TIDMLSE

RNS Number : 0141U

London Stock Exchange Group PLC

19 October 2017

19 October 2017

LONDON STOCK EXCHANGE GROUP plc

INTERIM MANAGEMENT STATEMENT

FOR THE PERIOD TO 18 OCTOBER 2017, INCLUDING REVENUES AND KPIs

FOR THE THREE MONTHSED 30 SEPTEMBER 2017 (Q3)

-- Another period of delivery against our targets with continued

good growth - Q3 total income up 17% to GBP486 million; and up 19%

for 9 months year-to-date, to GBP1,432 million

-- Q3 revenues up 18% to GBP443 million; up 18% for 9 months year-to-date at GBP1,295 million

-- Strong demonstration of capital deployment to drive growth

and returns, including: completion of the Citi Fixed Income Indices

and The Yield Book acquisition; increasing our stake in LCH; and,

completion of the GBP200 million share buyback programme

Q3 summary:

-- Information Services: revenues up 22% (up 15% on organic and

constant currency basis) - with good underlying growth and one

month's inclusion of The Yield Book and Citi Fixed Income

Indices

-- Post Trade: LCH income up 26% (up 22% at constant currency),

with 23% revenue growth in OTC from higher volume of SwapClear

client trades; ForexClear continues to see strong volume growth.

CC&G and Monte Titoli income up 2% (down 4% at constant

currency)

-- Capital Markets: revenues up 8% (up 5% on organic and

constant currency basis), with record quarterly primary markets

revenues in a period of strong equity issuance; Turquoise continues

to trade well, with strong growth in the Turquoise Plato Block

Discovery service (including a record month in September)

-- Technology Services: revenues up 9% (up 7% at constant currency)

Commenting on performance in Q3, Xavier Rolet, Chief Executive,

said:

"The Group continues to perform very well, with good revenue

growth in our main businesses and a strong period of successful

development and delivery. The completion of the acquisition of Citi

Fixed Income Indices and The Yield Book is already contributing to

the further growth in FTSE Russell while LCH continues to perform

strongly and has launched innovative new services. I am also

delighted that we are increasing our stake in the LCH Group.

"The Group's excellent financial performance is reflective of

our continued innovation and execution of our growth strategy,

enabling us to deliver against our three year financial targets.

Together with our proven Customer Partnership and Open Access

approach, this positions us strongly to benefit from the

introduction of MiFID II in less than three months time."

Organic growth is calculated in respect of businesses owned for

at least 3 months in either period and so excludes The Yield Book

and Citi Fixed Income Indices, ISPS, Mergent and SwapMatch. The

Group's principal foreign exchange exposure arises from translating

our European based Euro and US based USD reporting businesses into

Sterling.

Investment in growth opportunities and new developments

continued across the business:

- LSEG will increase its stake in LCH Group to 64.4% (on

completion of regulatory processes before the end of 2017),

acquiring an additional 6.63% following a sale by certain minority

shareholders

- LCH SwapAgent service for non-cleared derivatives now live and has processed its first trades

- LCH RepoClear launched Sponsored Clearing, offering buy-side

firms direct access to LCH for repos clearing across 11 government

bond markets

- LCH signed binding terms with Euronext N.V. for the continued

provision of clearing services for listed financial and commodity

derivatives with LCH SA. The agreement is expected to be finalised

in Q4 2017

- The Government Pension Investment Fund (GPIF) of Japan

selected new FTSE Blossom Japan Index as a core ESG benchmark

through its flagship fund

- Good flow of new issues on our UK and Italian markets, with a

near doubling in the number of new issues year on year - in early

October Borsa Italiana welcomed Pirelli to its market, the largest

continental European IPO so far in 2017; together with Allied Irish

Bank in the summer, the two largest European IPOs have been on

Group markets

- Turquoise Lit Auctions, a pre-trade transparent and MiFID II

compliant trading mechanism, received regulatory approval for Q4

2017 launch; and Turquoise Plato Block Discovery delivered record

value traded in September (8 times the level of Q3 last year)

