By Keach Hagey

Jeff Bewkes, the chief executive of Time Warner Inc., built his

reputation on shrinking the media conglomerate down to focus on TV

and film content by unraveling the failed marriage with AOL and

breaking free from the Time Warner Cable distribution business.

Now, before exiting stage left, he is writing his own legacy

with the $85 billion sale to AT&T Inc. that will reunite Time

Warner's coveted content with a vast distribution network that

spans satellite TV and mobile phones.

The price -- $107.50 a share, a 36% premium over where Time

Warner's stock had been trading in the middle of last week --

represents a triumph for Mr. Bewkes, two years after he walked away

from an $85-a-share offer from 21st Century Fox Inc.

But the sale to AT&T also represents a strategic departure

for Mr. Bewkes, who spent his nearly nine years as CEO slimming

down the onetime media behemoth, unwinding the AOL merger and

spinning out Time Warner Cable and Time Inc. The three businesses

that remained -- HBO, Turner Broadcasting and Warner Bros. -- are

focused solely on video content. In lieu of acquisitions, Mr.

Bewkes focused on containing costs and buying back stock.

A cerebral Stanford M.B.A. known for his financial acumen, Mr.

Bewkes implemented a strategy shaped in part by scars from the

disastrous AOL-Time Warner merger that closed in 2001.

While the ill-fated deal carried lofty promises of new online

distribution methods for Time Warner's sprawling cache of content,

it ultimately left shareholders in the combined company --

including employees such as Mr. Bewkes -- in a lurch after AOL's

business collapsed.

Mr. Bewkes said a big difference from the AOL days is that

distribution has become even more central to giving consumers what

they demand from media. They want more flexibility in the packages

they can buy and the platforms they can accesses content from.

Much has changed in the media landscape in recent years.

The rise of Netflix Inc. and YouTube and growth of so-called

"skinny bundles" -- smaller, cheaper packages of channels -- has

chipped away at the longtime engine of media companies'

profitability: the ever-rising fees they could once depend upon

from pay-TV distributors.

Time Warner first attempted to meet the challenge from more

nimble streaming competitors by pioneering so-called "TV

Everywhere," which allowed viewers to watch its content on

desktops, mobile devices and streaming video players -- but only if

they proved they were pay-TV subscribers. The model's rollout

across the industry was frustratingly slow, Mr. Bewkes often noted.

Meanwhile, Netflix, Amazon Prime Instant Video and Hulu's market

share exploded.

More recently, Time Warner has tried to meet the challenge by

launching its own direct-to-consumer products, such as the

broadband-delivered HBO Now.

In a conference call Saturday night, Mr. Bewkes cast Time

Warner's tie-up with AT&T as a continuation of his quest to

give consumers more of the shows they want, when and where they

want them.

In an industry whose leaders are often described as "moguls,"

Mr. Bewkes cut a different figure. He grew up in Darien, Conn., the

son of a businessman, and spent his days at Yale University

studying philosophy and hanging out with the artistic crowd. His

first media job was making documentaries for NBC News. But after

getting his M.B.A., he went into the business side, joining a

fledgling HBO in 1979 following a stint at Citibank. He never left,

steadily rising through the ranks at HBO to CEO, and then to CEO of

its parent company in 2008.

After the deal closes, Mr. Bewkes, 64, said he would stay on for

an interim period to help with the transition.

If he exits as part of the change in control, he could stand to

walk with what today would be worth almost $95 million, including

the value of his stock, according to regulatory filings. However,

he has said he plans to stay on at least until the deal closes,

expected at the end of 2017, and perhaps beyond.

Unlike many companies, Time Warner doesn't have so-called golden

parachute payments for executives if they are dismissed as part of

an acquisition. Instead, Mr. Bewkes would get almost $24 million in

options and other benefits like the maintenance of his

life-insurance plan. Plus, he owns about 658,000 shares of Time

Warner, which are valued by AT&T's cash-and-stock offer at

about $71 million.

Not an ego-driven builder, Mr. Bewkes turned Time Warner into a

takeover target by spinning and slimming the once far-flung

conglomerate.

When 21st Century Fox came calling in 2014, attracted by the HBO

crown jewel and synergies between the similar companies, Mr. Bewkes

and his team were unimpressed by both the form and the content of

the offer -- presented at a lunch with Fox's then-Chief Operating

Officer Chase Carey.

Time Warner rejected the approach. At the same time, they made

clear that should another suitor come along from the tech or

telecom worlds with a better price and more cash, it might be

entertained.

Time Warner then made a bold pitch to investors that it could

top Fox's $85-a-share price on its own. It surprised the media

world by announcing the direct-to-consumer HBO Now. While the stock

did push past that level for a time, it spent much of the past year

well below that, dragged down by sector-wide concerns about

cord-cutting.

Mr. Bewkes faced pressure from some investors to consider

breaking up the company and potentially spinning off HBO, but he

and the Time Warner board steadfastly refused. If a buyer wanted

Time Warner, they were going to have to take the whole thing.

Write to Keach Hagey at keach.hagey@wsj.com

(END) Dow Jones Newswires

October 23, 2016 15:42 ET (19:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

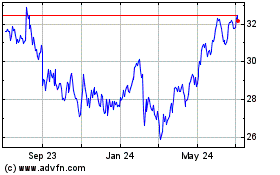

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

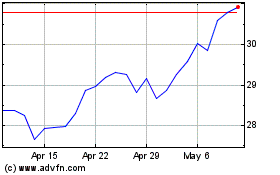

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024