TIDMLLOY

RNS Number : 5823W

Lloyds Banking Group PLC

28 April 2016

Lloyds Banking Group plc

Q1 2016 Interim Management Statement

28 April 2016

HIGHLIGHTS FOR THE THREE MONTHS ENDED 31 MARCH 2016

Robust financial performance with stable underlying profit and

strong underlying returns

-- Underlying profit of GBP2.1 billion with an underlying return

on required equity of 13.8 per cent

-- Positive operating jaws of 1 per cent achieved with lower

operating costs offset by marginally lower income

-- Credit quality remains strong with a 6 per cent reduction in

impairment and an asset quality ratio of 14 basis points

-- Statutory profit before tax of GBP0.7 billion after the

expected GBP0.8 billion charge relating to Enhanced Capital Notes

(ECNs) which were redeemed in the period

-- Strong balance sheet maintained with a CET1 ratio of 13.0 per

cent (pre dividend accrual), after 0.4 per cent impact of ECNs

-- Tangible net assets per share increased to 55.2 pence (31

December 2015: 52.3 pence), driven by underlying profit and reserve

movements

Our differentiated UK focused business model continues to

deliver in a challenging operating environment

-- Cost discipline and low risk business model providing competitive advantage

-- Strong underlying capital generation of c.60 basis points

2016 guidance reaffirmed

-- Net interest margin for the year expected to be around 2.70 per cent

-- Year-on-year reduction in cost:income ratio targeted

-- Asset quality ratio for the year expected to be around 20 basis points

-- Expect to generate around 2 per cent of CET1 capital per annum

GROUP CHIEF EXECUTIVE'S STATEMENT

In the first three months of this year we have continued to make

good progress, delivering a robust financial performance and

maintaining our strong balance sheet. These results demonstrate the

strength of our differentiated, simple, low risk business model and

reflect our ability to actively respond to the challenging

operating environment.

We continue to support and benefit from a resilient UK economy

and remain focused on delivering on our targets to people,

businesses and communities as set out in our updated Helping

Britain Prosper Plan. We have also recently launched our SME

charter to help small businesses grow and to provide access to

funding. In addition, we continue to make good progress in our

strategic initiatives: creating the best customer experience;

becoming simpler and more efficient; and delivering sustainable

growth.

This performance, coupled with our differentiated, capital

generative, business model, underpins our confidence in generating

superior and sustainable returns as we aim to become the best bank

for customers and shareholders.

António Horta-Osório

Group Chief Executive

CONSOLIDATED INCOME STATEMENT AND KEY RATIOS - UNDERLYING

BASIS

Three Three Three

months months months

ended ended ended

31 Mar 31 Mar 31 Dec

2016 2015 Change 2015 Change

GBP million GBP million % GBP million %

Net interest income 2,906 2,829 3 2,904 -

Other income 1,477 1,592 (7) 1,528 (3)

----------- ----------- -----------

Total income 4,383 4,421 (1) 4,432 (1)

----------- ----------- -----------

Operating costs (1,987) (2,020) 2 (2,242) 11

Operating lease

depreciation (193) (183) (5) (201) 4

----------- ----------- -----------

Total costs (2,180) (2,203) 1 (2,443) 11

Impairment (149) (158) 6 (232) 36

----------- ----------- -----------

Underlying profit

excluding TSB 2,054 2,060 - 1,757 17

TSB - 118 -

----------- ----------- -----------

Underlying profit 2,054 2,178 (6) 1,757 17

Enhanced Capital

Notes (790) (65) 268

Market volatility

and other items (334) (128) (29)

Restructuring costs (161) (26) (101)

Payment protection

insurance provisions - - (2,100)

Conduct provisions (115) - (302)

TSB costs - (745) -

Profit (loss) before

tax - statutory 654 1,214 (46) (507)

Taxation (123) (270) 54 (152) 19

----------- ----------- -----------

Profit (loss) for

the period 531 944 (44) (659)