- CurveGlobal marked its first year in operation - the platform

is building a firm foundation, with 1.5 million lots traded since

launch (of which 40% of the volume traded was in the last three

months)

- UK's Financial Conduct Authority approved London Stock

Exchange to be authorised as an Approved Publication Arrangement

(APA) and an Approved Reporting Mechanism (ARM) - enabling firms to

meet their trade and transaction reporting obligations under MiFID

II and MiFIR

- Borsa Italiana and IBM announced they are building a

blockchain solution to digitise the issuance of securities for

small and medium enterprises (SMEs) in Europe

- LSEG Technology completed the go-live of Millennium Exchange

through a technology partnership with Caja de Valores S.A., which

acts as the technology provider for Bolsas y Mercados

Argentinos

- Gatelab has become an approved provider of risk gateway services for Bombay Stock Exchange

Financial Position

Refinancing to extend Group debt maturities was successfully

completed in September. The Group issued EUR500 million 0.875% 2024

bonds and EUR500 million 1.75% 2029 bonds, of which an aggregate

EUR700 million was immediately swapped into USD to appropriately

match Group currency of debt to currency of earnings. The resulting

effective blended rate of interest on the bonds is fixed at c2.8%

per annum until the first maturity date.

The Group's financial position remains strong, with good cash

generation from operations offset by normal course interim dividend

and bond coupon payments, and the conclusion of the GBP200 million

share buyback programme. We also continue to invest in projects to

support growth initiatives. During the period the Group completed

the acquisition of the Citi Fixed Income Indices and The Yield

Book, paying US$685 million. At 30 September 2017, the Group's

committed facility headroom was cGBP700 million, available for

general corporate purposes.

The euro and US dollar both strengthened by 8% against sterling

compared with the same period last year. To illustrate our exposure

to movements in exchange rates, a EUR0.05 change in the average

euro:sterling rate would have resulted in a change to continuing

operations total income of cGBP6.9 million for Q3, while a US$0.05

move would have resulted in a cGBP4.8 million change.

Current trading

The Group continues to execute on its successful growth strategy

to deliver attractive shareholder returns. All main parts of the

Group continue to perform well and investment remains ongoing on a

number of initiatives. We are well positioned for the introduction

of MiFID II and a broader changing regulatory environment.

The Group released a separate statement this morning regarding

succession planning.

Further information is available from:

Lucie Holloway/Ramesh Chhabra +44 (0) 20 7797 1222

London Stock Exchange - Media

Group plc Paul Froud - Investor Relations +44 (0) 20 7797 3322

A conference call for analysts and investors will be held at

8:30 (UK time) on Thursday 19 October. On the call will be David

Warren (CFO) and Paul Froud (Head of Investor Relations).

To access the telephone conference call dial 0800 694 0257 or

+44 (0) 1452 555 566

Conference ID: 8705 3054

Q3 Revenue Summary

Revenues for three months and nine months ended 30 September

2017 refer to continuing operations, with comparatives against

performance for the same period last year, are provided below.

Growth rates for both Q3 and year to date performance are also

expressed on an organic and constant currency basis. All figures

are unaudited.

Organic Organic

Three months and Nine months and

ended constant ended constant

30 September currency 30 September currency

------------------------------ -----------------------------

2017 2016 Variance variance(1) 2017 2016 Variance variance(1)

Continuing

operations: GBPm GBPm % % GBPm GBPm % %

Revenue

Information

Services 181.8 148.5 22% 15% 536.7 434.4 24% 14%

Post Trade

Services -

LCH 113.9 89.5 27% 24% 321.1 256.7 25% 19%

Post Trade

Services -

CC&G and

Monte

Titoli 26.2 25.2 4% (2%) 81.5 73.3 11% 2%

Capital

Markets 96.7 89.6 8% 5% 286.3 271.2 6% 1%

Technology

Services 22.7 20.8 9% 7% 63.8 58.8 9% 3%

Other 1.4 2.6 - - 5.9 3.7 - -

------------- -------------- -------------- --------- ------------ --------------- ------------ --------- ------------

