MTW Closes Senior Secured Credit Facilities - Analyst Blog

January 07 2014 - 11:50AM

Zacks

Commercial foodservice equipment manufacturer, The

Manitowoc Company, Inc. (MTW), has declared the closure of

senior secured credit facilities worth $1.05 billion.

The credit facilities consist of a revolving facility of $500

million, Term Loan A worth $350 million and Term Loan B worth $200

million. While Term Loan A and the revolving facility have a

five-year term maturity, Term Loan B will mature in seven

years.

The new credit facilities extend the maturity dates of the

revolving credit facility and term loans from 2016 and 2017 to 2018

and 2020, respectively. The Term Loan A and revolving facility will

bear interest at LIBOR plus 2.25% or 1.25% over an alternate base

rate.

The proceeds from this new credit facilities will help the company

to redeem its 9.5% Senior Notes due 2018 after reaching the call

date in Feb 2014. In addition, the new credit facilities and lower

interest expense from the bond redemption will generate interest

savings of about $20 million in 2014.

As of Sep 30, 2013, Manitowoc had cash and temporary investments

totaling $87.2 million versus $76.1 million as of Dec 31, 2012.

Cash flow from operating activities improved substantially to $114

million in the third quarter of 2013 from $49.7 million in the

prior-year quarter driven by cash from profitability, partially

offset by seasonal working capital requirements in both

segments.

However, for full-year 2013, Manitowoc lowered its revenue guidance

for the Crane segment from the high single-digit to mid

single-digit range. Additionally, this segment will benefit from

the introduction of new products and services.

On the other hand, Foodservice revenues are expected to rise in

modest single digits, as compared with the mid single-digit growth

projected earlier. Margins for both the Crane and Foodservice

segments are expected to improve in 2013. However, high debt levels

will continue to be a headwind.

Wisconsin-based Manitowoc is one of the world's major innovators

and manufacturers of commercial foodservice equipment. The company

is among the premier creators and providers of crawler cranes,

tower cranes and mobile cranes for the heavy construction industry.

These are complemented by industry-leading product support

services.

Currently, Manitowoc carries a Zacks Rank #4 (Sell).

However, some better-ranked stocks in the in the sector include

Kubota Corp. (KUBTY), Alamo Group,

Inc. (ALG) and Terex Corp. (TEX). While

Kubota and Alamo Group carry a Zacks Rank #1 (Strong Buy), Terex

holds a Zacks Rank #2 (Buy).

ALAMO GROUP INC (ALG): Free Stock Analysis Report

KUBOTA CORP ADR (KUBTY): Get Free Report

MANITOWOC INC (MTW): Free Stock Analysis Report

TEREX CORP (TEX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

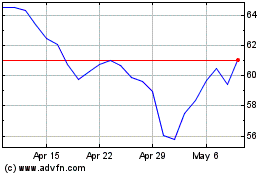

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

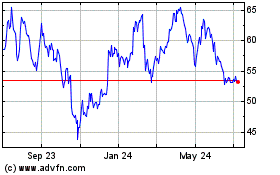

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024