----------- ----------- -----------

Underlying earnings

per share 1.9p 2.3p (0.4)p 1.8p 0.1p

Earnings (loss)

per share 0.6p 1.2p (0.6)p (1.1)p 1.7p

Banking net interest

margin 2.74% 2.60% 14bp 2.64% 10bp

Cost:income ratio 47.4% 47.7% (0.3)pp 53.0% (5.6)pp

Asset quality ratio 0.14% 0.14% - 0.22% (8)bp

Return on risk-weighted

assets 3.70% 3.73% (3)bp 3.12% 58bp

Return on assets 1.01% 1.05% (4)bp 0.86% 15bp

Underlying return

on required equity 13.8% 16.0% (2.2)pp 13.1% 0.7pp

Statutory return

on required equity 4.4% 8.3% (3.9)pp (7.4)% 11.8pp

BALANCE SHEET AND KEY RATIOS

At 31 At 31

Mar Dec Change

2016 2015 %

Loans and advances to customers GBP457bn GBP455bn -

Average interest-earning banking assets(1) GBP438bn GBP439bn -

Customer deposits GBP419bn GBP418bn -

Loan to deposit ratio 109% 109% -

Common equity tier 1 ratio pre dividend accrual(2) 13.0% -

Common equity tier 1 ratio(2,3) 12.8% 13.0% (0.2)pp

Transitional total capital ratio 21.4% 21.5% (0.1)pp

Risk-weighted assets(2) GBP223bn GBP223bn -

Leverage ratio(2,3) 4.7% 4.8% (0.1)pp

Tangible net assets per share 55.2p 52.3p 2.9p

(1) Reported balances are for the first quarter 2016

and fourth quarter 2015.

(2) Reported on a fully loaded basis.

(3) The CET1 and leverage ratios at 31 December 2015

were reported on a pro forma basis, including the

dividend paid by the Insurance business in February

2016 relating to 2015.

REVIEW OF FINANCIAL PERFORMANCE

Overview: robust financial performance with stable underlying

profit and strong underlying returns

Underlying profit of GBP2,054 million was down 6 per cent versus

the prior year, but in line after excluding TSB. A small reduction

in income was offset by lower operating costs and reduced

impairment charges. Statutory profit before tax was GBP654 million

(2015: GBP1,214 million) after the expected charge relating to the

redemption of ECNs in the first quarter of GBP790 million.

The underlying return on required equity was 13.8 per cent

compared with 16.0 per cent in the first three months of 2015. The

reduction largely reflects the disposal of TSB and a higher assumed

underlying tax rate. The statutory return on required equity was

4.4 per cent (2015: 8.3 per cent).

Total loans and advances to customers were GBP457 billion at 31

March 2016, an increase of GBP2 billion since 31 December 2015 with

increased lending to SMEs, other commercial clients and UK consumer

finance customers. Customer deposits at GBP419 billion were GBP1

billion higher than at 31 December 2015.

The common equity tier 1 ratio was 13.0 per cent before accruing

dividends for 2016, with the leverage ratio at 4.7 per cent. The

tangible net asset value per share increased to 55.2 pence (31

December 2015: 52.3 pence).

(MORE TO FOLLOW) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

Total income

Three Three Three

months months months

ended ended ended

31 Mar 31 Mar 31 Dec

2016 2015 Change 2015 Change

GBP GBP GBP

million million % million %

Net interest income 2,906 2,829 3 2,904 -

Other income 1,477 1,592 (7) 1,528 (3)

---------- ---------- ----------

Total income 4,383 4,421 (1) 4,432 (1)

---------- ----------

Banking net interest

margin 2.74% 2.60% 14bp 2.64% 10bp

Average interest-earning

banking assets GBP438.2bn GBP446.5bn (2) GBP439.2bn -

Average interest-earning

banking assets excluding

run-off GBP427.2bn GBP429.5bn (1) GBP427.8bn -

Total income was GBP4,383 million with increased net interest

income offset by lower other income. Net interest income increased

3 per cent to GBP2,906 million reflecting a further improvement in

net interest margin to 2.74 per cent (2015: 2.60 per cent). The

improved margin more than offset the impact of the 2 per cent

reduction in average interest-earning banking assets, which was

largely due to lower run-off assets.

