TIDMMTO

RNS Number : 7540P

MITIE Group PLC

10 June 2015

10 June 2015

Mitie Group plc

Mitie Group plc (the "Company") - Annual Financial Report

Following the release on 18 May 2015 of the Company's

preliminary results for the year ended 31 March 2015 (the

'Preliminary Announcement'), the Company announces that it has

published its Annual Report and Accounts for 2015 (the 'Annual

Report and Accounts').

The Company's 2015 Annual General Meeting will be held at

Rothschild, New Court, St Swithin's Lane, London EC4N 8AL on 13

July 2015 at 2.30pm.

Copies of the Annual Report and Accounts and the Notice of the

Annual General Meeting for 2015 (the 'AGM Notice') are available to

view on the Company's website: www.mitie.com. Hard copies have been

mailed to those shareholders who have elected to continue to

receive paper communications.

Copies of the Annual Report and Accounts, the AGM Notice, and

the form of proxy in relation to the AGM are being submitted to the

National Storage Mechanism and will shortly be available for

inspection at: www.hemscott.com/nsm.do.

The Preliminary Announcement included a set of financial

statements and a review of the development and performance of the

Company. In compliance with Disclosure and Transparency Rule (DTR)

6.3.5 the Company has extracted and set out below certain

information from its Annual Report and Accounts 2015. This

information is included herein solely for the purpose of complying

with DTR 6.3.5 and the requirements it imposes on the Company as to

how to make public its annual financial reports. It should be read

in conjunction with the Company's Preliminary Announcement issued

on 18 May 2015. Together these constitute the material required by

DTR 6.3.5 to be communicated to the media in unedited full text

through a Regulatory Information Service. This material is not a

substitute for reading the full Annual Report and Accounts. Page

numbers and cross-references in the extracted information below

refer to page numbers and cross-references in the Annual Report and

Accounts.

The information contained in this announcement and in the

Preliminary Announcement does not constitute the Group's statutory

accounts but is derived from those accounts. The statutory accounts

for the year ended 31 March 2015 have been approved by the Board

and will be delivered to the Registrar of Companies following the

Company's Annual General Meeting.

Principal Risks and Uncertainties

Identified principal risks to the achievement of our strategic

business objectives are outlined in the section below, together

with their potential impact and the mitigation measures in place.

The Board believe these risks to be the most significant with the

potential to impact our strategy, our financial and operational

performance and, ultimately, our reputation. There may be other

risks which are currently unknown to the group or which may become

material in the future. Our key risk categories continue to be:

strategic, financial, operational, and regulatory.

Strategic risks

Risk Mitigation

Contract bidding, mobilisation Central to achieving our Our bid, mobilisation

and management strategy is the successful and contract management

delivery of our contract processes operate under

portfolio, particularly strict delegated authorities

our large scale, complex and are subject to rigorous

integrated FM contracts. executive management

Our strong financial position oversight and approval

relies on our ability for the large and complex

to successfully bid, mobilise, integrated FM contracts.

operate and manage such These contracts are

contracts. supported by teams of

We see an increasingly experienced bid, mobilisation

complex service offering and operational delivery

as a business differentiator specialists to mitigate

to our clients, supported the risk of failure

by more sophisticated at any stage. On-going

and contract assurance occurs

complex technological together with regular

solutions. When compared client dialogue to ensure

to our more traditional service delivery remains

business activities, these in line with the client's

solutions necessarily expectations. Through

carry increased risk around these activities we

bidding, design, delivery aim to develop long

and successful implementation. term client relationships,

Winning new and retaining supported by a strengthened

existing contracts of framework to retain

this nature continues our existing client

to be critical for the base.

future success of our

business. Investment and support

for the development

and deployment of technical

solutions is governed

by our Board to provide

assurance on their on-going

performance.

Company performance The UK market remains We continue to be focused

and resourcing requirements our principal macro-economic on the delivery of sustainable,

impacted by change exposure, with only very profitable

to the market and economic limited exposure to the growth and during the

conditions wider global economy. year we completed our

We anticipate a continued exit strategy from more

improvement in the pipeline cyclical, complex, margin-diluting

of new opportunities and markets and have de-risked

so our business model the business as a result.

needs to adapt and grow We continue to strategically

with any on-going economic target growth areas

upturn. Our ability to with good margins, underpinned

recognise and respond by the right supporting

to variations in the volume, business infrastructure

value and range of services and our financial exposure

required, particularly to rapid changes in

from our private sector the economic environment

clients, may impact the is mitigated through

Group's ability to win the continued development

or retain significant of our long term diverse

business opportunities. contract portfolio.

