By Wallace Witkowski and Ellie Ismailidou, MarketWatch

Materials stocks lead gains; dollar struggles to recover against

yen

U.S. stocks traded higher Monday on lower-than-average volume,

but off their best levels of the session, as oil futures rallied

and the dollar traded lower against most of its rivals.

Investors were bracing for the start of the first-quarter

earnings season, which kicks off unofficially with the results from

Alcoa

(http://www.marketwatch.com/story/what-to-expect-from-alcoas-earnings-2016-04-08)

Inc. (AA) after the market closes.

The S&P 500 Index climbed 6 points, or 0.3%, to 2,054, led

by gains in the financials, consumer-discretionary, and materials

sectors. Earlier, the index had up been as many as 15 points.

The Dow Jones Industrial Average gained 79 points, or 0.5%, to

17,665, led by gains in Goldman Sachs Group Inc. (GS) and J.P.

Morgan Chase & Co. (JPM) Earlier, the blue-chip average had

been up 155 points.

Meanwhile, the tech-heavy Nasdaq Composite Index advanced 15

points, or 0.3%, to 4,866. Earlier in the session, the index had

been up 47 points.

Monday's fluctuating price action is likely the result of

lower-than-average volume, which has tapered off since the February

selloff, said Paul Nolte, portfolio manager at Kingsview Asset

Management.

"I'm struggling to see where the buying interest is coming in,"

said Nolte. "With volume so low, it's pretty easy to push prices

around."

According to Dow Jones data, year-to-date average daily volume

for the NYSE Composite is 4.43 billion shares and for the Nasdaq is

2.05 billion shares. Month-to-date, the daily average has been 3.68

billion for the NYSE and 1.73 billion for the Nasdaq. With less

than an 90 minutes of trading remaining in the day, the NYSE stood

at 2.28 billion shares and the Nasdaq stood at 1.02 billion shares

traded.

A rally in crude-oil futures

(http://www.marketwatch.com/story/crude-prices-higher-after-us-rig-count-adds-to-streak-of-declines-2016-04-11)

had boosted the main benchmarks, following a recent trend of strong

correlation between oil and stock prices.

Oil remained the "key market driver" on Monday, as firmer oil

prices were "trumping the prospects of a poor earnings season,

along with the absence of major economic reports today," said Peter

Cardillo, chief market economist at First Standard Financial.

A surge in gold prices

(http://www.marketwatch.com/story/gold-pushes-higher-to-log-best-settlement-in-3-weeks-2016-04-11)

boosted the stocks of gold miners, like Kinross Gold Corp. (KGC)

and AngloGold Ashanti Ltd. (AU) (AU)Gold continued to advance after

enjoying its best weekly gain in three weeks on Friday.

Stocks retreated from their intraday high after a slight

recovery in the dollar but the buck has been trading broadly lower

against its main currency rivals, although it has recovered some

ground against the yen

(http://www.marketwatch.com/story/dollar-drops-to-fresh-17-month-low-against-the-yen-2016-04-11).

The yen has recently been at the center of equity selloffs, as yen

strength has fueled risk aversion. The Japanese currency is

perceived as a haven in times of global economic worries.

John Manley, chief equity strategist at Wells Fargo Advantage

Funds, called the dollar-yen relationship a "market mosquito

bite."

"Sometimes a mosquito bite can really grab your attention. But

in the long run, the dollar-yen will correct -- just not in a

straight line," Manley said, adding that the impact on equities and

risk aversion could become bigger in the short term if the Bank of

Japan steps in to weaken its currency by flooding the market with

yen.

Read:Japan can't be gentle with yen intervention

(http://www.marketwatch.com/story/japan-cant-be-gentle-with-yen-intervention-2016-04-08)

Yellen and Obama: Fed chief Janet Yellen will meet President

Obama at 3 p.m. Eastern in the Oval Office. The two will discuss

(http://www.marketwatch.com/story/obama-yellen-to-meet-monday-to-talk-economy-2016-04-10)

"the state of the American and global economy, Wall Street reform,

and the long-term economic outlook, economic and regulatory

issues," the White House said in a statement.