The improvement in net interest margin was due to improved

deposit pricing and mix, lower wholesale funding costs and a

benefit, as expected, from the recent ECN redemptions. The net

interest margin also included a 5 basis point uplift from a one-off

credit to net interest income relating to the credit cards

portfolio. The Group continues to expect that the net interest

margin for the 2016 full year will be around 2.70 per cent, in line

with the guidance given with the 2015 full year results.

Other income at GBP1,477 million was resilient in the current

market conditions and broadly in line with our historic run rate

and quarterly run rate expectations for 2016. This was 7 per cent

lower than in the first three months of 2015, largely due to lower

insurance income and continued pressure on fees and

commissions.

REVIEW OF FINANCIAL PERFORMANCE (continued)

Costs

Three Three Three

months months months

ended ended ended

31 Mar 31 Mar 31 Dec

2016 2015 Change 2015 Change

GBP GBP GBP

million million % million %

Operating costs 1,987 2,020 2 2,242 11

Cost:income ratio 47.4% 47.7% (0.3)pp 53.0% (5.6)pp

Simplification savings

annual run-rate 495 148 373

Operating costs of GBP1,987 million were 2 per cent lower

compared with the first quarter of 2015 reflecting the acceleration

of savings from Simplification initiatives, partly offset by

increased investment. Phase II of the Simplification programme has

now delivered GBP495 million of annual run-rate savings to date,

ahead of plan and on track to deliver GBP1 billion of

Simplification savings by the end of 2017.

The Group delivered positive operating jaws(1) of 1 per cent

with the cost:income ratio improving to 47.4 per cent from 47.7 per

cent in the first quarter of 2015. The Group continues to target

annual improvements in the cost:income ratio with a target ratio of

around 45 per cent as it exits 2019.

Operating lease depreciation increased 5 per cent to GBP193

million driven by the continued growth in the Lex Autolease

business.

(1) Operating jaws represents the percentage change

in total income less the percentage change in operating

costs.

Impairment

Three Three Three

months months months

ended ended ended

31 Mar 31 Mar 31 Dec

2016 2015 Change 2015 Change

GBP GBP GBP

million million % million %

Impairment charge 149 158 6 232 36

Asset quality ratio 0.14% 0.14% - 0.22% (8)bp

Impaired loans as

a % of closing advances 2.0% 2.8% (0.8)pp 2.1% (0.1)pp

The impairment charge was GBP149 million, 6 per cent lower than

in the first quarter of 2015. The asset quality ratio was 14 basis

points in the quarter, with a 22 basis point gross impairment

charge offset by 8 basis points of releases and writebacks. Credit

quality remains strong with the gross charge slightly better than

expected but, for now, we continue to expect a 2016 full year asset

quality ratio of around 20 basis points.

Impaired loans as a percentage of closing advances reduced to

2.0 per cent from 2.1 per cent at the end of December 2015.

REVIEW OF FINANCIAL PERFORMANCE (continued)

Statutory profit

Three Three Three

months months months

ended ended ended

31 Mar 31 Mar 31 Dec

2016 2015 Change 2015 Change

GBP GBP GBP

million million % million %

Underlying profit 2,054 2,178 (6) 1,757 17

Enhanced Capital Notes (790) (65) 268

Market volatility

and other items:

-------- -------- --------

Market volatility

and asset sales (203) 83 123

Fair value unwind (47) (129) (56)

Other items (84) (82) (96)

-------- -------- --------

(334) (128) (29)

Restructuring costs (161) (26) (101)

Payment protection

insurance provision - - (2,100)

Conduct provisions (115) - (302)

TSB costs - (745) -

Profit before tax

- statutory 654 1,214 (46) (507)

Taxation (123) (270) 54 (152) 19

-------- -------- --------

Profit for the period 531 944 (44) (659)

-------- -------- --------

Underlying return

on required equity 13.8% 16.0% (2.2)pp 13.1% 0.7pp

Statutory return on

required equity 4.4% 8.3% (3.9)pp (7.4)% 11.8pp

Further information on the reconciliation of underlying

to statutory results is included on page 8.