Resilience is provided Formal control occurs

by our diverse business over entry into new

portfolio during times business areas and is

of economic change, with subject to Board approval.

varying demands on our

resources dependent on

the way in which our client

base responds to the economic

cycle. We are well placed

to adapt to any policy

changes from the Government.

Protecting our reputation Maintaining a strong reputation The basis for effective

is vital to our success reputational management

as a business. A loss is a strong corporate

in market confidence in governance framework

our ability to maintain supported by clear and

current business or undertake demonstrable values

new client opportunities and behaviours, clearly

may be caused by an adverse communicated at all

impact to our reputation levels of our business.

which may, in turn, significantly Our governance and ethical

affect our financial performance business frameworks

and growth prospects; provide a set of linked

this is particularly the policies, procedures,

case in our public sector training programmes

contracts where the need and audits, all centred

for transparency is paramount. on our code of conduct

Significant impact to (One Code), to address

our reputation could be specific issues which,

caused by any incident if realised, may give

involving major harm to rise to reputational

one of our people or our impact. These frameworks

clients/partners, corrupt were further strengthened

practices involving fraud in 2014/15 to ensure

or bribery, inadequate our people are aware

financial control processes of their responsibilities.

or failure to comply with A strong and consistent

regulatory requirements. 'tone from the top'

Impacts of this type would is provided by our senior

potentially result in management to ensure

financial penalties, losses our values and expected

of key contracts, an inability behaviours are clear

to win new business and and understood by everyone.

challenges in retaining We have also strengthened

key staff and recruiting our public relations

new staff. and external communications

programme to ensure

a fair and balanced

view of our services

is provided to our clients

and other interested

parties. As our business

continues

to grow and develop

into new sectors we

will remain strongly

focused on protecting

the strength of our

reputation through effective

governance, leadership,

the continued enhancement

of our ethical business

framework, and through

maintaining open and

transparent relationships

with all stakeholders.

Financial risks Risk Mitigation

Financial strength Our financial strength We have mature financial

and access to appropriately makes us an attractive governance arrangements

scaled and diverse partner to our clients in place, providing

sources of funding and stakeholders (including oversight and monitoring

our funding partners). of our financial performance

Our ability to grow if including daily monitoring

our financial performance of bank balances, cash

deteriorates, by weakening flow reporting on a

profitability and limiting daily and weekly basis

our ability to access and regular financial

diverse sources of funding performance and balance

on competitive terms, sheet reviews, which

causing an increase in include detailed working

the cost of borrowing capital reviews. We

or cash flow issues which have strong banking,

could, in turn, further debt finance and equity

affect our financial performance. relationships, a diverse

As a people business staff committed long term

costs remain our most funding portfolio and

significant area of expenditure. appropriate levels of

Our ability to pay our gearing for our business.

people and suppliers regularly

and at specific times

relies upon funding being

continually available

and, in particular, our

ability to manage our

cash flow and working

capital exposures.

Reliance on material We depend on a number We are limited on the

counterparties of significant counterparties dependency of any one

such as insurers, banks, counterparty and hence

clients and suppliers the impact of any potential

to maintain our business failure, through strategic

activities. The failure development of a diverse

of a key business partner, and robust counterparty

supplier, subcontractor, base. The

financer or other provider Board undertakes a formal

could materially affect review of material counterparty

the operational and financial risk at divisional and

effectiveness of our business business level.

and our ability to trade.

Ensuring on-going relationships

with our material counterparties

will underpin the Group's

ability to meet its strategic

objectives. Lloyds Banking

Group is a material counterparty

to the Group, providing

both banking facilities

and being our largest

client, accounting for

7% of the Group's revenue.

Operational risks Risk Mitigation

Significant health, Due to our diverse operational The Board, through effective

safety or environmental portfolio, the potential governance, oversight

incident to cause significant harm and management standards

to our employees, our maintains its commitment

business partners, members to the highest standards

of the public, or to damage of quality, health,

the environment will always safety and environmental

exist. We have an unwavering (QHSE) performance,

commitment to safeguarding which remains the first

our people and protecting item on every Board

the environment wherever agenda.

we operate. Failure to Our performance is achieved

maintain our high standards through two cornerstones,

could result in a significant QHSE management systems

incident affecting an and employee engagement.

employee, their family, Our well established

friends or colleagues management systems are

or lead to regulatory certified to the ISO

action, financial impact 9001, 14001 and OHSAS

or damage to our reputation. 18001 standards, and

our Work Safe Home Safe!

programme is central

to achieving employee

engagement, having been

revised and strengthened

during the year. To

support our management

system and engagement

programme we focus on

developing training

programmes to ensure

every employee, at

every level of the business,

has the core competencies

required

to do their work safely.

