MITIE Group PLC Disposal of Healthcare business (1476Y)

March 01 2017 - 2:01AM

UK Regulatory

TIDMMTO

RNS Number : 1476Y

MITIE Group PLC

01 March 2017

This announcement contains inside information

1 March 2017

For immediate release

Mitie Group plc

("Mitie" or the "Group")

Disposal of Healthcare business to Apposite Capital

Mitie Group plc announces that it has disposed of the Group's UK

social care division consisting of domiciliary care and homecare

businesses, Enara Group Limited ("Enara") and Complete Care

Holdings Limited ("Complete Care") to Apposite Capital LLP

("Apposite"), the specialist healthcare investor, for a cash

consideration of GBP2 (the "Disposal").

In addition, the Group will contribute GBP9.45m to the funding

of trading losses and the cost of the turnaround plan. This will be

paid in two tranches with the first (GBP5.4m) on 1(st) April 2017

and the second (GBP4.05m) on 1(st) July 2017.

Enara, trading as MiHomecare, provides care at home for people

who require help and support due to illness, infirmity or

disability. It currently undertakes approximately 80,000 client

visits per week. Enara's statutory loss before tax for the 12

months to 31 March 2016 was GBP11.5m. The value of gross assets at

31 March 2016 was GBP17.9m. Enara's revenue and operating loss for

the 10 months to 31 January 2017 as per unaudited management

accounts were GBP42.3m and GBP8.8m respectively.

Complete Care provides nurse-led, complex care solutions in the

home. It currently serves approximately 100 clients across England

and Wales. Complete Care's statutory loss before tax for the 12

months to 31 March 2016 was GBP0.2m. The value of gross assets at

31 March 2016 was GBP4.2m. Complete Care's revenue and operating

loss for the 10 months to 31 January 2017 as per unaudited

management accounts were GBP12.6m and GBP2.6m respectively.

In addition to the GBP115.3m impairment and write down of

healthcare goodwill and acquisition related intangibles recognised

in the Mitie Group plc September 2016 half-year results, there will

be further losses in this financial year which are estimated to be

GBP36.8m. These comprise forecast operating losses for the

healthcare businesses of GBP12.5m for the 11 months to 28(th)

February 2017, the GBP9.45m contribution to future losses and the

turnaround plan, and GBP14.8m in respect of net asset write offs

and the costs of separation, all of which will be recognised in the

full year results.

The divestment of Enara and Complete Care follows the previously

publicly communicated decision, as set out in the Group's interims

announcement on 21 November 2016, by Mitie to withdraw from the

domiciliary healthcare market. Throughout the review period and

sale process, Enara and Complete Care have continued to operate in

an orderly and responsible manner, prioritising high standards of

patient care.

The Group will announce its preliminary results for the 12

months ending 31 March 2017 on 25 May 2017.

Enquiries:

Mitie Group plc

John Telling

Group Corporate Affairs Director

T: +44 (0)203 123 8673 M: +44 (0)7979 701 006 E: john.telling@mitie.com

Anna Chen

Investor Relations Manager

T: +44 (0)203 123 8675 M: +44 (0)7818 527 265 E:

anna.chen@mitie.com

About Mitie Group

Mitie is a FTSE 250 business providing facilities management,

real estate consultancy, project management and a range of

specialist services, managing and maintaining some of the nation's

most recognised landmarks for a range of blue-chip public and

private sector customers.

We work in partnership with organisations to deliver long-term

savings, offering a wide range of services - from real estate and

energy consultancy, compliance, risk assessment and security

systems to cleaning, catering, engineering, technical and

environmental services.

About Apposite Capital

Apposite Capital is an independent investment firm focused

exclusively on healthcare. The firm operates at the small end of

the private equity market, providing both capital and expertise to

growth and buyout transactions. Fundamental to Apposite's

philosophy is achieving high quality care to create market leaders

in healthcare.

Apposite has an in-depth sector knowledge covering key aspects

of the healthcare industry internationally coupled with local

insights, an exceptional network and an entrepreneurial mindset

which it applies to drive the growth of its portfolio

companies.

Apposite was created in 2006 and is headquartered in London,

UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISGLGDXSBGBGRB

(END) Dow Jones Newswires

March 01, 2017 02:01 ET (07:01 GMT)

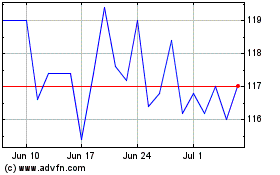

Mitie (LSE:MTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

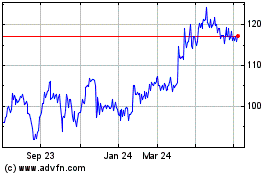

Mitie (LSE:MTO)

Historical Stock Chart

From Apr 2023 to Apr 2024