London Stock Exchange Group PLC Final Results -17-

March 05 2015 - 2:02AM

UK Regulatory

The fair values of the identifiable assets and liabilities

arising out of each acquisition at the relevant acquisition date

are as follows:

Frank Russell

Bonds.com Company Total

Book Fair Book Book Fair

value value value Fair value value value

Notes GBPm GBPm GBPm GBPm GBPm GBPm

Non-current

assets:

Intangible

assets 14 0.5 0.5 12.8 1,514.0 13.3 1,514.5

Goodwill 14 7.0 - 7.0 -

Property, plant

and equipment 13 0.1 0.1 28.8 28.8 28.9 28.9

Deferred income

taxes - - 34.6 34.6 34.6 34.6

Investments - - 21.0 21.0 21.0 21.0

Other non-current

assets 0.1 0.1 17.3 17.3 17.4 17.4

Current assets:

Cash and cash

equivalents 22 0.7 0.7 290.1 290.1 290.8 290.8

Receivables - - 183.5 183.5 183.5 183.5

Other current

assets 0.2 0.2 29.0 29.0 29.2 29.2

Current liabilities:

Payables 25 - - (56.4) (56.4) (56.4) (56.4)

Other current

liabilities (1.5) (1.5) (223.4) (223.4) (224.9) (224.9)

Non-current

liabilities:

Provision - - (15.4) (15.4) (15.4) (15.4)

Deferred tax

liabilities - - - (576.9) - (576.9)

Other non-current

liabilities - - (36.3) (36.3) (36.3) (36.3)

Net assets 0.1 0.1 292.6 1,209.9 292.7 1,210.0

Non controlling

interest - - - (7.4) - (7.4)

Goodwill - 8.7 - 476.0 - 484.7

0.1 8.8 292.6 1,678.5 292.7 1,687.3

Satisfied by:

Cash and capital

raise 8.8 1,678.5 1,687.3

Total investment 8.8 1,678.5 1,687.3

The fair values are preliminary and will be finalised within twelve

months of the acquisition date.

None of the goodwill recognised is expected to be deductible for tax

purposes.

The fair value adjustments include:

Frank Russell Company

The additional GBP1,508.0m of intangible assets arising on

consolidation represents GBP30.7m relating to various technologies,

GBP799.7m relating to customer relations and GBP677.6m relating to

trade names. Deferred tax liability on these intangible assets was

GBP576.9m. The fair values of these purchased intangible assets are

being amortised over their remaining useful life from the date of

completion.

The goodwill of GBP476.0m arising on consolidation represents

the growth of future expected income streams from Russell's

customer base and the value of expected synergies arising from the

acquisition.

Bonds.com Group

The Group is currently undertaking a full allocation exercise of

the purchased intangibles of Bonds.com, until that is complete the

excess of consideration over net assets acquired of GBP8.7m is held

as goodwill.

Acquisitions in the year to 31 March 2014

The Group made three acquisitions during the year ended 31 March

2014.

On 5 April 2013, the Group and TMX Group Limited completed a

transaction to combine their fixed income businesses into a new

business, FTSE TMX Global Debt Capital Markets Limited. The

transaction resulted in the Group acquiring a 75 per cent stake in

FTSE TMX Global Debt Capital Markets Limited for a total

consideration of GBP78.2m. The non-controlling interest ('NCI') has

an option to sell the remaining 25 per cent interest to the Group

after six years or earlier in other limited scenarios. The Group

recognised GBP27.4m in goodwill and GBP74.1m of other intangible

assets.

On 1 May 2013, the Group completed the acquisition of a further

55.5 per cent stake in LCH.Clearnet resulting in a majority stake

of 57.8 per cent in LCH.Clearnet. The total investment of GBP470.3m

includes deferred consideration of GBP20.0m, payable on 30

September 2017 subject to acceleration or delay in certain limited

circumstances. The investment is inclusive of the Group's

participation in the capital raise of LCH.Clearnet issued share

capital of GBP158.2m. The Group recognised GBP123.8m in goodwill

and GBP245.2m of other intangible assets.

