MELA Sciences Reports Its First Quarter 2014 Business and Financial Results

May 13 2014 - 4:01PM

Marketwired

MELA Sciences Reports Its First Quarter 2014 Business and Financial

Results

Company to Host Conference Call Today at 4:30PM Eastern Time

IRVINGTON, NY--(Marketwired - May 13, 2014) - MELA Sciences,

Inc. (NASDAQ: MELA), developer of the MelaFind® system, an optical

diagnostic device approved for use in the United States and the

European Union to assist dermatologists in melanoma diagnosis,

today announced results for its fiscal 2014 first quarter (Q1'14)

ended March 31, 2014. MELA will host a conference call today at

4:30 pm EDT to review its results and recent progress.

CEO Overview

Rose Crane, President and CEO, commented, "The MELA team made

strong progress the past quarter against our strategic initiatives.

We are focused on key strategies for 2014 and will review these

efforts in greater detail in today's conference call."

The highlights include:

- Introducing the MelaFind system in key medical institutions

where leading dermatologists treat high-risk patients. Most

recently we have expanded our system placements to include Baylor

University, Stanford University and The Ohio State University;

- Conducting further clinical trials to build our research base

and further illustrate the value of the MelaFind system. This

includes our Post-Approval Study now underway and a Predictive

Probability Study conducted with 191 dermatologists that

demonstrated the benefit of our system in the diagnosis of

melanoma;

- Advancing our technology through design enhancements, including

a new user interface introduced in the U.S. and Germany;

- Redirecting our small sales force to focus on key institutions

and physicians as well as areas of high incidence of melanoma, in

addition to moving from a rental-based model to a sales-based

revenue model as previously disclosed, including third-party

medical lease financing to help physicians purchase our

systems;

- Initiating the process to seek insurance reimbursement codes

and status for the MelaFind system, which we believe should become

a significant driver of future system demand; and

- Continuing our disciplined management of cash and our other

resources to best support our key initiatives.

"I am very excited by our technology as I believe it is vital to

the health of thousands," added Ms. Crane. "A person dies every

hour from melanoma, sixteen people are diagnosed every hour and 75%

of all skin cancer deaths are from melanoma. If caught early and

treated, melanoma is curable and MELA Sciences is bringing to

market a powerful new solution in support of this cause."

Financial and Operating Highlights

MELA Sciences reported a Q1'14 net loss of approximately $8.0

million, or $0.16 per share, compared with a net loss of

approximately $6.5 million, or $0.17 per share for the comparable

period last year. Included in the Q1'14 financial results were

liquidated damages of approximately $3.4 million incurred and paid

in connection with the Company's financing completed in February

2014.

Total operating expenses of $3.9 million in Q1'14 declined more

than 29% from Q1'13, with significant declines in both research and

development expenses and selling, general and administrative

expenses. The decrease resulted primarily from salary and headcount

reductions in accordance with the cost reduction plan initiated in

August 2013. The Company intends to institute actions during 2014

that may further reduce its quarterly rate of SG&A expense.

Net revenues and cost of sales were adversely affected during

Q1'14 by the Company's change in business strategy from a

rental-based revenue model to a sales-based revenue model. No

revenue from sales of the MelaFind system were recorded during

Q1'14, however sales contracts signed during the first quarter have

been completed during the second quarter. The Company believes that

once it obtains the necessary reimbursement codes and insurer

approvals revenues from the sales of the MelaFind system could

increase significantly.

Net cash used in operations was approximately $7.1 million in

Q1'14 as compared with approximately $6.1 million in Q1'13. Net

cash used in operations in Q1'14 includes $3.4 million in

liquidated damages paid to investors in connection with the

February 2014 financing.

Liquidity

In connection with the February 2014 financing, MELA granted

registration rights with respect to the shares of common stock

underlying both the Series A Preferred Stock and the warrants

pursuant to the terms of a Registration Rights Agreement. The

investors were entitled to receive liquidated damages upon the

occurrence of a number of events relating to filing, effectiveness

and maintaining an effective registration statement covering the

shares underlying the securities issued in the February financing.

The Company was unable to meet certain filing and effectiveness

requirements and as a result paid approximately $3.4 million in

liquidated damages to the investors.

