Lufthansa Attempts to Reassure Investors After Recent Terror Attacks

August 02 2016 - 6:50AM

Dow Jones News

FRANKFURT—Deutsche Lufthansa AG on Tuesday tried to reassure

investors that it still expected to pay a dividend for 2016, two

weeks after warning that terrorist attacks had led to a drop in

demand that prompted the airline to cut its full-year outlook.

"Based on current calculations, we're capable of paying a

dividend," Chief Financial Officer Simone Menne told journalists in

a conference call. "The technical conditions are met."

The airline's net profit for the quarter ended June 30 fell to

€437 million ($487 million) from €529 million a year earlier.

Despite higher passenger volumes, traffic revenue fell 5.4% due to

strong pricing pressure in both the airline and cargo businesses.

Adjusted earnings before interest and taxes, a key earnings figure,

fell to €582 million from €635 million.

Over recent months Europe has been hit by a string of violent

attacks that have made consumers hesitant about traveling, denting

the profits of airlines and hotels. In July, a man in Nice killed

84 people when he plowed a truck into revelers celebrating Bastille

Day. In March, attacks at a subway stop and the main airport in

Brussels killed 32 people and put Lufthansa's plan to take over

Brussels Airlines on hold.

Germany, too, has seen an unprecedented series of attacks,

including an ax attack on train passengers and a suicide blast in a

Bavarian town. Both incidents are linked to Islamic State

sympathizers.

"Our industry has to prepare for a difficult second half,"

Lufthansa Chief Executive Carsten Spohr said Tuesday.

Lufthansa said its passenger airline unit anticipated "very weak

trends" in the third quarter in particular. Unit revenues excluding

currency effects are expected to fall between 8% and 9% in the

second half.

Lufthansa didn't provide detailed 2016 guidance but Ms. Menne

said analyst expectations for an adjusted EBIT of around €1.5

billion were "certainly not badly calculated."

Lufthansa plans to provide more detail on its guidance in the

third quarter, she said.

Lufthansa had already reported some preliminary results for the

first half on July 20. At that time it said it now expected

adjusted EBIT to be below last year's €1.8 billion, having

previously guided for it to come in "slightly above" the prior

year. The company also said it expected capacity growth of 5.4% in

2016, down from an earlier forecast of 6%.

In July, Lufthansa had said that advance bookings, especially on

long-haul routes to Europe, "declined significantly, in particular

due to repeated terrorist attacks in Europe and to greater

political and economic uncertainty."

Lufthansa's statements mirrored those of other airlines. Air

France-KLM SA said last week the geopolitical and economic

uncertainties that are depressing ticket prices would more than

wipe out this year's savings from lower fuel costs. British budget

carrier easyJet PLC said last month that third-quarter sales fell

and that recent political turmoil across Europe has sparked fresh

concerns about bookings.

Write to Natascha Divac at natascha.divac@wsj.com and Archibald

Preuschat at archibald.preuschat@wsj.com

(END) Dow Jones Newswires

August 02, 2016 06:35 ET (10:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

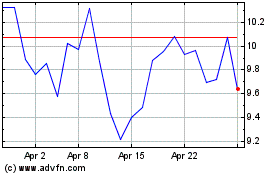

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024