Lloyds Banking Group PLC Sale of Irish Commercial Loans Portfolio (5027U)

July 30 2015 - 2:02AM

UK Regulatory

TIDMLLOY

RNS Number : 5027U

Lloyds Banking Group PLC

30 July 2015

30 July 2015

LLOYDS BANKING GROUP ANNOUNCES THE SALE OF A PORTFOLIO OF IRISH

COMMERCIAL LOANS

Lloyds Banking Group plc ('the Group') announces today that it

has agreed the sale of a portfolio of Irish commercial loans to a

consortium comprising Ennis Property Finance Limited, an entity

affiliated to Goldman Sachs; Feniton Property Finance Limited, an

entity affiliated to CarVal; and Bank of Ireland, for a cash

consideration of approximately GBP827 million at current exchange

rates.

The gross assets subject to the transaction are c.GBP2.6

billion, of which GBP2.3 billion were impaired and in the year to

31 December 2014 they generated pre tax losses of c.GBP130 million.

The sale proceeds will be used for general corporate purposes and

the transaction is not expected to have a material impact on the

Group but will be capital accretive (c.7bps).

The sale is in line with the Group's strategy of deleveraging

its balance sheet by reducing run off assets and creating a low

risk, UK focused bank. As at 30 June 2015, impaired loans as a

percentage of closing advances for the Group were 2.7 per cent and

provisions as a percentage of impaired loans were 55.1 per cent. On

a pro-forma basis, the impact of this sale would be to reduce the

impaired loans as a percentage of closing advances to 2.2 per cent

and reduce provisions as a percentage of impaired loans to 48.3 per

cent. These compare with 2.9 per cent and 56.4 per cent at 31

December 2014, and 8.6 per cent and 48.2 per cent as at 31 December

2012. Following this transaction, the Group will have minimal

remaining exposure to commercial assets in Ireland (<GBP30

million).

The transaction is expected to complete in Q4 of 2015.

- END -

For further information:

Investor Relations

Douglas Radcliffe +44 (0) 20 7356 1571

Investor Relations Director

Email: douglas.radcliffe@finance.lloydsbanking.com

Corporate Affairs

Ian Kitts +44 (0) 20 7356 1347

Head of Media (Commercial Banking & Consumer Finance)

Email: ian.kitts@lloydsbanking.com

FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements with

respect to the business, strategy and plans of Lloyds Banking Group

and its current goals and expectations relating to its future

financial condition and performance. Statements that are not

historical facts, including statements about Lloyds Banking Group's

or its directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans

and/or results to differ materially from the plans, objectives,

expectations, estimates and intentions expressed in such forward

looking statements made by the Group or on its behalf include, but

are not limited to: general economic and business conditions in the

UK and internationally; market related trends and developments;

fluctuations in exchange rates, stock markets and currencies; the

ability to access sufficient sources of capital, liquidity and

funding when required; changes to the Group's credit ratings; the

ability to derive cost savings; changing customer behaviour

including consumer spending, saving and borrowing habits; changes

to borrower or counterparty credit quality; instability in the

global financial markets, including Eurozone instability, the

potential for one or more countries to exit the Eurozone or

European Union (EU) (including the UK as a result of a referendum

on its EU membership) and the impact of any sovereign credit rating

downgrade or other sovereign financial issues; technological

changes and risks to cyber security; pandemic, natural and other

disasters, adverse weather and similar contingencies outside the

Group's control; inadequate or failed internal or external

processes or systems; acts of war, other acts of hostility,

terrorist acts and responses to those acts, geopolitical, pandemic

or other such events; changes in laws, regulations, accounting

standards or taxation, including as a result of further Scottish

devolution; changes to regulatory capital or liquidity requirements

and similar contingencies outside the Group's control; the

policies, decisions and actions of governmental or regulatory

authorities in the UK, the EU, the US or elsewhere including the

implementation of key legislation and regulation; the ability to

attract and retain senior management and other employees;

requirements or limitations imposed on the Group as a result of HM

Treasury's investment in the Group; actions or omissions by the

Group's directors, management or employees including industrial

action; changes to the Group's post-retirement defined benefit

scheme obligations; the provision of banking operations services to

TSB Banking Group plc; the extent of any future impairment charges

or write-downs caused by, but not limited to, depressed asset

valuations, market disruptions and illiquid markets; the value and

effectiveness of any credit protection purchased by the Group; the

inability to hedge certain risks economically; the adequacy of loss

reserves; the actions of competitors, including non-bank financial

services and lending companies; and exposure to regulatory or

competition scrutiny, legal, regulatory or competition proceedings,

investigations or complaints. Please refer to the latest Annual

Report on Form 20-F filed with the US Securities and Exchange

Commission for a discussion of certain factors together with

examples of forward looking statements. Except as required by any

applicable law or regulation, the forward looking statements

contained in this document are made as of today's date, and Lloyds

Banking Group expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward looking

statements.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISRLMMTMBBTTPA

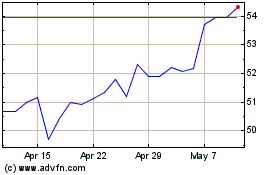

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024