London Stock Exchange Group PLC Final Results -18-

March 05 2015 - 2:02AM

UK Regulatory

CONSOLIDATED balance sheet

At 31 December

2014 2013

(Unaudited)

Restated*

GBPm GBPm

Assets

Non-current assets

Property, plant and equipment 115.6 88.7

Intangible assets 4,492.0 2,660.8

Investment in associates 12.1 0.6

Deferred tax assets 76.5 36.1

Derivative financial instruments 22.7 5.3

Available for sale investments 4.8 4.8

Retirement benefit asset 16.0 11.6

Other non-current assets 64.8 16.4

4,804.5 2,824.3

Current assets

Inventories 6.6 2.5

Trade and other receivables 571.1 214.1

Derivative financial instruments 0.4 -

CCP financial assets 429,952.8 493,979.6

CCP cash and cash equivalents (restricted) 21,493.0 16,734.0

CCP clearing business assets 451,445.8 510,713.6

Current tax 24.3 11.0

Assets held at fair value 12.4 30.9

Cash and cash equivalents 1,127.2 955.4

453,187.8 511,927.5

Assets held for sale 5.3 -

Total assets 457,997.6 514,751.8

Liabilities

Current liabilities

Trade and other payables 727.4 382.2

Derivative financial instruments - 17.4

CCP clearing business liabilities 451,467.5 510,654.8

Current tax 51.6 46.8

Borrowings 789.9 304.1

Provisions 0.9 2.8

453,037.3 511,408.1

Non-current liabilities

Borrowings 936.5 946.1

Other non-current payables 73.3 -

Derivative financial instruments - 5.6

Deferred income 4.9 -

Deferred tax liabilities 859.5 334.3

Retirement benefit obligations 39.8 29.0

Other non-current liabilities 77.5 27.3

Provisions 13.5 36.8

2,005.0 1,379.1

Total liabilities 455,042.3 512,787.2

Net assets 2,955.3 1,964.6

Equity

Capital and reserves attributable

to the Company's equity holders

Share capital 23.9 18.8

Share premium 957.7 -

Retained earnings / (losses) 20.0 (80.3)

Other reserves 1,524.9 1,595.7

Total shareholders' funds 2,526.5 1,534.2

Non-controlling interests 428.8 430.4

Total equity 2,955.3 1,964.6

*The restatement for the 12 months ended 31 December 2013 is

detailed in Note 1.

CONSOLIDATED cash flow statement

12 months 12 months

to to

31 December 31 December

2014 2013

(Unaudited) (Unaudited)

Notes GBPm GBPm

------------

Cash flow from operating activities

Cash generated from operations 7 531.8 514.8

Interest received 3.6 4.6

Interest paid (71.5) (66.8)

Corporation tax paid (126.2) (74.2)

Withholding tax paid (1.9) (23.2)

------------

Net cash inflow from operating activities 335.8 355.2

------------

Cash flow from investing activities

Purchase of property, plant and equipment (23.7) (17.5)

Purchase of intangible assets (60.7) (52.3)

Investment in acquisition (1,687.3) (376.7)

Investment in other acquisition (1.3) -

Proceeds from sale of investment - 7.1

Dividends received 0.7 0.3

Net cash inflow from acquisitions 290.8 432.0

Net cash outflow from investing activities (1,481.5) (7.1)

Cash flow from financing activities

Capital raise 962.7 114.4

Dividends paid to shareholders (83.5) (79.7)

Dividends paid to non-controlling

interests (6.2) (1.5)

Capital contributions received from

non-controlling interests 1.3 -

Cost of capital raise - (2.7)

Proceeds from own shares on exercise

of employee share options - 1.1

Purchase of own shares by ESOP Trust (0.6) (28.0)

Finance lease 1.8 -

Repayment of finance lease (1.2) -

Repayment of borrowings (24.2) (84.3)

Proceeds from borrowings 519.9 300.9

------------

Net cash inflow from financing activities 1,370.0 220.1

------------

Increase in cash and cash equivalents 224.3 568.2

Cash and cash equivalents at beginning

of period 955.4 394.8

Exchange loss on cash and cash equivalents (52.5) (7.6)

Cash and cash equivalents at end

of period 1,127.2 955.4

NOTES TO THE NON STATUTORY FINANCIAL INFORMATION

The non-statutory financial statements for London Stock Exchange

Group plc ('the Group' or 'the Company') for the 12 months ended 31

December 2014 was approved by the Directors on 5 March 2015.

1. Basis of Preparation and Accounting Policies

These non-statutory financial statements have been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and in accordance with International

Accounting Standard (IAS) 34 - 'Interim Financial Reporting',

except for the following:

The non-statutory financial statements do not contain the

minimum content of an interim financial report, including

disclosures. In particular, the non-statutory financial statements

do not contain a condensed consolidated statement of changes in

comprehensive income or a condensed consolidated statement of

changes in equity.

The accounting policies used are consistent with those set out

in the Group's Annual Report for the year ended 31 December 2014,

with the exception of the changes in the standards identified

below.

The non-statutory financial statements are a set of

non-statutory unaudited accounts, therefore in accordance with

section 435 of Companies Act 2006 the directors confirm:

a) they are not the company's statutory accounts;

b) statutory accounts relating to the financial year ended 31

March 2014 have been delivered to the registrar and statutory

accounts for nine month period to 31 December 2014 will be

delivered to the register within 60 days; and

c) an unqualified auditor's report has been made on the

company's statutory accounts for the years ended 31 March 2014 and

the nine months ended 31 December 2014 and neither contained a

statement under section 498 of the Companies Act 2006.

The following standards and interpretations have been issued by

the International Accounting Standards Board (IASB) and IFRIC and

have been adopted in these financial statements:

IFRS 10, 'Consolidated financial statements' and amendments

regarding control;

IFRS 11, 'Joint arrangements' ;

IFRS 12, 'Disclosure of interests in other entities' and

amendments;

Amendments to IAS 19, 'Employee Benefits' on Defined Benefit

Plans: Employee Contributions;

IAS 27 (Revised 2011), 'Separate financial statements' and

amendments;

IAS 28 (Revised 2011), 'Associates and joint ventures';

Amendments to IAS 32, 'Financial instruments: Presentation' on

Offsetting Financial Assets and Financial Liabilities;

Amendments to IAS 36, 'Impairment of assets' on recoverable

amount disclosures;

Amendment to IAS 39 'Financial instruments: Recognition and

measurement', on novation of derivatives and hedge accounting;

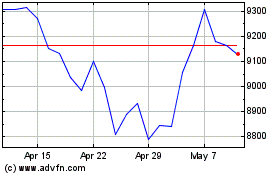

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

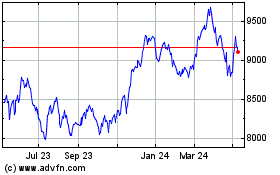

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024