MARKET SNAPSHOT: S&P 500, Dow Hit Intraday Records, On Track For Weekly Gains

December 09 2016 - 10:04AM

Dow Jones News

By Anora Mahmudova and Sara Sjolin, MarketWatch

Some analysts warn a correction may be coming

U.S. stocks extended gains to a fifth consecutive session

Friday, with main benchmarks setting fresh intraday highs after

opening modestly higher.

The S&P 500 index added 5 points, or 0.2%, to 2,251, with

six of the 11 main sectors trading higher. Health-care stocks led

the gains, while financials pulled back the most. The benchmark was

looking at a 2.7% weekly gain.

The Dow Jones industrials Average advanced 28 points, or 0.1%,

to 19,646. Meanwhile, the Nasdaq Composite rose 28 points, or 0.5%,

to 5,445, thanks to a rally in biotechnology stocks. The iShares

Nasdaq Biotechnology ETF (IBB) was up 1.8%.

All three benchmarks were on track to post hefty weekly gains,

prompting some analysts to warn of a corrective pullback after a

solid rally.

On Thursday, five major stock benchmarks, including Russell 2000

and the Dow Jones Transports finished in record territory. That was

the first time in more than 18 years

(http://www.marketwatch.com/story/stock-benchmarks-just-did-something-they-havent-done-in-nearly-20-years-2016-12-08)

that they have all ended at all-time highs on the same day.

Read:This buying panic may last until Dow 20,000

(http://www.marketwatch.com/story/this-buying-panic-may-last-until-dow-20000-2016-12-08)

However, analysts have started to ask if the surge in stocks

since the election on Nov. 8 is now looking a bit overdone.

See:This top market timer says stocks' 'Trump bump' won't last

much longer

(http://www.marketwatch.com/story/this-top-market-timer-says-stocks-trump-bump-wont-last-much-longer-2016-12-09)

"The Relative Strength Index hints at deepening overbought

conditions in the U.S. stock markets, suggesting that the time for

a correction could be approaching," said Ipek Ozkardeskaya, senior

market analyst at London Capital Group, in emailed comments.

"Of course it is just a technical indicator, and we have seen

that investors have proved to be very eager in stocks over the last

couple of days," she added.

Economic news: It's a relatively quiet day on the economic

calendar. A reading on consumer sentiment for December comes out at

10 a.m. Eastern Time, and it is forecast to have risen to 95.0 from

93.8 in November.

Wholesale inventories for October are also due at 10 a.m.

Eastern.

There are no Federal Reserve speakers on tap as the central bank

has entered its "blackout" period ahead of its December 13-14

meeting.

Movers: Shares of Restoration Hardware Holdings Inc.(RH) plunged

19% after the home-goods retailer late Thursday lowered its outlook

(http://www.marketwatch.com/story/restoration-hardware-shares-plunge-as-company-warns-of-slower-holiday-sales-2016-12-08)

for the fourth quarter on slower holiday sales.

Vail Resorts Inc.(MTN) shares were modestly higher despite the

ski resort reporting earnings below expectations.

Other markets: Oil prices moved firmly higher as traders looked

ahead to Saturday's meeting between OPEC and non-OPEC oil producers

(http://www.marketwatch.com/story/oil-futures-jump-ahead-of-non-opec-weekend-meeting-2016-12-09).

Asian markets

(http://www.marketwatch.com/story/asian-markets-mostly-gain-shaking-off-ecb-easing-2016-12-08)

closed mixed, while European stocks traded mostly higher

(http://www.marketwatch.com/story/european-stocks-cling-to-11-month-high-as-bank-shares-take-a-breather-2016-12-09).

Gold prices slipped, and the dollar firmed against other major

currencies, with the ICE Dollar index up 0.4%.

(END) Dow Jones Newswires

December 09, 2016 09:49 ET (14:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

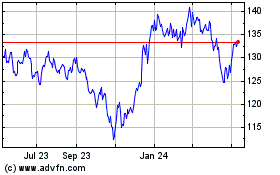

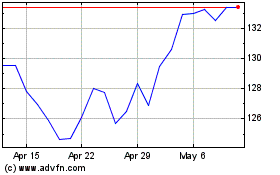

iShares Biotechnology ETF (NASDAQ:IBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

iShares Biotechnology ETF (NASDAQ:IBB)

Historical Stock Chart

From Apr 2023 to Apr 2024