Statutory profit before tax was GBP654 million compared with

GBP1,214 million in the first quarter of 2015.

The loss relating to the ECNs in the first quarter was GBP790

million, representing the write-off of the embedded derivative and

the premium paid on redemption of the remaining notes. Market

volatility and asset sales of GBP203 million (2015: positive GBP83

million) was largely due to negative insurance volatility of GBP163

million (2015: positive GBP242 million). Restructuring costs were

GBP161 million and comprise severance related costs incurred to

deliver phase II of the Simplification programme and the costs of

implementing ring-fencing.

There was a charge of GBP115 million in the first three months

to cover retail conduct matters. No further provision has been

taken for PPI, where complaint levels over the three months have

been around 8,500 per week on average, broadly in line with

expectations.

Statutory profit in the first quarter of 2015 included a charge

of GBP745 million comprising GBP660 million relating to the sale of

TSB and GBP85 million of TSB dual running costs.

Taxation

The tax charge for the first three months was GBP123 million

(2015: GBP270 million) representing an effective tax rate of 19 per

cent (2015: 22 per cent). The effective tax rate reflects the

impact of tax exempt gains and capital losses not previously

recognised. The Group continues to expect a medium term effective

tax rate of around 27 per cent.

REVIEW OF FINANCIAL PERFORMANCE (continued)

(MORE TO FOLLOW) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

Funding, liquidity and capital ratios

At At

31 Mar 31 Dec

2016 2015 Change

%

Wholesale funding GBP125bn GBP120bn 4

Wholesale funding <1 year

maturity GBP46bn GBP38bn 22

Of which money-market funding

<1 year maturity(1) GBP23bn GBP22bn 6

Loan to deposit ratio 109% 109% -

Common equity tier 1 ratio

pre dividend accrual(2) 13.0% -

Common equity tier 1 ratio(2,3) 12.8% 13.0% (0.2)pp

Transitional total capital

ratio 21.4% 21.5% (0.1)pp

Leverage ratio(2,3) 4.7% 4.8% (0.1)pp

Risk-weighted assets(2) GBP223bn GBP223bn -

Shareholders' equity GBP43bn GBP41bn 5

(1) Excludes balances relating to margins of GBP3.1

billion (31 December 2015: GBP2.5 billion) and

settlement accounts of GBP1.4 billion (31 December

2015: GBP1.4 billion).

(2) Reported on a fully loaded basis.

(3) The CET1 and leverage ratios at 31 December 2015

were reported on a pro forma basis, including the

dividend paid by the Insurance business in February

2016 relating to 2015.

Wholesale funding was GBP125 billion (31 December 2015: GBP120

billion) of which 37 per cent (31 December: 32 per cent) had a

maturity of less than one year.

The Group's liquidity position remains strong and the liquidity

coverage ratio was in excess of 100 per cent at 31 March 2016.

Capital

The Group maintained its strong balance sheet with a fully

loaded common equity tier 1 ratio of 13.0 per cent before 2016

accrued dividends and 12.8 per cent after dividends (31 December

2015: 13.0 per cent pro forma). Underlying capital generation in

the quarter was strong at around 60 basis points but was offset by

the charge relating to ECN redemptions and other movements. The

Group continues to expect to generate around 2 per cent of CET 1

capital per annum.

The leverage ratio reduced to 4.7 per cent primarily reflecting

the increase in balance sheet assets.

