By Wallace Witkowski and Anora Mahmudova, MarketWatch

Deere, Applied Materials, Ross Stores shares on the move

U.S. stocks advanced for a second straight session on Friday,

cutting into sharp losses for the week, after a drama surrounding

the White House abated.

The S&P 500 index added 20 points, or 0.9%, to 2,385, with

all of its 11 main sectors trading higher. The financials, energy

and industrials sectors led the gains, all up more than 1%.

The Dow Jones Industrial Average gained 170 points, or 0.8%, to

20,833. Caterpillar Inc. (CAT) and General Electric Co.(GE) were

leading the gains, up nearly 2%.

The Nasdaq Composite Index surged 44 points, or 0.7%, to 6,100,

powered by more than 2% gains in U.S. shares of Baidu Inc.(BIDU),

Nvidia Corp.(NVDA), and Starbucks Corp.(SBUX)

For the week, however, all three indexes are looking at losses

of 0.2% to 0.3% following Wednesday's sharp downdraft. Friday's

jump helped to cut into what would have been at least 1% losses for

the equity benchmarks.

"Over the past two days the news cycle went from the intense

inferno-type fire to just regular fire, allowing markets to calm

down," said Tom Siomades, head of the Investment Consulting Group

of Hartford Funds.

Markets were rattled earlier this week, with investors caught

off guard Wednesday following a report that President Donald Trump

in February asked then-Federal Bureau of Investigation Director

James Comey to stop an investigation into Russian interference into

the U.S. election, causing some investors to question whether Trump

will even finish his term. Stocks started to bounce back on

Thursday after Deputy Attorney General Rod Rosenstein appointed

former FBI Director Robert Mueller as special counsel

(http://www.marketwatch.com/story/robert-mueller-ex-fbi-director-named-special-counsel-for-russia-probe-2017-05-17)

to oversee the bureau's investigation.

Read:Why the White House should worry: Special counsels usually

result in criminal charges

(http://www.marketwatch.com/story/why-the-white-house-should-worry-special-counsels-usually-result-in-criminal-charges-2017-05-18)

That appointment did a lot to placate skittish investors, and

allow the focus to go back to economic growth more rooted in

current business conditions than those more favorable conditions

that could get derailed with the drama out of Washington, said

Diane Jaffee, senior portfolio manager at TCW

"Clearly, appointing Mueller was brilliant," Jaffee said.

"Regardless of who is in office you want the rule of law. You want

that the government will prevail in maintaining checks and

balances."

Even with weak GDP growth in the first quarter, which even the

Federal Reserve called "transitory"

(http://www.marketwatch.com/story/fed-holds-interest-rates-steady-dismisses-first-quarter-slump-as-transitory-2017-05-03),

what many people overlook is that business investment surged 9.4%

in the quarter, and not because of election promises, Jaffee

said.

Read: Fed minutes may quell fresh doubts about a June rate

increase

(http://www.marketwatch.com/story/fed-minutes-may-quell-fresh-doubts-about-a-june-rate-hike-2017-05-19)

As earnings are finally beginning to grow at a healthy pace and

fewer companies are cutting costs to pad their results, we're

beginning to see business investment, which Jaffee said has "been a

long time coming."

Still, investors have increasingly questioned whether President

Trump can deliver on his economic stimulus promises amid

investigations.

Opinion:Market sentiment during Watergate shows how stocks might

react to Trump

(http://www.marketwatch.com/story/market-sentiment-during-watergate-shows-how-stocks-might-react-to-trump-2017-05-19)

"This week political risk has caught up on the market but it's

still unclear whether it has any legs," wrote Deutsche Bank

strategist Jim Reid and research analyst Craig Nicol in a note to

clients Friday.

"Whether this latest Trump bout of volatility lasts depends on

what Mr. Comey really has on the president, but there wasn't much

new news to report on the story yesterday which helped U.S.

equities to recover," said the Deutsche Bank team.

Observers said investors will be closely watching potential

developments on the controversy next week. Lawmakers have asked the

FBI to turn over the notes Comey said he made from his meetings

with Trump by next week, and a congressional hearing on the matter

is due to take place, at which the former FBI head has been asked

to testify.

Economic data and Fed speakers: Once again, there are no data

points to distract investors from the political roller coaster.

