Lufthansa and Air Berlin to Bolster Long-Haul Flights

November 11 2015 - 12:20PM

Dow Jones News

German's two largest airlines on Wednesday announced plans to

bolster their long-haul operations, with Deutsche Lufthansa AG

deepening cooperation with Singapore Airlines and the country's No.

2 carrier Air Berlin betting more heavily on U.S. flights.

Both carriers have struggled to implement restructuring measures

that left them financially lagging behind competitors, such as

budget airlines Ryanair and EasyJet in the short-haul market and

British Airways parent International Consolidated Airlines Group in

long-haul.

Lufthansa and Singapore said they would seek antitrust immunity

to form a joint venture to allow them to closely coordinate

schedules and pricing. The tie-up is aimed at ending the loss of

business both carriers have suffered on routes between Asia and

Europe to the rapidly growing Middle East carriers, such as

Emirates Airline and Qatar Airways.

Lufthansa Chief Executive Carsten Spohr called the relationship

"a cornerstone of our Asia strategy."

The two will share revenue on flights between Lufthansa's

Frankfurt, Munich and Zurich hubs and Singapore, as well as on the

Asian carrier's newly announced route to Dü sseldorf.

Schedules will also be coordinated for flights beyond those

destinations, giving Lufthansa greater reach into markets such as

Indonesia, Australia and Malaysia. The partnership will also cover

the Lufthansa affiliates Swiss and Austrian and Singapore's

SilkAir.

The German carrier already has joint-venture agreements with

United Continental Holdings Inc. and Air Canada, covering

trans-Atlantic flights, and with All Nippon Airways on Japans

routes. It also is in talks with Air China to establish a similar

arrangement on flights between Germany and China.

Carriers have embraced such joint ventures to gain merger-like

efficiencies at a time when national airline ownership regulators

limit cross-border consolidation.

Lufthansa's problems are far larger, though. The airline is

battling with pilots unions and those of cabin crew to win

concessions over pay and employment terms.

Cabin staff have been on strike since Friday, grounding much of

the airline, with 931 flights canceled Wednesday, or about a third

of the airline's schedule. The strike is poised to last through

Friday.

Lufthansa has offered several concessions to unions in recent

days, raising concern with analysts the carrier may not have the

stomach to force through changes considered overdue.

Air Berlin's overhaul aims to streamline operations to focus on

regularly scheduled flights and deliver profitability in 12 to 18

months, Chief Executive Stefan Pichler said in Berlin. He said the

airline's costs are lower than those at rivals.

The airline will grow its long-haul business, adding flights to

Boston, Dallas and San Francisco from Dü sseldorf, and promises to

expand cooperating with Oneworld alliance partner American

Airlines. It also is adding frequencies to other U.S. cities to

help win higher-paying business passengers.

The focus on growth will mean Air Berlin will cut fewer jobs

than it projected, said Mr. Pichler, who has been at the helm since

February. He didn't spell out how many positions would be cut.

Air Berlin will also strengthen ties with Etihad Airways an

Alitalia. The Abu Dhabi based airline owns 29.2% of Air Berlin and

has provided financial support the keep the airline afloat. It also

owns 49% of Alitalia.

Cooperation with Etihad is facing headwinds, though, with the

German government threatening to withhold approval of some

code-share flights between the two airlines, which could further

weaken Air Berlin's financial position. Mr. Pichler said not

granting those codeshares could jeopardize his airline.

Debt at the airline was €787 million ($844 million) at the end

of September, while shareholder equity was a negative €544 million,

about 30% worse than at the end of last year. Mr. Pichler said the

company's financing plan would allow it to cover its obligations,

though he declined to say whether this would involve a fresh

injection of funds from Etihad, its largest shareholder.

Natascha Divac contributed to this article.

Write to Robert Wall at robert.wall@wsj.com and Archibald

Preuschat at archibald.preuschat@wsj.com

Access Investor Kit for "Deutsche Lufthansa AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0008232125

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 12:05 ET (17:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

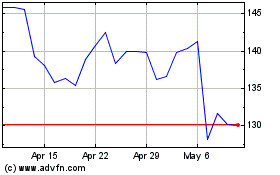

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

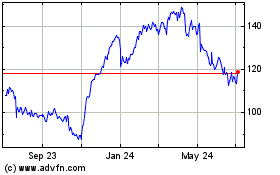

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024