STATUTORY CONSOLIDATED INCOME STATEMENT AND BALANCE SHEET

(UNAUDITED)

Three Three

months months

ended ended

31 Mar 31 Mar

Income statement 2016 2015

GBP million GBP million

Net interest income 2,761 2,263

Other income, net of insurance claims 612 2,280

----------- -----------

Total income, net of insurance claims 3,373 4,543

Total operating expenses (2,586) (3,185)

Impairment (133) (144)

----------- -----------

Profit before tax 654 1,214

Taxation (123) (270)

----------- -----------

Profit for the period 531 944

----------- -----------

Profit attributable to ordinary shareholders 405 814

Profit attributable to other equity

holders 101 99

----------- -----------

Profit attributable to equity holders 506 913

Profit attributable to non-controlling

interests 25 31

----------- -----------

Profit for the period 531 944

----------- -----------

At 31 At 31

Mar Dec

Balance sheet 2016 2015

GBP million GBP million

Assets

Cash and balances at central banks 60,712 58,417

Trading and other financial assets

at fair value through profit or loss 141,763 140,536

Derivative financial instruments 35,357 29,467

Loans and receivables 486,510 484,483

Available-for-sale financial assets 35,443 33,032

Held-to-maturity investments 21,449 19,808

Other assets 42,864 40,945

----------- -----------

Total assets 824,098 806,688

----------- -----------

Liabilities

Deposits from banks 19,049 16,925

Customer deposits 418,963 418,326

Trading and other financial liabilities

at fair value through profit or loss 49,998 51,863

Derivative financial instruments 33,043 26,301

Debt securities in issue 88,084 82,056

Liabilities arising from insurance

and investment contracts 104,320 103,071

Subordinated liabilities 22,119 23,312

Other liabilities 39,485 37,854

------- -------

Total liabilities 775,061 759,708

------- -------

Shareholders' equity 43,268 41,234

Other equity instruments 5,355 5,355

Non-controlling interests 414 391

------- -------

Total equity 49,037 46,980

------- -------

Total equity and liabilities 824,098 806,688

------- -------

NOTES

1. Reconciliation between statutory and underlying basis results

The tables below set out a reconciliation from the statutory

results to the underlying basis results.

Removal of:

Market

Lloyds volatility PPI

Three months Banking and Insurance and other

to 31 March Group other Restructuring gross conduct Underlying

2016 statutory items(1) ECNs(2) costs(3) up provisions basis

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Net interest

income 2,761 69 - - 76 - 2,906

Other income,

net of

insurance

claims 612 189 790 - (114) - 1,477

----------- ------- -----------

Total income 3,373 258 790 - (38) - 4,383

Operating

expenses(4) (2,586) 92 - 161 38 115 (2,180)

Impairment (133) (16) - - - - (149)

-------

Profit

before

tax 654 334 790 161 - 115 2,054

---------- ----------- ------- ------------- --------- ----------- ----------

Removal of:

------------------------------------------------------

Market

Lloyds volatility

Three months Banking and Insurance

to 31 March Group other Restructuring gross Underlying

2015 statutory items(5) ECNs(6) costs(3) TSB(7) up basis

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Net interest

income 2,263 100 - - (192) 658 2,829

Other income,

net of

insurance

claims 2,280 (31) 65 - (36) (686) 1,592

----------- -------

Total income 4,543 69 65 - (228) (28) 4,421

Operating

expenses(4) (3,185) 92 - 26 836 28 (2,203)

Impairment (144) (33) - - 19 - (158)

TSB - - - - 118 - 118

---------- ----------- ------- ------------- ------ --------- ----------

Profit before

tax 1,214 128 65 26 745 - 2,178

---------- ----------- ------- ------------- ------ --------- ----------

(1) Comprises the effects of asset sales (loss of GBP1

million), volatile items (loss of GBP38 million),

liability management activities (loss of GBP1 million),

(MORE TO FOLLOW) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

volatility arising in the insurance businesses

(loss of GBP163 million), the fair value unwind

(loss of GBP47 million) and the amortisation of

purchased intangibles (GBP84 million).

(2) Comprises the change in fair value of the equity

conversion feature of the ECNs (loss of GBP69 million)

and the loss on the completion of the tender offers

and redemptions in respect of the ECNs (GBP721

million).

(3) Principally comprises the severance related costs

related to phase II of the Simplification programme.