We have a network of

dedicated and experienced

QHSE professionals who

strive to deliver continual

improvement in support

of the operational delivery

of our services.

System, process or Sophisticated, interdependent The basis of our governance

control failure may business systems underpin framework is provided

impact our operational our operations. Such systems by our core policies,

performance form the basis for our which are subject to

contract management and continual review and

business support activities optimisation to manage

and we foresee increasing our growing and diversifying

future reliance on such business requirements

capability. These systems, in line with sound governance

in conjunction with our practice. Our internal

governance framework of control effectiveness

policies and procedures, continues to be reviewed

will help to drive innovation formally, supported

in customer requirements, by a programme of internal

improve our operational audits and self-certification

efficiency and provide on the operation of

the foundation of our key controls and procedures.

business support functions. Formal testing of our

As such they remain critical business critical systems

for the control and success occurs to ensure

of the business and the effective recovery following

achievement of our strategic a potential disaster

aims. scenario and we

Operational failure may have in place an assurance

result in a significant programme to test the

impact on operational adequacy of our mitigation

delivery, contract management activity. IT related

and client expectations governance oversight

due to the business critical is provided by the IT

nature of these systems. steering group (compromising

System failure could also senior management) who

result in a breakdown continue to monitor

in the controls around the effectiveness of

high volume transactions the information security

and compliance areas such management system, which

as vetting and employment is aligned with recognised

legislation. Financial international standards.

or other misstatements,

fines through statutory

non-compliance issues

and loss of client and/or

regulator confidence could

occur as a result.

Attracting and retaining Attracting and retaining To ensure a pipeline

skilled people the best skilled people of opportunities exist

at all levels of the business for staff at every level

is critical. This is particularly of the business our

the case in ensuring we career development and

have access to a diverse talent management programmes

range of views and experience are a key focus for

and in attracting specific our management teams.

expertise at both managerial Additionally, to ensure

and operational levels a talent pool is identified,

where the market may be developed and ready

highly competitive. Failure for succession if needed,

to attract new talent, succession plans exist

or to develop and retain for key management.

our existing employees, We are also aiming to

could impact our ability develop the next generation

to achieve our strategic of leaders via our graduate

growth objectives. As programme. Our focus

we continue to grow and on training and competency

diversify into new areas, at all levels of the

this risk will continue business continues to

to be a focus for the ensure that we develop

Board. our people and enable

them to successfully

manage the changing

profile of our business.

Regulatory risks Risk Mitigation

Non-compliance with As a major employer, further A key element of our

the developing regulatory development of the regulatory management system is

framework and legal framework in the legal compliance

areas where we work may framework, developed

have a material financial to ensure proactive

and reputational impact identification of legal

on the business. As such and regulatory requirements

we continue to provide in our diverse range

a strong focus on ensuring, of business areas. Our

as a minimum requirement, operational teams remain

legal and regulatory compliance primarily responsible

in all of our business for ensuring legal compliance,

areas, in particular where supported by experienced

we enter into new areas. teams of functional

Failure to achieve this experts and backed up

could lead to enforcement by our assurance teams.

action, fines, adverse Where required we obtain

publicity and therefore specialist technical

potential damage to our advice to support our

reputation, all of which in-house teams. We continue

would threaten the ability to proactively monitor

to achieve our strategic the developing regulatory

objectives. framework to plan and

budget for on-going

compliance.

Directors' Responsibility Statement

The following statement is extracted from page 85 of the Annual

Report and Accounts and is repeated here for the purposes of

Disclosure and Transparency Rule 6.3.5 to comply with Disclosure

and Transparency Rule 6.3. This statement relates solely to the

Annual Report and Accounts and is not connected to the extracted

information set out in this announcement or the Preliminary

Announcement:

"The Directors are responsible for preparing the Annual Report,

the Directors' remuneration report and the financial statements in

accordance with applicable law and regulations. The Directors are

required to prepare the financial statements for the group in

accordance with International Financial Reporting Standards as

adopted by the EU (IFRS) and Article 4 of the International

Accounting Standard (IAS) Regulation and have chosen to prepare

Company financial statements in accordance with United Kingdom

Generally Accepted Accounting Practice (UK GAAP).

