Lloyds Buys Zurich's UK Workplace-Pensions and Savings Business for Undisclosed Sum

October 12 2017 - 7:10AM

Dow Jones News

By Ian Walker

Lloyds Banking Group PLC (LLOY.LN) said Thursday that it is

buying Zurich Insurance Group AG's (ZURN.EB) U.K.

workplace-pensions and savings business, which has assets under

administration of 19 billion pounds ($25.1 billion).

Lloyds said the deal is in line with the group's targeted growth

strategy, and accelerates the development of its financial planning

and retirement business.

It didn't say how much it is paying.

The acquisition is expected to partially close in the first

quarter of 2018, with final completion and transfer of assets

following the required regulatory and legal approvals, Lloyds

said.

Lloyds returned to private hands in May after the U.K.

government sold its remaining shares in the bank it bailed out

during the financial crisis.

Lloyds is the U.K.'s biggest retail bank and was bailed out by

taxpayers in 2008, with the government taking a 39% stake. The

government started selling its shares in late 2013.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

October 12, 2017 06:55 ET (10:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

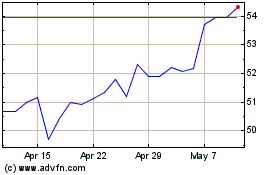

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024