Total

revenue 442.7 376.2 18% 13% 1,295.3 1,098.1 18% 11%

Net treasury

income

through

CCP

businesses 42.0 35.3 19% 13% 116.8 91.3 28% 18%

Other income 1.4 3.1 - - 19.4 11.0 - -

---------

Total income 486.1 414.6 17% 12% 1,431.5 1,200.4 19% 12%

------------- -------------- -------------- --------- ------------ --------------- ------------ --------- ------------

Cost of

sales (55.7) (44.8) 24% 20% (157.3) (121.8) 29% 22%

Gross profit 430.4 369.8 16% 11% 1,274.2 1,078.6 18% 11%

------------- -------------- -------------- --------- ------------ --------------- ------------ --------- ------------

(1) Organic growth is calculated in respect of businesses owned

for at least the full 3 or 9 months in either period and excludes

The Yield Book and Citi Fixed Income Indices, ISPS, Mergent and

SwapMatch. The Group's principal foreign exchange exposure arises

from translating our European based euro and US based USD reporting

businesses into sterling.

More detailed revenues by segment are provided in tables

below:

Information Services

Organic Organic

Three months and and

Nine months

ended constant ended constant

30 September currency 30 September currency

---------------- ----------------

2017 2016 Variance variance(1) 2017 2016 Variance variance(1)

GBPm GBPm % % GBPm GBPm % %

Revenue

FTSE Russell Indexes 135.3 102.1 33% 19% 395.8 295.7 34% 17%

Real time data 23.0 23.3 (1%) (3%) 70.4 67.7 4% 1%

Other information services 23.5 23.1 2% 18% 70.5 71.0 (1%) 11%

Total revenue 181.8 148.5 22% 15% 536.7 434.4 24% 14%

---------------------------- ------- ------- --------- ------------ ------- ------- --------- ------------

Cost of sales (15.4) (13.6) 13% 8% (45.5) (38.5) 18% 9%

---------------------------- ------- ------- --------- ------------ ------- ------- --------- ------------

Gross profit 166.4 134.9 23% 15% 491.2 395.9 24% 14%

---------------------------- ------- ------- --------- ------------ ------- ------- --------- ------------

(1) Removal of Mergent (acquired Q1 2017) and The Yield Book and

Citi Fixed Income Indices (acquired Q3 2017) from FTSE Russell and

ISPS from Other information services (disposed Q1 2017)

Post Trade Services - LCH

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

---------------- ----------------

2017 2016 Variance variance 2017 2016 Variance variance

GBPm GBPm % % GBPm GBPm % %

Revenue

OTC - SwapClear, ForexClear

& CDSClear 58.6 47.6 23% 21% 171.2 136.7 25% 19%

Non-OTC - Fixed income,

Cash equities and Listed

derivatives 33.3 28.3 18% 12% 99.3 85.9 16% 7%

Other 22.0 13.6 62% 59% 50.6 34.1 48% 51%

------- ------- --------- --------- ------- ------- --------- ---------

Total revenue 113.9 89.5 27% 24% 321.1 256.7 25% 19%

----------------------------- ------- ------- --------- --------- ------- ------- --------- ---------

Net treasury income 31.1 24.1 29% 23% 86.6 59.1 47% 36%

Other income (0.5) 1.3 - - 6.5 5.7 - -

Total income 144.5 114.9 26% 22% 414.2 321.5 29% 22%

----------------------------- ------- ------- --------- --------- ------- ------- --------- ---------

Cost of sales (22.7) (15.8) 44% 36% (63.1) (39.0) 62% 49%

------- ------- ------- -------

Gross profit 121.8 99.1 23% 20% 351.1 282.5 24% 18%

----------------------------- ------- ------- --------- --------- ------- ------- --------- ---------