(4) On an underlying basis, this is described as total

costs.

(5) Comprises the effects of asset sales (loss of GBP5

million), volatile items (loss of GBP150 million),

liability management (loss of GBP4 million), volatility

arising in the insurance business (gain of GBP242

million), the fair value unwind (loss of GBP129

million) and the amortisation of purchased intangibles

(GBP82 million).

(6) Comprises the change in fair value of the equity

conversion feature of the ECNs (loss of GBP65 million).

(7) Comprises the underlying results of TSB, dual running

and build costs and the charge related to the disposal

of TSB.

NOTES (continued)

2. Summary of movements in total equity

Other Non-

Shareholders' equity controlling Total

equity instruments interests equity

GBPm GBPm GBPm GBPm

Balance at 1 January

2016 41,234 5,355 391 46,980

Movements in the period:

Profit for the period 506 - 25 531

Defined benefit pension

scheme remeasurements 186 - - 186

AFS revaluation reserve 53 - - 53

Cash flow hedging reserve 1,333 - - 1,333

Distributions on other

equity instruments, net

of tax (81) - - (81)

Treasury shares and employee

award schemes 48 - - 48

Other movements (11) - (2) (13)

Balance at 31 March 2016 43,268 5,355 414 49,037

------------- ------------ ------------ -------

3. Quarterly underlying basis information

Quarter Quarter Quarter Quarter Quarter

ended ended ended ended ended

31 31 30 30 31

Mar Dec Sept June Mar

2016 2015 2015 2015 2015

GBPm GBPm GBPm GBPm GBPm

Net interest income 2,906 2,904 2,863 2,886 2,829

Other income 1,477 1,528 1,374 1,661 1,592

---------- ---------- ---------- ---------- ----------

Total income 4,383 4,432 4,237 4,547 4,421

----------

Operating costs (1,987) (2,242) (1,919) (2,130) (2,020)

Operating lease

depreciation (193) (201) (189) (191) (183)

---------- ---------- ---------- ---------- ----------

Total costs (2,180) (2,443) (2,108) (2,321) (2,203)

Impairment (149) (232) (157) (21) (158)

---------- ---------- ---------- ---------- ----------

Underlying profit

excluding TSB 2,054 1,757 1,972 2,205 2,060

TSB - - - - 118

---------- ---------- ---------- ---------- ----------

Underlying profit 2,054 1,757 1,972 2,205 2,178

Enhanced Capital

Notes (790) 268 21 (325) (65)

Market volatility

and other items (334) (29) (398) (60) (128)

Restructuring costs (161) (101) (37) (6) (26)

TSB costs - - - - (745)

Conduct provisions (115) (2,402) (600) (1,835) -

---------- ----------

Statutory profit

(loss) before tax 654 (507) 958 (21) 1,214

---------- ---------- ---------- ---------- ----------

Banking net interest

margin 2.74% 2.64% 2.64% 2.65% 2.60%

Average interest-earning

banking assets GBP438.2bn GBP439.2bn GBP438.7bn GBP443.2bn GBP446.5bn

Cost:income ratio 47.4% 53.0% 47.4% 48.9% 47.7%

Asset quality ratio 0.14% 0.22% 0.15% 0.03% 0.14%

Return on risk-weighted

assets(1) 3.70% 3.12% 3.47% 3.84% 3.73%

Return on assets(1) 1.01% 0.86% 0.95% 1.06% 1.05%

(1) Based on underlying profit.