MELA's cash balance at March 31, 2014 was $8.1 million compared

with $3.8 million at December 31, 2013. The Company believes that

its existing cash on hand and the actions it expects to take to

reduce expenses will support the Company's operations into the

fourth quarter of 2014. The Company continues to assess the effects

of its previously announced cost reduction plan and will reduce

various costs as necessary. The Company will need to raise

additional capital during the upcoming months, the timing and

amount of which will be affected by numerous factors, many of which

are not under its control.

Conference Call and Webcast Details:

Conference Call: 845-675-0437 or 866-519-4004 - Passcode:

42498987

Telephone Replay: 855-452-5696 or 646 254 3697 - Available May

13th - May 21st

Live Webcast & Replay:

www.melasciences.com/investors/home

About MELA Sciences, Inc. www.melasciences.com

MELA Sciences is a medical device company developing dermatology

diagnostics utilizing state-of-the-art optical imaging. The

Company's flagship product is the MelaFind® system, a non-invasive

diagnostic tool to aid dermatologists in melanoma evaluation and

diagnosis, which has secured FDA Pre-Market Approval (PMA) for the

U.S. and CE Marking certification for the European Union. The

MelaFind® system uses a variety of visible to near-infrared light

waves to evaluate skin lesions from the surface to 2.5 mm beneath

the skin. It provides images and data on the relative

disorganization of a lesion's cell structure that provides

substantial additional perspective to aid melanoma diagnosis. MELA

is also exploring new potential uses for its core imaging

technology and algorithms.

Safe Harbor

This press release includes "forward-looking statements" within

the meaning of the Securities Litigation Reform Act of 1995. These

statements include but are not limited to our plans, objectives,

expectations and intentions and may contain words such as "seeks,"

"look forward," and "there seems" that suggest future events or

trends. These statements are based on our current expectations and

are inherently subject to significant uncertainties and changes in

circumstances. Actual results may differ materially from our

expectations due to financial, economic, business, competitive,

market, regulatory and political factors or conditions affecting

the company and the medical device industry in general, as well as

more specific risks and uncertainties set forth in the company's

SEC reports on Forms 10-Q and 10-K. Given such uncertainties, any

or all of these forward-looking statements may prove to be

incorrect or unreliable. MELA Sciences assumes no duty to update

its forward-looking statements and urges investors to carefully

review its SEC disclosures available at www.sec.gov and

www.melasciences.com.

