By Ellie Ismailidou and Carla Mozee, MarketWatch

Hewlett-Packard shares tumble after weak quarterly sales

U.S. stocks inched higher Wednesday as a pre-Thanksgiving round

of U.S. economic data were interpreted as solid enough to keep the

Federal Reserve on track for a potential interest-rate increase in

December.

The S&P 500 rose 1.5 points, or less than 0.1%, to 2,090.

The Dow Jones Industrial Average rose 17 points, or 0.1%, to 17,828

and the Nasdaq Composite was up 12 points, or 0.2%, at 5,114.

U.S. orders for long-lasting or durable goods rebounded

(http://www.marketwatch.com/story/durable-goods-orders-climb-3-in-october-2015-11-25)in

October to show the first increase in three months, led by a surge

in demand for large, commercial airplanes. Meanwhile, the number of

people who applied for U.S. unemployment benefits

(http://www.marketwatch.com/story/us-jobless-claims-drop-12000-to-260000-2015-11-25)

fell by 12,000 to 260,000 in the week before Thanksgiving,

indicating that the labor market is continuing its steady path to

recovery.

Wednesday's data keep the Fed on track to raise rates in

December, particularly as they "offer a strong gauge of the

employment situation, which means we could see a 200,000 job gain

in November's jobs report next week," said Douglas Coté, chief

market strategist at Voya Investment Management.

But inflation, as gauged by the personal consumption expenditure

price index, edged up just 0.1% in October, the Commerce Department

said on Wednesday morning. The PCE price index is considered by

analysts as the Fed's preferred inflation measure, as the central

bank considers raising rates for the first time in nearly a

decade.

The PCE index has risen just 0.2% in the past 12 months

(http://www.marketwatch.com/story/consumer-spending-rises-scant-01-in-october-2015-11-25),

while the core PCE index that excludes food and energy was flat,

and it's up 1.3% over the past year, well below the Fed's 2%

inflation target.

As for the weak PCE, "the Fed's view seems to be that this is a

lagging indicator," Coté said, with policy makers viewing it as

transitory, particularly in the context of strong wage gains in the

October jobs report.

Read: The Fed is ready for higher rates--are you?

(http://www.marketwatch.com/story/the-fed-is-ready-for-higher-rates-are-you-2015-11-24)

Stocks ended slightly higher Tuesday

(http://www.marketwatch.com/story/wall-street-set-for-muted-open-after-turkey-shoots-down-jet-2015-11-24),

aided by gains for the energy sector as oil prices surged 3% in the

wake of Turkey's downing of a Russian jet fighter near the Syrian

border. The S&P 500 edged up 0.1%, as did the Dow Jones

Industrial Average . The Nasdaq Composite was little changed at

5,102.81.

Trading will closed Thursday for Thanksgiving Day, and open for

a half-day on Friday. No economic data are scheduled for release on

either day.

Read: When do markets close Thanksgiving Week?

(http://www.marketwatch.com/story/when-do-markets-close-around-thanksgiving-2015-11-23)

Data: New home sales were up 10.7%

(http://www.marketwatch.com/story/sales-of-new-homes-leap-107-to-495000-annual-rate-2015-11-25)

for the month of October, but median prices fell 7% for the year,

the Commerce Department said Wednesday.

Consumer sentiment rose in November, but not as much as

previously indicated, according to the latest monthly survey by the

University of Michigan

(http://www.marketwatch.com/story/consumer-sentiment-improves-in-november---but-with-a-hitch-2015-11-25).

Corporates: Hewlett-Packard Co. (HPQ) shares fell 14% after the

tech heavyweight late Tuesday reported weak quarterly sales

(http://www.marketwatch.com/story/hp-inc-stock-dives-following-weak-quarterly-sales-2015-11-24).

But shares of Hewlett Packard Enterprise Co. (HPE), which now

houses the cloud and enterprise-market properties of the former

Hewlett-Packard Co., rose 3.1%.

Deere & Co. (DE) shares jumped 2.3% after the heavy

equipment maker's fourth-quarter profit and sales leapt above

expectations

(http://www.marketwatch.com/story/deere-shares-up-6-in-premarket-after-profit-and-sales-beat-estimates-2015-11-25).

Cost cuts helped offset weakness in global markets for farm and

construction equipment.

Shares in Baxalta Inc. (BXLT) climbed 2.7% after a report that

Dublin-based Shire PLC (SHPG) is preparing a renewed takeover bid

(http://www.marketwatch.com/story/shire-shares-rise-on-report-of-renewed-baxalta-bid-2015-11-25)

for the U.S. biotech company. U.S.-listed shares of Shire

(SHPG)(SHPG) slipped 0.8%.

Other markets: Most Asian markets slipped Wednesday, still

feeling the weight of geopolitical tensions, although a rise in oil

prices overnight helped some energy shares. The Nikkei Average fell

0.4%, for its first loss in four sessions.

European stocks were moving higher

(http://www.marketwatch.com/story/european-stocks-gain-with-travel-shares-finding-relief-2015-11-25)

after Turkey's president said the country isn't looking to escalate

tensions with Russia.

Gold prices were off nearly 0.5%, while oil futures lost nearly

2% after Tuesday's leap. The U.S. dollar index rose 0.5% to 100, as

the euro fell below $1.06.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 25, 2015 10:42 ET (15:42 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

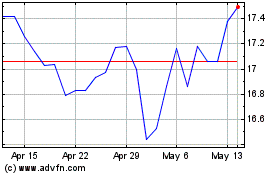

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

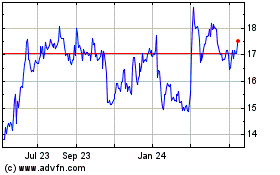

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Apr 2023 to Apr 2024