NOTES (continued)

4. Transitional capital ratios and fully loaded leverage disclosures

At 31 At 31

Mar Dec

2016 2015

Capital resources GBP million GBP million

Common equity tier 1

Shareholders' equity per balance

sheet 43,268 41,234

Deconsolidation of insurance entities (636) (1,199)

Other adjustments (3,982) (2,015)

Deductions from common equity tier

1 (9,874) (9,476)

----------- -----------

Common equity tier 1 capital 28,776 28,544

----------- -----------

Additional tier 1 instruments 8,626 9,177

Deductions from tier 1 (1,313) (1,177)

----------- -----------

Total tier 1 capital 36,089 36,544

----------- -----------

Tier 2 instruments and eligible provisions 13,267 13,208

Deductions from tier 2 (1,540) (1,756)

----------- -----------

Total capital resources 47,816 47,996

----------- -----------

Risk-weighted assets

Foundation IRB Approach 69,249 68,990

Retail IRB Approach 63,220 63,912

Other IRB Approach 19,505 18,661

----------- -----------

IRB Approach 151,974 151,563

Standardised Approach 21,117 20,443

Contributions to the default fund

of a central counterparty 581 488

----------- -----------

Credit risk 173,672 172,494

Counterparty credit risk 8,451 7,981

Credit valuation adjustment risk 1,087 1,684

Operational risk 26,123 26,123

Market risk 3,241 3,775

----------- -----------

Underlying risk-weighted assets 212,574 212,057

----------- -----------

Threshold risk-weighted assets 11,349 10,788

----------- -----------

Total risk-weighted assets 223,923 222,845

----------- -----------

Leverage

Total tier 1 capital (fully loaded) 33,869 33,860

----------- -----------

Statutory balance sheet assets 824,098 806,688

Deconsolidation and other adjustments (160,865) (150,912)

Off-balance sheet items 56,890 56,424

----------- -----------

Total exposure measure 720,123 712,200

----------- -----------

Ratios

Transitional common equity tier 1

capital ratio 12.9% 12.8%

Transitional tier 1 capital ratio 16.1% 16.4%

Transitional total capital ratio 21.4% 21.5%

Leverage ratio(1) 4.7% 4.8%

Average leverage ratio(2) 4.7%

Average leverage exposure measure(3) 718,775

(MORE TO FOLLOW) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

(1) The countercyclical leverage ratio buffer is currently

nil.

(2) The average leverage ratio is based on the average

of the month end tier 1 capital and exposure measures

over the quarter. The average of 4.7 per cent over

the quarter compared to 4.8 per cent and 4.7 per

cent at the start and end of the quarter respectively

reflects both the impact of the ECN losses recognised

during the quarter and the increase in balance

sheet assets.

(3) The average leverage exposure measure is based

on the average of the month end exposure measures

over the quarter.

BASIS OF PRESENTATION

This release covers the results of Lloyds Banking

Group plc together with its subsidiaries (the Group)

for the three months ended 31 March 2016.

Statutory basis: Statutory information is set out

on page 7. However, a number of factors have had

a significant effect on the comparability of the

Group's financial position and results. As a result,

comparison on a statutory basis of the 2016 results

with 2015 is of limited benefit.

Underlying basis: In order to present a more meaningful

view of business performance, the results are presented

on an underlying basis excluding items that in

management's view would distort the comparison

of performance between periods. Based on this principle

the following items are excluded from underlying

profit:

* losses on redemption of the Enhanced Capital Notes

and the volatility in the value of the embedded

equity conversion feature;

* market volatility and other items, which includes the

effects of certain asset sales, the volatility

relating to the Group's own debt and hedging

arrangements as well as that arising in the insurance

businesses, insurance gross up, the unwind of

acquisition-related fair value adjustments and the

amortisation of purchased intangible assets;

* restructuring costs, comprising severance related

costs relating to the Simplification programme

announced in October 2014 and the costs of

implementing regulatory reform and ring fencing;

* TSB build and dual running costs and the loss

relating to the TSB sale in 2015; and

* payment protection insurance and other conduct

provisions.

Unless otherwise stated, income statement commentaries

throughout this document compare the three months

ended 31 March 2016 to the three months ended 31

March 2015, and the balance sheet analysis compares

the Group balance sheet as at 31 March 2016 to

the Group balance sheet as at 31 December 2015.

