TIDMLLOY TIDM94WP

RNS Number : 0039J

Lloyds Banking Group PLC

23 June 2017

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION IN RELATION TO THE

LLOYDS BANK PLC DEBT SECURITIES DESCRIBED HEREIN AND IS DISCLOSED

IN ACCORDANCE WITH THE MARKET ABUSE REGULATION.

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES OF AMERICA (INCLUDING ITS TERRITORIES

AND POSSESSIONS) (THE "UNITED STATES") OR IN ANY OTHER JURISDICTION

WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

LLOYDS BANK PLC ANNOUNCES INDICATIVE RESULTS OF ITS TENDER

OFFERS IN RELATION TO CERTAIN STERLING AND EURO NOTES

23 June 2017

Further to its announcement on 12 June 2017, Lloyds Bank plc

(the "Offeror") is today announcing, on a non-binding basis,

indicative results of its invitations to all Holders of the Notes

set out in the table below to tender their outstanding Notes for

purchase by the Offeror for cash up to a maximum aggregate nominal

amount to be determined by the Offeror in its sole and absolute

discretion (being the Maximum Acceptance Amount) (each such

invitation an "Offer" and, together, the "Offers").

The Offers were announced on 12 June 2017 and were made subject

to the offer and distribution restrictions set out in the tender

offer memorandum dated 12 June 2017 (the "Tender Offer

Memorandum"). Capitalised terms not otherwise defined in this

announcement have the same meaning as assigned to them in the

Tender Offer Memorandum.

INDICATIVE RESULTS

The Offeror hereby announces its non-binding intention to accept

valid tenders of the Notes pursuant to the Offers with an

indicative Maximum Acceptance Amount of approximately

GBP950,273,348.

The following table sets out the aggregate nominal amount of

Notes validly tendered pursuant to the relevant Offer, the

indicative Pro-ration Factor (if any) and the indicative Series

Acceptance Amount, in each case in relation to each Series of

Notes.

Indicative Series

Acceptance Amount

(Sterling equivalent

Nominal Amount Indicative Indicative Series converted at the

Title of Security ISIN Number Validly Tendered Pro-ration Factor Acceptance Amount Euro FX Rate)

------------------- -------------- ------------------ ------------------ ------------------ ---------------------

Sterling Notes

GBP250,000,000 XS1239389684 GBP80,855,000 1 GBP80,855,000 n.a.

2.500 per cent.

Notes due June

2022

Euro Notes

EUR1,350,000,000

Floating Rate

Notes due

September 2019 XS1109333986 EUR324,329,000 1 EUR324,329,000 GBP285,827,972

EUR1,000,000,000

0.625 per cent.

Notes due April

2020 XS1219428957 EUR196,225,000 1 EUR196,225,000 GBP172,931,171

EUR1,500,000,000

1.000 per cent.

Notes due

November 2021 XS1139091372 EUR434,789,000 0 EUR0 GBP0

EUR1,250,000,000

1.375 per cent.

Notes due

September 2022 XS1280783983 EUR298,364,000 1 EUR298,364,000 GBP262,945,272

EUR1,250,000,000

1.250 per cent.

Notes due January

2025 XS1167204699 EUR167,611,000 1 EUR167,611,000 GBP147,713,933

PRICE DETERMINATION TIME

The Price Determination Time is expected to be at or around 2.00

p.m. London time on 23 June 2017.

As soon as reasonably practicable after the Price Determination

Time, the Offeror is expected to announce whether it will accept

valid tenders of Notes of any Series pursuant to the relevant Offer

and, if so, (i) the Maximum Acceptance Amount, (ii) in relation to

each Series of Notes, the Series Acceptance Amount and any

Pro-ration Factor(s) and (iii) the relevant Reference Yield,

Repurchase Yield and Purchase Price in relation to each relevant

Series of Fixed Spread Notes accepted for purchase.

Holders who do not participate in the Offers or whose Notes are

not accepted for purchase will continue to hold their Notes subject

to their terms and conditions.

SETTLEMENT DATE

The Settlement Date is expected to be 27 June 2017.

FURTHER INFORMATION

For further information please contact:

Investor Relations:

Douglas Radcliffe

Group Investor Relations Director

Telephone: +44 (0)20 7356 1571

Email: douglas.radcliffe@finance.lloydsbanking.com

Requests for information in relation to the

Offers should be directed to:

DEALER MANAGER

Lloyds Bank plc

10 Gresham Street

London EC2V 7AE

United Kingdom

Tel: +44 20 7158 2720

Attention: Liability Management Group

email: liability.management@lloydsbanking.com

Requests for information in relation to, and

for any documents or materials relating to,

the Offers should be directed to:

TENDER AGENT

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom

Tel: +44 20 7704 0880

Attention: Paul Kamminga/Arlind Bytyqi

email: lloydsbank@lucid-is.com

The Offeror launched, contemporaneously with the launch of the

Offers, offers to holders of three series of U.S. dollar

denominated notes issued by the Offeror. This announcement does not

relate to the U.S. Offer.

DISCLAIMER

This announcement must be read in conjunction with the

announcement relating to the Offers published via RNS on 12 June

2017 and the Tender Offer Memorandum. This announcement does not

constitute an offer or an invitation to participate in the Offers

in the United States or in any other jurisdiction in which, or to

any person to or from whom, it is unlawful to make such offer or

invitation or for there to be such participation under applicable

laws.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUOVWRBNANURR

(END) Dow Jones Newswires

June 23, 2017 05:01 ET (09:01 GMT)

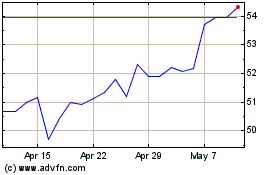

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024