Read:The U.S. economy--Goldilocks, it's not

(http://www.marketwatch.com/story/the-us-economy-goldilocks-its-not-2016-04-10)

Stocks to watch: Chesapeake Energy Corp.(CHK) shares surged 15%

after the company reached an amended agreement with its lenders

(http://www.marketwatch.com/story/chesapeake-amends-credit-facility-agreement-with-lenders-2016-04-11-91034841)that

allows it to borrow as much as $2.5 billion and offers relief on

some terms of its debt covenants.

Shares of Yahoo Inc. (YHOO) rose 1.9% after the U.K.'s Daily

Mail emerged as a possible bidder for the Internet group's assets,

The Wall Street Journal reported

(http://www.marketwatch.com/story/daily-mail-exploring-buyout-bid-for-yahoo-2016-04-11).

Telecom giant Verizon Communications Inc. (VZ) is also among a big

group of companies interested in Yahoo, as a deadline of April 18

looms for preliminary offers.

Shares of Hatteras Financial Corp. (HTS) surged 11% after Annaly

Capital Management Inc. (NLY) announced a deal to buy the fellow

real-estate investment trust for about $1.5 billion.

(http://www.marketwatch.com/story/annaly-capital-to-buy-hatteras-financial-for-15-billion-2016-04-11-710317)

Alcoa shares rose 3.8% ahead of earnings. The company will

report after the market closes on Monday. Wall Street analysts

expect a third straight quarter of declines in both earnings and

revenue from the aluminum producer. Read more on what to expect

from Alcoa

(http://www.marketwatch.com/story/what-to-expect-from-alcoas-earnings-2016-04-08).

Those results will come amid expectations that S&P 500

companies will deliver the worst earnings quarter since 2009.

The recent market correction appears to have come from concerns

that price-to-earnings ratios may have bounced back too quickly,

said Colin Cieszynski, chief market strategist at CMC Markets, in

emailed comments.

"The answer to the question of whether prices are currently too

high or earnings estimates are currently too low could spark

significant moves in the markets over the coming weeks," he

added.

Banks

"It's hard to argue against overall Street expectations for this

quarter being particularly low, and the interesting reports this

week will more than likely come out from the banks, which are

expected to be a front-runner for negative earnings growth this

period," said Jim Reid, strategist at Deutsche Bank, in a note to

clients on Monday.

Shares have badly lagged behind the broader market amid a

hesitancy by the Fed to raise interest rates off ultra-low levels.

Lower rates can erode the gap between what banks make on loans and

how much they pay on deposits. Financial stocks have been the worst

performing sector this year, falling 7% year to date.

On Wednesday, J.P. Morgan Chase & Co. (JPM) will report

earnings. Wells Fargo & Co. (WFC) and Bank of America Corp.

(BAC) will follow on Thursday, and Citigroup Inc. (C) on

Friday.

Other markets:European stocks

(http://www.marketwatch.com/story/european-stocks-get-a-lift-from-italian-shares-2016-04-11)

rose, led by the banking sector, while Asia

(http://www.marketwatch.com/story/china-shares-aided-by-soft-inflation-data-but-strong-yen-hits-nikkei-2016-04-11)

had a mixed day. The Shanghai Composite Index finished 1.6% higher

after soft Chinese inflation data drove hopes that authorities will

act again to stimulate the economy. The Nikkei 225 index closed

down 0.4%, weighed by yen strength.

The yield on the benchmark 10-year Treasury note gained less

than a basis point to 1.728%. Yields move in the opposite direction

of prices.

--Barbara Kollmeyer in Madrid contributed to this article.

(END) Dow Jones Newswires

April 11, 2016 14:48 ET (18:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

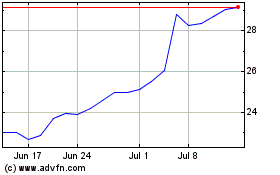

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Mar 2024 to Apr 2024

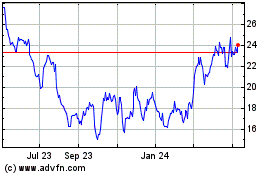

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Apr 2023 to Apr 2024