By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Retail in the spotlight after weekend of holiday shopping

U.S. stocks edged lower Monday afternoon but remained on track

to post modest monthly gains, as investors weighed the kickoff of

the holiday shopping season along with weaker-than-expected

economic data ahead of a busy week of economic releases and

central-bank watching.

The S&P 500 was down 1.2 points, or less than 0.1%, at

2,088. The Dow Jones Industrial Average fell 5 points, or less than

0.1%, to 17,793. The Nasdaq Composite lost 8 points, or 0.2%, at

5,119.

The major indexes were left mostly flat in last week's

holiday-shortened trade. For November, the Nasdaq Composite is

looking at a gain of around 1.3%, while the Dow industrials and

S&P 500 index are less buoyant, set to add around 0.7% and

0.4%, respectively.

An uptick in oil prices gave energy shares a boost on the day,

with the energy sector leading the S&P 500 Monday afternoon, up

0.9%. Meanwhile, financials looked on track to be the best

performer on the S&P 500 for the month, eyeing a 2.2% rise, as

investors anticipated that an interest-rate hike may boost bank

net-interest income.

Meanwhile, traders were also looking to the retail sector to add

some end-of-month sparkle, though there were concerns about

slower-than-expected Black Friday sales in stores. Some were

worried that if early returns on Cyber Monday sales are also weak,

then that could dampen what appetite is out there for retail stocks

(http://www.marketwatch.com/story/holiday-sales-wage-data-likely-to-drive-stocks-this-week-2015-11-29).

A National Retail Federation survey on Sunday found that more

people shopped online than in stores during the holiday weekend

(http://www.marketwatch.com/story/online-shopping-tops-stores-on-black-friday-weekend-2015-11-29-19103331).

The retail outlook for the holiday season is relatively modest,

with analysts looking at a 3% increase, said Randy Frederick,

managing director of Schwab Center for Financial Research

"But it's very early in the process, as Black Friday is only one

piece of the puzzle," Frederick said, adding that investors should

look for data at least a couple weeks into December for a more

informed view of the sector.

(http://www.marketwatch.com/story/dont-expect-saudi-arabia-to-back-down-when-opec-meets-2015-11-25)

Central-bank watching: This week could be volatile for markets,

with a policy meeting at the European Central Bank on Thursday and

speeches by Federal Reserve Chairwoman Janet Yellen on the docket.

Friday brings the last batch of U.S. jobs numbers before the Fed's

December policy meeting and a meeting of the Organization of the

Petroleum Exporting Countries.

Economic data on Monday came in below expectations, with the

Chicago PMI, or business barometer, falling back into

contractionary territory in November

(http://www.marketwatch.com/story/chicago-pmi-tumbles-back-into-contractionary-territory-in-november-2015-11-30).

This was the last major regional release before the Institute for

Supply Management's manufacturing gauge, set for release on Tuesday

morning. Meanwhile, pending home sales edge up 0.2% in October

(http://www.marketwatch.com/story/pending-home-sales-edge-up-02-in-october-2015-11-30),

following two months of declines.

Later this week, a steady trickle of data builds to the November

nonfarm payrolls report on Friday.

Barring a surprise on the downside in the upcoming data

releases, investors are largely expecting that the Fed will hike

rates in December. The market-implied probability of a December

rate increase was 78% Monday morning, according to the CME Group's

FedWatch Tool

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html),

which tracks Fed-funds futures prices.

See: November jobs report likely to give Fed go-ahead to raise

interest rates

(http://www.marketwatch.com/story/november-jobs-report-likely-to-give-fed-go-ahead-to-raise-interest-rates-2015-11-29).

"The question should now shift however to how the economic data

stacks up in moving towards a second hike in early 2016," said

Peter Boockvar, chief market analyst at The Lindsey Group, in a

note.

This is particularly important for the U.S. dollar, Boockvar

added, "in the context of the large bullishness of it based

predominantly on the fact that the Fed's monetary policy is

diverging from everyone else."

Investors will also be watching closely speeches by the Fed's

Yellen on Wednesday and Thursday. On Thursday, they'll look to see

whether ECB President Mario Draghi delivers further easing as

expected, and whether any action taken will be enough to keep

markets happy.

The market is in position to rally and could reach record highs

by the end of the year, said Peter Cardillo, chief market economist

at First Standard Financial. He added that a potential Fed hike has

largely been factored in.

"I still think we'll see new highs, between 2,175 and 2,200 by

year-end [on the S&P 500], in spite of a possible change in

monetary policy and in spite of a strong dollar," he said. "The

fact that the ECB is likely to increase stimulus is a plus for

global equities."

Stocks to watch:

Amazon.com Inc. (AMZN) is among the retailers in the spotlight

as investors get ready to assess the holiday weekend of sales.

Amazon's shares inched 0.3 lower Monday afternoon, while Under

Armour shares (UA) lost 3.7%.

Shares of Microsoft Corp. (MSFT) rose 1.7% after the company got

upgraded to strong buy from market perform at Raymond James, and

Fitbit (FIT) shares rose 3.1% after the company got upgraded to

overweight from equalweight at Barclays.

Computer Sciences Corp. shares (CSC) rose 6%, after the company

began trading as two separate companies Monday after the spinoff of

its public-sector company as CSRA Inc

(http://www.marketwatch.com/story/computer-sciences-spins-off-into-2-separate-companies-2015-11-30-91035350).

CSRA's (CSRA) shares rose 5.8%.

Other markets:Oil prices

(http://www.marketwatch.com/story/oil-prices-pause-ahead-of-central-bank-opec-meetings-2015-11-30)

turned higher Monday ahead of another major event this week, the

OPEC meeting on Friday, but looked poised for monthly loss of more

than 10%. Pressure is building on Saudi Arabia to cut oil output,

but many say the kingdom is unlikely to change its approach

(http://www.marketwatch.com/story/pressure-builds-on-saudi-arabia-before-fridays-opec-meeting-2015-11-30).

Gold prices edged higher Monday but suffered a monthly drop of

6.7%, the biggest monthly loss in over two years

(http://www.marketwatch.com/story/gold-dips-set-for-biggest-monthly-loss-in-more-than-2-years-2015-11-30).

The dollar

(http://www.marketwatch.com/story/dollar-pinned-down-as-ecb-and-us-payrolls-line-up-this-week-2015-11-30),

meanwhile, was eyeing the best month since January, boosted by

rising rate-hike expectations.

The Stoxx Europe 600 index

(http://www.marketwatch.com/story/european-stocks-climb-ahead-of-key-policy-data-week-2015-11-30)

rose 2.7% for November, a second-straight month of gains. In Asia

(http://www.marketwatch.com/story/china-november-stock-gains-nearly-wiped-out-by-broker-probe-2015-11-30),

the Shanghai Composite managed a 1.9% gain for November, but much

of the month's gains were wiped out by an investigation into

China's biggest brokerage houses. The index is up just 16% from its

Aug. 26 bottom.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 30, 2015 15:05 ET (20:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

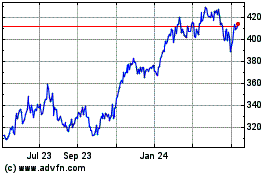

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

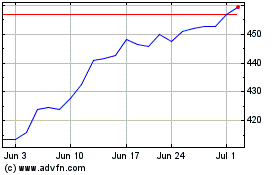

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024