Post Trade Services - CC&G and Monte Titoli

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

--------------- ---------------

2017 2016 Variance variance 2017 2016 Variance variance

GBPm GBPm % % GBPm GBPm % %

Revenue

Clearing 8.9 10.0 (11%) (16%) 29.5 30.7 (4%) (12%)

Settlement, Custody &

other 17.3 15.2 14% 7% 52.0 42.6 22% 12%

Total revenue 26.2 25.2 4% (2%) 81.5 73.3 11% 2%

----------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Net treasury income 10.9 11.2 (3%) (8%) 30.2 32.2 (6%) (14%)

Total income 37.1 36.4 2% (4%) 111.7 105.5 6% (3%)

----------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Cost of sales (4.3) (3.1) 39% 30% (12.7) (8.8) 44% 34%

------- ------ ------- ------

Gross profit 32.8 33.3 (2%) (7%) 99.0 96.7 2% (6%)

----------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Capital Markets

Organic Organic

Three months and and

Nine months

ended constant ended constant

30 September currency 30 September currency

--------------- ----------------

2017 2016 Variance variance(1) 2017 2016 Variance variance(1)

GBPm GBPm % % GBPm GBPm % %

Revenue

Primary Markets 29.6 21.1 40% 38% 77.3 65.3 18% 16%

Secondary Markets - Equities 39.0 40.0 (3%) (4%) 122.9 123.1 (0%) (2%)

Secondary Markets - Fixed

income, derivatives and

other 28.1 28.5 (1%) (6%) 86.1 82.8 4% (4%)

Total revenue 96.7 89.6 8% 5% 286.3 271.2 6% 1%

------------------------------ ------- ------ --------- ------------ ------- ------- --------- ------------

Cost of sales (4.0) (5.5) (27%) (29%) (12.9) (17.2) (25%) (27%)

------- ------ ------- -------

Gross profit 92.7 84.1 10% 7% 273.4 254.0 8% 3%

------------------------------ ------- ------ --------- ------------ ------- ------- --------- ------------

(1) Removal of SwapMatch from Capital Markets (acquired Q3

2016)

Technology Services

Three months

Nine months

ended Constant ended Constant

30 September currency 30 September currency

--------------- ----------------

2017 2016 Variance variance 2017 2016 Variance variance

Revenue GBPm GBPm % % GBPm GBPm % %

MillenniumIT & other technology 22.7 20.8 9% 7% 63.8 58.8 9% 3%

--------------------------------- ------- ------ --------- --------- ------- ------- --------- ---------

Cost of sales (9.0) (6.5) 38% 41% (21.6) (17.1) 26% 20%

------- ------ ------- -------

Gross profit 13.7 14.3 (4%) (8%) 42.2 41.7 1% (5%)

--------------------------------- ------- ------ --------- --------- ------- ------- --------- ---------

Basis of Preparation

Results for the period ended 30 September 2017 have been

translated into Sterling using the average exchange rates for the

period. Constant currency growth rates have been calculated by

translating prior period results at the average exchange rate for

the current period.

Average rate

9 months ended Closing rate

at

30 September 30 September

2017 2017

---------------

GBP : EUR 1.15 1.13

----------- --------------- -------------

GBP : USD 1.28 1.34

----------- --------------- -------------

Average rate

9 months ended Closing rate

at

30 September 30 September

2016 2016

GBP : EUR 1.25 1.15

----------- --------------- -------------

GBP : USD 1.39 1.30

----------- --------------- -------------

Appendix - Key performance indicators

Information Services

As at

30 September Variance

------------------

2017 2016 %

ETF assets under management

benchmarked ($bn)

FTSE 345 246 40%

Russell Indexes 227 176 29%

----------------------------- ---------

Total 572 422 36%

----------------------------- -------- -------- ---------

Terminals

UK 69,000 73,000 (5%)

