Macau's Latest Woe: Embezzlement Allegations

September 29 2015 - 8:51AM

Dow Jones News

By Kate O'Keeffe

MACAU--An alleged embezzlement scandal at a junket business that

lends money to high-rollers inside the VIP rooms of Wynn Resorts

Ltd.'s Macau casino is adding to the woes of the world's biggest

gambling center.

Investors in the junket business rushed to pull out money after

rumors about the alleged incident spread within casino circles,

according to Macau gambling executives. An analyst's report also

noted allegations that an employee had absconded with as much as 2

billion Hong Kong dollars (US$258 million).

Dozens of investors took to the streets in groups to protest,

saying their requests to withdraw money had been refused--deepening

a crisis of confidence in the lending system that powers the

Chinese gambling hub.

Macau casinos rely on junkets to bring in high-stakes gamblers

because they have underground banking networks that enable punters

to circumvent China's controls on capital leaving the country.

Junkets, whose major financial backers are often undisclosed, also

attract investors who range from working-class locals to wealthy

mainland Chinese by offering them fixed monthly returns of 1% to

2%.

Junkets drove Macau's explosive growth--gambling revenue totaled

$44 billion last year, or seven times that of the Las Vegas

Strip--but the system has been shriveling under the weight of

Beijing's crackdown on corruption, money laundering and capital

flight.

Macau's gambling revenue is on a 15-month losing streak, tanking

37% so far this year compared with a year ago. Shares of Macau's

six casino operators--including units of Wynn, Las Vegas Sands

Corp. and MGM Resorts International--have fallen an average of 56%

in the past 12 months.

Neptune Group Ltd., the Hong Kong-listed arm of one of Macau's

biggest junkets, Friday said it had swung to a net loss for the

year ended June 30 and that management is facing "pressing

concerns" amid a "vicious circle which has devastated Macau VIP

gaming business."

On Sept. 10, Hong Kong-based analysts at Daiwa Capital Markets

issued a report noting allegations that a staff member from Dore

Entertainment Co.--a junket operator active at Wynn--had absconded

with between HK$200 million the HK$2 billion. Daiwa gave no

accounting or source for its estimate or the allegations.

Dore said in a newspaper ad published Sept. 17 that it suspects

one of its executives had stolen over HK$100 million after using

its name without authorization to attract investments by offering

high interest rates. The junket said it reported the incident to

the police. Dore didn't respond to questions from the Journal.

In a statement to the Hong Kong stock exchange Sept. 14, Wynn's

Macau unit said Dore doesn't owe the company any money and

continues to operate at the casino. Wynn said it hoped Dore and its

investors would quickly resolve any issues.

Macau police said in statement last week that they had so far

received 42 complaints from Dore investors who claim they are owed

a total of HK$440 million. Wynn and the police declined to comment

further.

The incident has had a knock-on effect on other junkets across

Macau. Suncity Group, Macau's largest junket operator, received

HK$4 billion in withdrawal requests over five days in

mid-September, an unusually high number, according to a person

familiar with the operation.

Suncity chairman Alvin Chau issued a statement calling for

everyone to "have faith" in the industry. But his message, titled

"Macau gaming industry entering a devastating black hole," only

increased jitters when it spread on social media, said some

gambling executives.

"If the CEO of a bank embezzles, will the banking system

collapse? If someone could not withdraw his deposit from a bank,

would you queue up at the doors of HSBC?" Mr. Chau said in the

statement. "If everybody queues up at HSBC, this bank will also go

bankrupt." Suncity representatives didn't return requests for

comment.

The Dore episode--which follows a similar one in April 2014 when

another junket figure allegedly skipped town with up to HK$10

billion in debt--prompted a strong statement from Macau's usually

low-profile gambling regulator, who said it may start forcing

junkets to disclose more about their financial backers and limit

their ability to take deposits from the public.

Groups have waved banners outside the Wynn Macau, as well as the

office of China's government representative in Macau, calling on

Charles Heung--one of Dore's financiers, according to people

familiar with the matter--to pay them back. The protesters say they

are collectively owed around HK$700 million.

Mr. Heung was identified in a 1992 U.S. Senate subcommittee

report as a leader of a criminal Triad gang. He has denied any

involvement in organized crime. A representative for Mr. Heung and

his company, Hong Kong-listed China Star Entertainment Ltd., didn't

respond to requests for comment on this story.

A Wynn spokesman reiterated an earlier statement to the Journal

that Mr. Heung "isn't an identified principal in any Wynn

junket."

Write to Kate O'Keeffe at kathryn.okeeffe@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 29, 2015 08:36 ET (12:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

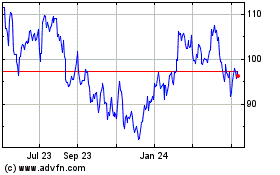

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024