St. Louis Fed President James Bullard questioned the need for a

June rate increase

(http://www.marketwatch.com/story/feds-bullard-questions-need-for-june-rate-hike-2017-05-19),

citing a slowdown in the U.S. economy during the first half of the

year. Bullard isn't a voting member of the Fed policy committee

this year.

Moving stocks: Deere shares (DE) jumped 7.7% after earnings and

sales beat Wall Street forecasts

(http://www.marketwatch.com/story/deeres-stock-surges-after-big-profit-and-sales-beats-raised-outlook-2017-05-19).

Earnings from Campbell Soup Co.(CPB) were below expectations,

sending shares down 2.1%.

Shares of Autodesk Inc.(ADSK) jumped 16% as the company said its

shift to a subscription-based software model was going well.

Dynegy Inc. shares (DYN) soared 23%, and headed to a three-month

high after reports that the power producer received a buyout offer

from Vistra Energy(VST).

Also in the retail sector, Ross Stores Inc. (ROST) rose 2.8%

after earnings and sales met forecasts

(http://www.marketwatch.com/story/ross-shares-higher-after-eps-beats-expectations-sales-meet-forecast-2017-05-18).

Shares of Foot Locker Inc.(FL) slid 16% after

weaker-than-expected first-quarter results.

Shares of Under Armour Inc.(UAA) looked to snap a seven-session

losing streak and were last up 0.6%.

McKesson Corp.(MCK) shares rallied after the health-care supply

chain management company topped earnings expectation

(http://www.marketwatch.com/story/mckesson-shares-surge-after-earnings-outlook-top-street-view-2017-05-18)

late Thursday.

Read:Only two S&P 500 companies passed this

sales-and-earnings test

(http://www.marketwatch.com/story/only-two-sp-500-companies-passed-this-sales-and-earnings-test-2017-05-11)

Shares of Applied Materials Inc.(AMAT) rose 0.6% after the

microchip-materials maker's results and outlook topped Wall Street

estimates late Thursday

(http://www.marketwatch.com/story/applied-materials-shares-rise-on-earnings-beat-strong-outlook-2017-05-18).

Read:Bill Ackman has 'something to prove' after Valeant mistake

(http://www.marketwatch.com/story/bill-ackman-has-something-to-prove-after-valeant-mistake-2017-05-18)

(http://www.marketwatch.com/story/bill-ackman-has-something-to-prove-after-valeant-mistake-2017-05-18)Other

markets: European stocks end up across the board

(http://www.marketwatch.com/story/european-stocks-start-digging-out-of-trump-inspired-rout-2017-05-19),

and the FTSE 100 index

(http://www.marketwatch.com/story/uk-stocks-break-2-day-losing-streak-after-pounds-mini-flash-crash-2017-05-19)

snapped a two-day losing streak. In Asia , stocks finished mostly

higher.

The dollar traded lower across the board, with the U.S. Dollar

Index down 0.7%, and the British pound recapturing the $1.30 level

(http://www.marketwatch.com/story/the-pound-looks-set-for-significant-further-upside-now-that-its-regained-130-2017-05-18)

it lost late Thursday after a mini "flash crash," which sent it to

as low as $1.2888 within seconds.

Read:The pound looks set for 'significant further upside' now

that it's regained $1.30

(http://www.marketwatch.com/story/the-pound-looks-set-for-significant-further-upside-now-that-its-regained-130-2017-05-18)

Gold prices

(http://www.marketwatch.com/story/gold-futures-hit-pause-as-stocks-improve-but-weekly-advance-on-track-2017-05-19)

settled up less than 0.1% at $1,253.60 an ounce, while oil prices

added to gains, with West Texas Intermediate crude prices trading

above the $50-a-barrel mark

(http://www.marketwatch.com/story/optimism-ahead-of-opec-meeting-drives-further-gains-for-oil-2017-05-19).

--Barbara Kollmeyer in Madrid contributed to this article.

(END) Dow Jones Newswires

May 19, 2017 14:01 ET (18:01 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

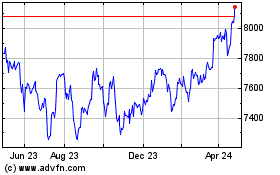

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

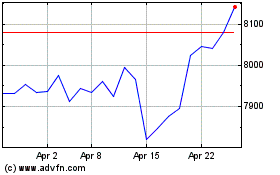

FTSE 100

Index Chart

From Apr 2023 to Apr 2024