In the case of IFRS accounts, IAS 1 requires that financial

statements present fairly for each financial year the Company's

financial position, financial performance and cash flows. This

requires the faithful representation of the effects of

transactions, other events and conditions in accordance with the

definitions and recognition criteria for assets, liabilities,

income and expenses set out in the International Accounting

Standards Board's 'Framework for the Preparation and Presentation

of Financial Statements'. In virtually all circumstances, a fair

presentation will be achieved by compliance with IFRS where

applicable. The Directors are also required to:

- properly select and apply accounting policies;

- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

- provide additional disclosures when compliance with the

specific IFRS requirements is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and,

- make an assessment of the Company's ability to continue as a going concern.

In the parent company accounts, the Directors have elected to

prepare the financial statements in accordance with UK GAAP. The

Directors are required to prepare financial statements for each

financial year which give a true and fair view of the state of

affairs of the Company and of the profit or loss of the Company for

that period. In preparing these financial statements, the Directors

are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and estimates that are reasonable and prudent;

- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

- prepare financial statements on the going concern basis unless

it is inappropriate to presume that the Company will continue in

business.

The Directors are responsible for keeping adequate accounting

records which disclose with reasonable accuracy at any time the

financial position of the Company, safeguarding of the assets, the

reasonable steps taken for the prevention and detection of fraud

and other irregularities, and the preparation of a Directors'

remuneration report which complies with the relevant requirements

of the Companies Acts, Listing Rules and Disclosure and

Transparency Rules (DTRs).

The Directors are also responsible for the maintenance and

integrity of the Company website. Financial statements published by

the Company on this website are prepared in accordance with UK

legislation which may differ from legislation in other

jurisdictions.

To the best of each Director's knowledge:

- the financial statements, prepared in accordance with the

applicable set of accounting standards and contained within this

Annual Report and Accounts, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

group and the undertakings included in the consolidation taken as a

whole;

- the strategic report includes a fair review of the development

and performance of the business and the position of the Company and

the undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face; and

- the Annual Report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's performance,

business model and strategy."

Related party transactions

The following extract from the Annual Report and Accounts refers

to related party transactions as set out in Note 37:

"Transactions between the Company and its subsidiaries, which

are related parties, have been eliminated on consolidation and are

not disclosed in this Note.

During the year, the group derived GBP0.3m (2014: GBP10.5m) of

revenue from contracts with joint ventures and associated

undertakings. At 31 March 2015 trade and other receivables of

GBPnil (2014: GBP7.5m) were outstanding and loans to joint ventures

and associates of GBP1.1m (2014: GBP14.8m) were included in

Financing assets.

Mitie Group plc has a related party relationship with the Mitie

Foundation, a charitable company, as R McGregor-Smith and S C

Baxter are two of the trustees of the Foundation. During the year,

the group made donations of GBP25,000 (2014: GBP63,000) and gifts

in kind of GBP277,000 (2014: GBP298,000) to the Foundation. At the

end of the year GBP23,000 (2014: GBP17,000) was due to the

Foundation and the Foundation had GBP11,000 (2014: GBP3,000) held

within creditors as an amount accrued to Mitie Group plc.

No material contract or arrangement has been entered into during

the year, nor existed at the end of the year, in which a Director

had a material interest.

The group's key management personnel are the directors and

Non-Executive Directors whose remuneration is disclosed in the

audited section of the Directors' remuneration report. The

share-based payment charge for key management personnel was GBP1.6m

(2014: GBP1.5m)."

-Ends-

For further information, contact:

John Telling

Group Corporate Affairs Director, Mitie Group plc

T: +44 (0)20 3123 8673 E: john.telling@mitie.com

M: 07979 701006

Helen Greenwood

Investor & Public Relations Manager, Mitie Group plc

T: +44 (0)20 3123 8731 E: helen.greenwood@mitie.com

Notes for editors

What is Mitie?

Mitie is a facilities management company.

We work with people who want to perform better - now and in the

future. We help our clients to run more efficient and effective

businesses by looking after their facilities, their energy needs

and the people they're responsible for.

We're all about developing our people to excel every day,

challenge the status quo, and inspire change in the way people live

and work.

Find out more at www.mitie.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSGGUWWQUPAUBU

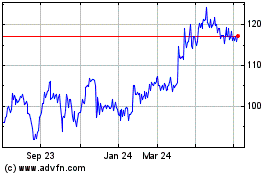

Mitie (LSE:MTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

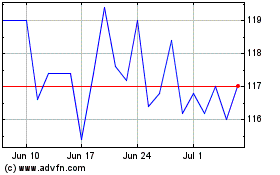

Mitie (LSE:MTO)

Historical Stock Chart

From Apr 2023 to Apr 2024