Borsa Italiana Professional

Terminals 116,000 129,000 (10%)

Post Trade Services -

LCH

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

2017 2016 % 2017 2016 %

OTC derivatives

SwapClear

IRS notional cleared

($tn) 197 160 23% 666 506 32%

SwapClear members 105 105 0% 105 105 0%

Client trades ('000) 313 232 35% 923 693 33%

CDSClear

Notional cleared (EURbn) 147 106 39% 445 348 28%

CDSClear members 13 12 8% 13 12 8%

ForexClear

Notional value cleared

($bn) 3,097 630 392% 7,954 1,206 560%

ForexClear members 28 24 17% 28 24 17%

------------------------------- ----------- -------- --------- --------- --------- ---------

Non-OTC

Fixed income - Nominal

value (EURtn) 22.3 17.1 30% 65.2 52.1 25%

Listed derivatives (contracts

m) 33.7 28.5 18% 110.1 98.5 12%

Cash equities trades

(m) 194 166 17% 613 511 20%

------------------------------- ----------- -------- --------- --------- --------- ---------

Average cash collateral

(EURbn) 82.1 68.9 19% 85.0 63.8 33%

Post Trade Services - CC&G and Monte Titoli

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

2017 2016 % 2017 2016 %

CC&G Clearing

Contracts (m) 22.6 28.0 (19%) 82.7 96.4 (14%)

Initial margin held (average

EURbn) 9.4 11.7 (20%) 11.6 11.8 (2%)

Monte Titoli

Settlement instructions

(trades m) 10.1 9.4 7% 33.0 32.0 3%

Custody assets under

management (average EURtn) 3.30 3.17 4% 3.26 3.17 3%

Capital Markets - Primary

Markets

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

2017 2016 % 2017 2016 %

New Issues

UK Main Market, PSM &

SFM 18 11 64% 60 36 67%

UK AIM 25 11 127% 53 52 2%

Borsa Italiana 10 5 100% 24 13 85%

Total 53 27 96% 137 101 36%

--------------------------- ---------- --------- --------- --------- --------- ---------

Money Raised (GBPbn)

UK New 2.5 0.3 733% 5.0 2.2 127%

UK Further 3.8 4.0 (5%) 12.2 10.0 22%

Borsa Italiana new and

further 0.8 0.8 (2%) 13.7 4.7 191%

Total (GBPbn) 7.1 5.1 39% 30.9 16.9 83%

--------------------------- ---------- --------- --------- --------- --------- ---------

Capital Markets - Secondary

Markets

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

Equity 2017 2016 % 2017 2016 %

Totals for period

UK value traded (GBPbn) 327 310 5% 1,010 947 7%

Borsa Italiana (no of

trades m) 15.1 16.6 (9%) 52.6 57.2 (8%)

Turquoise value traded

(EURbn) 225 325 (31%) 781 1,085 (28%)

SETS Yield (basis points) 0.63 0.63 0% 0.63 0.63 0%

Average daily

UK value traded (GBPbn) 5.1 4.8 6% 5.3 5.0 6%

Borsa Italiana (no of

trades '000) 237 255 (7%) 275 298 (8%)

Turquoise value traded

(EURbn) 3.5 4.9 (29%) 4.1 5.6 (27%)

Derivatives (contracts

m)

LSE Derivatives 1.5 0.9 67% 4.7 3.3 42%

IDEM 6.6 10.2 (35%) 27.1 35.4 (23%)

Total 8.2 11.1 (26%) 31.8 38.7 (18%)

--------------------------- ---------- --------- --------- --------- --------- ---------

Fixed Income

MTS cash and BondVision

(EURbn) 733 982 (25%) 2,635 3,024 (13%)

MTS money markets (EURbn

term adjusted) 17,385 19,305 (10%) 58,740 63,730 (8%)

