Loonie Steady After Canada's Inflation Report

June 22 2012 - 8:55AM

RTTF2

The Canadian dollar held steady against its major rivals on

Friday following the Statistics Canada report revealed that the

nation's inflation rate in May slowed more-than analysts had

predicted.

Statistics Canada said consumer prices rose 1.2 percent in the

12 months to May. Economists were looking for consumer prices to

rise 1.5 percent on an annual basis, following a 2.0 percent

increase in April.

Excluding energy, the Consumer Price Index (CPI) rose 1.7

percent in the 12 months to May after increasing 2.1 percent in

April. The report also showed that its seasonally adjusted core

consumer price index was flat in May, after rising by 0.4 percent

in the previous month.

The Bank of Canada's core index, which the bank uses to measure

inflation relative to its 2 percent target rate, advanced 1.8

percent in the 12 months to May, slower than the 2.1 percent gain

in April. Analysts had expected the core CPI to rise 1.9 percent in

May.

The Bank of Canada aims to keep inflation at the 2 percent

midpoint of an inflation-control target range of 1 to 3 per cent.

The seasonally adjusted monthly core index was unchanged in May,

following a 0.4 percent increase in the previous month.

Crude oil, the Canada's key export, was lingering below $80

Friday morning as traders fret over the strength in the global

economic recovery after poor manufacturing data from out of China

and Europe yesterday.

Light Sweet Crude Oil (WTI) futures for August delivery, the

most actively traded contract, edged up $0.48 to $78.68 a

barrel.

Yesterday, oil settled below $80, a fresh 8-month low, on demand

concerns after some weak economic data from China and U.S., coupled

with a strengthening dollar. Prices were also impacted by the

more-than-expected U.S. crude oil stockpile increase last week.

Investor sentiments were at a low after the Federal Reserve failed

to provide any monetary stimulus measures, widely expected this

time.

The Canadian dollar that tested yesterday's multi-day high of

1.2886 against the euro ahead of the data stabilized around the

1.29 area following the report. The loonie is presently worth

1.2892 against the euro with 1.2870 seen as the next likely

resistance level and 1.2960 as the probable support.

Germany's business sentiment weakened more than expected in

June, reports said citing the latest survey results from Ifo

Institute. The business confidence index fell to 105.3 from 106.9 a

month ago. Economists were expecting the index to fall to

105.6.

On the other hand, the current assessment index rose

unexpectedly to 113.9 from 113.2. The reading was well above the

consensus forecast of 112. Economic expectations deteriorated in

June to 97.3 from 100.8 a month ago. The index stayed below the

99.8 level forecast by economists.

The Canadian dollar that fell below the 1.03 level against the

US dollar after gap of 8-days at the time of the release leveled

off around the 1.0285/90 area shortly. Against the yen, the loonie

steadied at 78.10 after having dropped to a 2-day low of 77.79

early in the session.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

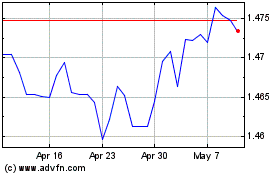

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024