| |

|

| MELA SCIENCES, INC. |

|

| BALANCE SHEETS |

|

| |

|

| |

|

|

|

|

|

|

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

(unaudited) |

|

|

* |

|

| ASSETS |

|

| Current Assets: |

|

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

8,122,709 |

|

|

$ |

3,782,881 |

|

| |

Accounts receivable (net of allowance of $43,080 and

$46,130 as of March 31, 2014 and December 31, 2013,

respectively) |

|

|

34,121 |

|

|

|

57,151 |

|

| |

Inventory (net of reserve of $325,000 as of March 31,

2014 and December 31, 2013) |

|

|

5,648,020 |

|

|

|

5,631,205 |

|

| |

Prepaid expenses and other current assets |

|

|

465,140 |

|

|

|

879,698 |

|

| |

|

Total

Current Assets |

|

|

14,269,990 |

|

|

|

10,350,935 |

|

| |

Property and equipment, net |

|

|

2,995,253 |

|

|

|

3,690,784 |

|

| |

Patents and trademarks, net |

|

|

40,526 |

|

|

|

41,795 |

|

| |

Other assets |

|

|

48,000 |

|

|

|

48,000 |

|

| Total Assets |

|

$ |

17,353,769 |

|

|

$ |

14,131,514 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| |

Accounts payable (includes related parties of $85,972

and $32,902 as of March 31, 2014 and December 31, 2013,

respectively) |

|

$ |

1,311,174 |

|

|

$ |

1,478,995 |

|

| |

Accrued expenses (includes related parties of $23,129

and $48,000 as of March 31, 2014 and December 31, 2013,

respectively) |

|

|

819,851 |

|

|

|

844,131 |

|

| |

Deferred placement revenue |

|

|

201,864 |

|

|

|

243,605 |

|

| |

Warrant liability |

|

|

8,464,865 |

|

|

|

3,017,142 |

|

| |

Other current liabilities |

|

|

61,815 |

|

|

|

67,934 |

|

| |

|

Total

Current Liabilities |

|

|

10,859,569 |

|

|

|

5,651,807 |

|

| |

|

|

|

|

|

|

|

|

| Long Term Liabilities: |

|

|

|

|

|

|

|

|

| |

Deferred placement revenue |

|

|

28,834 |

|

|

|

63,754 |

|

| |

Deferred rent |

|

|

110,111 |

|

|

|

120,120 |

|

| |

|

Total

Long Term Liabilities |

|

|

138,945 |

|

|

|

183,874 |

|

| Total Liabilities |

|

|

10,998,514 |

|

|

|

5,835,681 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' Equity: |

|

|

|

|

|

|

|

|

| |

Preferred stock - $0.10 par value; authorized

10,000,000 shares: issued and outstanding: 12,300 at March 31, 2014

and 0 at December 31, 2013 |

|

|

1,230 |

|

|

|

- |

|

| |

Common stock - $0.001 par value; authorized 95,000,000

shares: |

|

|

|

|

|

|

|

|

| |

Issued and outstanding 52,107,465 shares at March 31,

2014 and 47,501,596 at December 31, 2013 |

|

|

52,108 |

|

|

|

47,502 |

|

| |

Additional paid-in capital |

|

|

182,430,391 |

|

|

|

176,396,209 |

|

| |

Accumulated deficit |

|

|

(176,128,474 |

) |

|

|

(168,147,878 |

) |

| |

|

Total

Stockholders' Equity |

|

|

6,355,255 |

|

|

|

8,295,833 |

|

| Total Liabilities and Stockholders' Equity |

|

$ |

17,353,769 |

|

|

$ |

14,131,514 |

|

| |

|

|

|

|

|

|

|

|

| * Derived from the audited balance sheet as of December

31, 2013 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

| MELA SCIENCES, INC. |

|

| STATEMENTS OF OPERATIONS |

|

| (unaudited) |

|

| |

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

2014 |

|

|

2013 |

|

| Net revenues |

|

$ |

97,638 |

|

|

$ |

144,100 |

|

| Cost of revenue |

|

|

918,523 |

|

|

|

1,080,263 |

|

| |

|

Gross

profit |

|

|

(820,885 |

) |

|

|

(936,163 |

) |

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| |

Research and development |

|

|

707,824 |

|

|

|

1,262,001 |

|

| |

Selling, general and administrative |

|

|

3,203,533 |

|

|

|

4,287,228 |

|

| |

Total operating expenses |

|

|

3,911,357 |

|

|

|

5,549,229 |

|

| |

|

Operating loss |

|

|

(4,732,242 |

) |

|

|

(6,485,392 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

| |

Interest income |

|

|

618 |

|

|

|

2,105 |

|

| |

Interest expense |

|

|

(1,199 |

) |

|

|

(48,763 |

) |

| |

Change in fair value of warrant liability |

|

|

137,142 |

|

|

|

15,433 |

|

| |

Registration rights liquidated damages |

|

|

(3,389,940 |

) |

|

|

- |

|

| |

Other income, net |

|

|

5,025 |

|

|

|

5,000 |

|

| |

|

|

(3,248,354 |

) |

|

|

(26,225 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

Net

loss |

|

$ |

(7,980,596 |

) |

|

$ |

(6,511,617 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.16 |

) |

|

$ |

(0.17 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted weighted average number of common

shares outstanding |

|

|

48,926,409 |

|

|

|

39,233,943 |

|

| |

|

|

|

|

|

|

|

|

Media Diana Garcia Redruello MELA Sciences, Inc. 212-518-4226

dgarcia@melasciences.com Investors David Collins, Eric Lentini

Catalyst Global 212-924-9800 mela@catalyst-ir.com

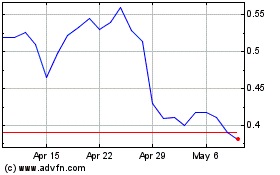

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Mar 2024 to Apr 2024

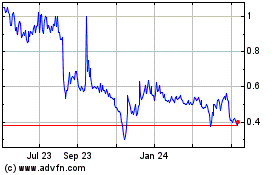

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Apr 2023 to Apr 2024