On 23 September 2013, the Group acquired a 70 per cent interest

in EuroTLX SIM SpA for a consideration of GBP26.1m and GBP0.9m in

deferred consideration. The NCI has an option to sell the remaining

30 per cent interest to the Group. The value of the option is

dependent on achieving growth and cost synergies in the next

financial year. The Group recognised GBP15.6m in goodwill and

GBP10.9m of other intangible assets.

There were no material changes to the preliminary fair

values.

20. Events after the reporting period

On 5 February 2015, the Group announced the completion of the

comprehensive review focused principally on assessing the strategic

fit of Russell Investment Management with the Group's long term

strategy. After careful consideration, the conclusion of the

comprehensive review is to explore a sale of this business in its

entirety. The Group has already received a number of expressions of

interest in a potential acquisition of Russell Investment

Management reflecting the high quality of its business and market

leading positions. A sale process of the business has now

commenced.

On 4 March 2015, the Board approved the allotment and issue of

225,476 ordinary shares of 6(79/86p) each in the Company to satisfy

options granted under the Company's Save-As-You-Earn and

International Sharesave Plans.

5 March 2015

LONDON STOCK EXCHANGE GROUP plc (LSEG)

NON-STATUTORY FINANCIAL STATEMENTS FOR 12 MONTHS TO

31 DECEMBER 2014 FOLLOWING CHANGE TO ACCOUNTING REFERENCE

DATE

The following section contains non-statutory financial

statements for the 12 month periods to December 2014 and 2013. It

has been prepared to provide comparative information for future

financial results on a December year end basis. The non-statutory

figures include the results of acquired subsidiaries during the

period from their respective dates of acquisition and do not

pro-rate any financial results had any of the transactions taken

place at the start of the period.

CONSOLIDATED Income Statement

12 months 12 months

to to

31 December 31 December

2014 2013

(Unaudited) (Unaudited)

Restated*

Notes GBPm GBPm

Revenue 1,283.2 974.0

Net treasury income through CCP business 92.6 107.3

Other income 4.8 12.2

Total income 2 1,380.6 1,093.5

Expenses

Operating expenses before amortisation

of purchased intangible assets and

non-recurring items 3 (823.2) (616.5)

Share of profit after tax of associates 0.1 -

Operating profit before amortisation

of purchased intangible assets and

non-recurring items 557.5 477.0

Amortisation of purchased intangible

assets 4 (122.0) (108.9)

Non-recurring items 4 (67.5) (38.7)

Impairment of purchased intangible

assets and goodwill 4 (22.0) -

Operating profit 346.0 329.4

Finance income 3.9 9.0

Finance expense (72.0) (76.2)

Net finance expense (68.1) (67.2)

Profit before taxation 277.9 262.2

Taxation on profit before amortisation

of purchased intangible assets and

non-recurring items (124.5) (109.1)

Taxation on amortisation of purchased

intangible assets and non-recurring

items 4 48.2 39.6

Total taxation (76.3) (69.5)

Profit for the financial period 201.6 192.7

Profit attributable to non-controlling

interests 22.3 4.6

Profit attributable to equity holders 179.3 188.1

201.6 192.7

Basic earnings per share 5 56.5p 64.2p

Adjusted basic earnings per share 5 103.3p 96.5p

*The restatement for the 12 months ended 31 December 2013 is

detailed in Note 1.

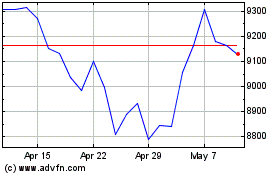

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

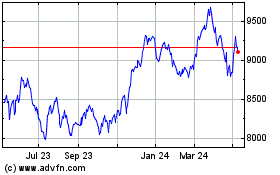

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024