----------------------------------------------------------------------------------------------------------------------

FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements with

respect to the business, strategy and plans of Lloyds Banking Group

and its current goals and expectations relating to its future

financial condition and performance. Statements that are not

historical facts, including statements about Lloyds Banking Group's

or its directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans

and/or results (including but not limited to the payment of

dividends) to differ materially from the plans, objectives,

expectations, estimates and intentions expressed in such forward

looking statements made by the Group or on its behalf include, but

are not limited to: general economic and business conditions in the

UK and internationally; market related trends and developments;

fluctuations in exchange rates, stock markets and currencies; the

ability to access sufficient sources of capital, liquidity and

funding when required; changes to the Group's credit ratings; the

ability to derive cost savings; changing customer behaviour

including consumer spending, saving and borrowing habits; changes

to borrower or counterparty credit quality; instability in the

global financial markets, including Eurozone instability, the

potential for one or more countries to exit the Eurozone or

European Union (EU) (including the UK as a result of a referendum

on its EU membership) and the impact of any sovereign credit rating

downgrade or other sovereign financial issues; technological

changes and risks to cyber security; natural, pandemic and other

disasters, adverse weather and similar contingencies outside the

Group's control; inadequate or failed internal or external

processes or systems; acts of war, other acts of hostility,

terrorist acts and responses to those acts, geopolitical, pandemic

or other such events; changes in laws, regulations, accounting

standards or taxation, including as a result of further Scottish

devolution; changes to regulatory capital or liquidity requirements

and similar contingencies outside the Group's control; the

policies, decisions and actions of governmental or regulatory

authorities or courts in the UK, the EU, the US or elsewhere

including the implementation and interpretation of key legislation

and regulation; the ability to attract and retain senior management

and other employees; requirements or limitations imposed on the

Group as a result of HM Treasury's investment in the Group; actions

or omissions by the Group's directors, management or employees

including industrial action; changes to the Group's post-retirement

defined benefit scheme obligations; the provision of banking

operations services to TSB Banking Group plc; the extent of any

future impairment charges or write-downs caused by, but not limited

to, depressed asset valuations, market disruptions and illiquid

markets; the value and effectiveness of any credit protection

purchased by the Group; the inability to hedge certain risks

economically; the adequacy of loss reserves; the actions of

competitors, including non-bank financial services and lending

companies; and exposure to regulatory or competition scrutiny,

legal, regulatory or competition proceedings, investigations or

complaints. Please refer to the latest Annual Report on Form 20-F

filed with the US Securities and Exchange Commission for a

discussion of certain factors together with examples of forward

looking statements. Except as required by any applicable law or

regulation, the forward looking statements contained in this

document are made as of today's date, and Lloyds Banking Group

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward looking

statements. The information, statements and opinions contained in

this document do not constitute a public offer under any applicable

law or an offer to sell any securities or financial instruments or

any advice or recommendation with respect to such securities or

financial instruments.

CONTACTS

For further information please contact:

INVESTORS AND ANALYSTS

Douglas Radcliffe

Group Investor Relations Director

020 7356 1571

douglas.radcliffe@finance.lloydsbanking.com

Mike Butters

Director of Investor Relations

020 7356 1187

mike.butters@finance.lloydsbanking.com

Andrew Downey

Director of Investor Relations

020 7356 2334

andrew.downey@finance.lloydsbanking.com

CORPORATE AFFAIRS

Ed Petter

Group Media Relations Director

020 8936 5655

ed.petter@lloydsbanking.com

Matt Smith

Head of Corporate Media

020 7356 3522

matt.smith@lloydsbanking.com

Copies of this interim management statement may be obtained

from:

Investor Relations, Lloyds Banking Group plc, 25 Gresham Street,

London EC2V 7HN

The statement can also be found on the Group's website -

www.lloydsbankinggroup.com

Registered office: Lloyds Banking Group plc, The Mound,

Edinburgh EH1 1YZ

Registered in Scotland no. SC95000

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFBCGDSUDDBGLR

(END) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

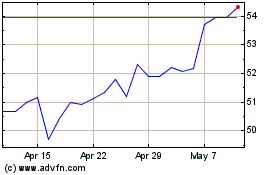

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024