roads' problems on

the housing crisis, rising gasoline prices, the Gulf oil spill and,

in the case of the Detroit-Windsor Tunnel, out-migration from the

area and a National Hockey League strike. The advisory firm relied

on consultants from the Sidney-based Maunsell unit of Aecom, a

Los-Angeles professional-services company.

Following the sale to Alinda, American Roads raised $496 million

in bonds in 2006, court records show. Traffic failed to live up to

expectations, and the company's debt continued to grow due to swap

agreements meant to protect against interest-rate increases that

never occurred.

American Roads' chapter 11 plan transferred ownership of the

company to Syncora, which agreed to forgive the swap debt.

Bondholders received no payments under the plan, but the insurance

policies were preserved and have been servicing the bonds ever

since. Bondholders unsuccessfully objected to their treatment under

the plan, arguing that they were left exposed to the chance that

Syncora would go insolvent in the future.

A $198 million tranche of the bonds matures in 2018, according

to FactSet. Another $298 million matures in 2034.

Syncora can't rescind the policies covering the bonds because it

received $10 million in premium payments after learning of

Macquarie's alleged wrongdoing in 2009, including a $600,000

installment four days after filing suit, Judge Singh said. He

allowed the insurer's claims for compensatory damages for fraud and

negligent misrepresentation to move forward.

--Ryan Dezember and Emily Glazer contributed to this

article.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

February 15, 2017 12:54 ET (17:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

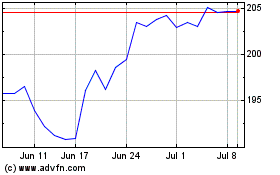

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

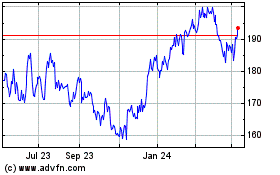

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024