Total Income - Quarterly

CY

CY 2016 2017

GBP millions Q1 Q2 Q3 Q4 CY 2016 Q1 Q2 Q3

-------------- -------------- -------------- -------------- ------- ------------- ----------------

Primary

Markets 22.2 22.0 21.1 25.5 90.8 21.3 26.4 29.6

Secondary

Markets -

Equities 42.2 40.9 40.0 41.8 164.9 42.0 41.9 39.0

Secondary

Markets -

Fixed

income,

derivatives

& other 28.0 26.3 28.5 29.8 112.6 30.4 27.6 28.1

------------- -------------- -------------- -------------- -------------- ------------- ------- ------------- ----------------

Capital

Markets 92.4 89.2 89.6 97.1 368.3 93.7 95.9 96.7

Clearing 10.6 10.1 10.0 11.8 42.5 10.7 9.9 8.9

Settlement,

Custody &

other 12.9 14.5 15.2 18.6 61.2 17.0 17.7 17.3

------------- -------------- -------------- -------------- -------------- ------------- ------- ------------- ----------------

Post Trade

Services -

CC&G and

Monte

Titoli 23.5 24.6 25.2 30.4 103.7 27.7 27.6 26.2

OTC -

SwapClear,

ForexClear

&

CDSClear 44.6 44.4 47.6 54.0 190.6 56.8 55.8 58.6

Non OTC -

Fixed

income,

Cash

equities &

Listed

derivatives 28.6 29.1 28.3 30.5 116.5 32.9 33.1 33.3

Other 11.1 9.3 13.6 15.4 49.4 16.0 12.6 22.0

------------- -------------- -------------- -------------- -------------- ------------- ------- ------------- ----------------

Post Trade

Services -

LCH 84.3 82.8 89.5 99.9 356.5 105.7 101.5 113.9

FTSE Russell

Indexes 96.4 97.1 102.1 113.7 409.3 126.7 133.8 135.3

Real time

data 22.7 21.8 23.3 23.1 90.9 23.0 24.4 23.0

Other

information 22.4 25.5 23.1 23.5 94.5 23.9 23.1 23.5

------------- ------- ------------- ----------------

Information

Services 141.5 144.4 148.5 160.3 594.7 173.6 181.3 181.8

Technology

Services 16.2 21.9 20.8 29.4 88.3 20.5 20.6 22.7

Other 1.0 0.1 2.6 0.4 4.1 1.4 3.2 1.4

Total

Revenue 358.9 363.0 376.2 417.5 1,515.6 422.6 430.1 442.7

Net treasury

income

through CCP:

CC&G 10.3 10.7 11.2 10.4 42.6 9.8 9.6 10.9

LCH 17.6 17.4 24.1 23.1 82.2 24.2 31.3 31.1

Other income 0.8 7.1 3.1 5.7 16.7 4.1 13.8 1.4

Total income 387.6 398.2 414.6 456.7 1,657.1 460.7 484.8 486.1

------------- -------------- -------------- -------------- -------------- ------------- ------- ------------- ----------------

Cost of

sales (35.3) (41.7) (44.8) (53.0) (174.8) (50.4) (51.2) (55.7)

Gross profit 352.3 356.5 369.8 403.7 1,482.3 410.3 433.6 430.4

------------- -------------- -------------- -------------- -------------- ------------- ------- ------------- ----------------

Note: Minor rounding differences may mean quarterly and other

segmental figures may differ slightly

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTGGGQUUUPMPUR

(END) Dow Jones Newswires

October 19, 2017 02:00 ET (06:00 GMT)

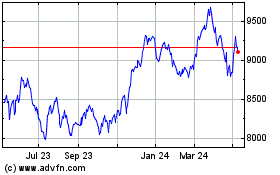

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

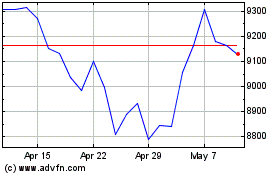

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024