By Sara Sjolin, MarketWatch , Ryan Vlastelica

Major indexes are on track to break a two-week losing streak

U.S. stocks edged lower on Friday after the latest batch of

corporate earnings raised concerns about whether the pace of

economic activity was justifying equity valuations, although major

indexes were off their lows of the day, on track to break a

two-week decline.

General Electric Co.(GE) sank 0.9% to $28.82 after the

industrial conglomerate reported weaker-than-expected revenue

growth

(http://www.marketwatch.com/story/ge-revenue-misses-expectations-while-profit-beats-2016-10-21)

in its latest quarter. While the stock was well off its lows of the

session -- at one point it had dropped 2.5% -- it remained on track

for its biggest one-day decline since early September and was

trading at levels last seen in February.

"When a bellwether like GE gives a tepid -- if not grim --

outlook for economic activity, investors are going to react to

that, and pretty negatively," said Mark Luschini, chief investment

strategist at Janney Montgomery Scott.

A 1.3% decline in shares of Travelers Cos. Inc.(TRV), along with

a 1.8% drop in Verizon Communications, also weighed on the Dow

industrials. Both components extended their Thursday weakness,

which came on the back of disappointing results.

Microsoft Corp. (MSFT), which reported better-than-expected

results thanks to its cloud-computing division

(http://www.marketwatch.com/story/the-secrets-behind-microsofts-big-profit-beat-and-dot-com-boom-share-price-2016-10-20),

was attempting to offset those large-cap declines with a rally.

Microsoft shares popped 4.8% to $60, and earlier hit a record.

The Dow Jones Industrial Average lost about 24 points, or 0.1%,

to 18,138, while the S&P 500 index lost 2 points, or 0.1%, to

2,139. The Nasdaq Composite Index , which is heavily weighted with

tech stocks and was supported by Microsoft's rally, rose 11 points,

or 0.2%, at 5,254.

In addition to Microsoft, McDonald's Corp.(MCD) also reported

better-than-expected

(http://www.marketwatch.com/story/mcdonalds-shares-rise-after-earnings-beat-2016-10-21)

third-quarter earnings, sending the stock up 3.3% to $114.24. The

two stocks were by far the biggest boosts on the Dow for the

day.

"Despite a couple of good reports, we're in the midst of another

earnings season that is hardly painting a bright picture," Luschini

said. "Having another quarter where profits contract is not an

underpinning for stocks to advance, and the market is searching

for, if not demanding, a catalyst to move higher. At the moment,

one is lacking."

S&P 500 companies are expected to post their sixth straight

quarter of declining earnings

(http://www.marketwatch.com/story/5-things-to-expect-this-earnings-season-2016-10-07)

this quarter, according to FactSet data.

Read:The stock market is caught deep in 'no man's land'

(http://www.marketwatch.com/story/the-stock-market-is-caught-deep-in-no-mans-land-2016-10-20)

(http://www.marketwatch.com/story/the-stock-market-is-caught-deep-in-no-mans-land-2016-10-20)See

also:Surprise: The earnings recession is just about over

(http://www.marketwatch.com/story/surprise-the-earnings-recession-is-just-about-over-2016-10-21)

All three indexes were set to snap a two-week streak of

losses.

On Thursday, U.S. stocks closed lower

(http://www.marketwatch.com/story/us-stock-futures-in-holding-pattern-after-debate-and-ahead-of-big-data-dump-2016-10-20),

partly driven by a 2.3% slide for oil futures Crude extended its

weakness on Friday

(http://www.marketwatch.com/story/strong-dollar-remarks-by-rosneft-chief-weigh-on-oil-2016-10-21),

down 0.1% at $50.59 a barrel.

While crude-oil futuresrose 0.2% to $50.71 per barrel on Friday,

energy stocks fell sharply, with the S&P energy sector down 1%.

Late Thursday, Schlumberger Ltd. reported weak third-quarter

results

(http://www.marketwatch.com/story/schlumberger-profit-falls-sharply-2016-10-20-174854654),

sending its stock down 3.6% to $80 on Friday.

Among other big movers, Reynolds American Inc.(RAI) soared 14%

to $53.63 after British American Tobacco PLC(BATS.LN) (BATS.LN)

offered to buy the remaining stake in its U.S. peer it doesn't

already own for $47 billion

(http://www.marketwatch.com/story/bat-in-47-billion-offer-for-reynolds-stake-2016-10-21).

Reynolds confirmed it had received the offer.

PayPal Holdings Inc.(PYPL) jumped 9.2% to $43.77 after its

earnings late Thursday met expectations.

On a downbeat note, Advanced Micro Devices Inc.(AMD) slumped

6.5% to $6.51 after the chip maker saw its loss widen in the third

quarter

(http://www.marketwatch.com/story/advanced-micro-devices-slides-after-posting-wider-quarterly-loss-2016-10-20).

Like GE, Honeywell International Inc.(HON) sales also fell short

of forecasts

(http://www.marketwatch.com/story/honeywell-sales-fall-short-of-estimates-2016-10-21),

though the stock rose 1.2% to $109.46.

Qualcomm Inc.(QCOM) rose 0.9% to $67.98 in the wake of a

Bloomberg report that its bid to take over NXP Semiconductors NV

(NXPI) was nearing its final stages

(http://www.bloomberg.com/news/articles/2016-10-20/qualcomm-said-to-be-near-final-nxp-deal-may-announce-next-week).

In central bank news, Fed Gov. Daniel Tarullo said that

academics

(http://www.marketwatch.com/story/feds-tarullo-wants-academics-to-focus-more-on-bank-liabilities-rather-than-capital-2016-10-21)

at business and law schools should place more emphasis on the

liability side of the balance sheets of financial firms, rather

than capital.

Other markets: Asia markets closed mostly lower

(http://www.marketwatch.com/story/asian-markets-lower-as-odds-of-fed-rate-hike-increase-2016-10-20)

on the higher expectations of Fed tightening. Trading was suspended

in Hong Kong

(http://www.marketwatch.com/story/stock-market-shuts-as-hong-kong-braces-for-typhoon-2016-10-20),

however, as Typhoon Haima approached.

Stocks in Europe wobbled

(http://www.marketwatch.com/story/european-stocks-edge-up-with-weekly-win-in-sight-2016-10-21)

as investors digested the European Central Bank's message from

Thursday's meeting

(http://www.marketwatch.com/story/will-mario-draghi-leave-investors-high-and-dry-in-december-2016-10-20).

The ICE dollar index was up 0.5% at 98.79 on Friday, set for a

0.7% weekly gain. The dollar has been climbing steadily this month

on rising expectation the Fed will lift interest rates at its

December meeting.

Gold futures were trading mostly flat

(http://www.marketwatch.com/story/gold-futures-drop-but-cling-to-weekly-gain-as-dollar-recovers-2016-10-21),

pressured by the stronger dollar.

(END) Dow Jones Newswires

October 21, 2016 14:41 ET (18:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

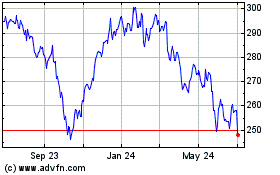

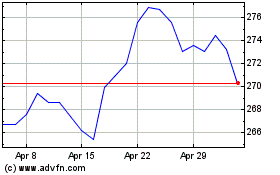

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024