Lloyds Banking First-Quarter Net Profit Falls 44% -- Update

April 28 2016 - 4:00AM

Dow Jones News

By Max Colchester

LONDON-- Lloyds Banking Group PLC said net profit fell sharply

in the first quarter hit by restructuring charges and the cost of

buying back high interest paying bonds.

The British retail bank, which is about 9% owned by the U.K.

government, said Thursday revenue dropped 1% to GBP4.4 billion

($6.4 billion) in the quarter. Profit fell 44% to GBP531 million in

the first three months of the year. Shares fell 2% in morning

trading in line with other British banks.

Like other lenders, Lloyds has been struggling as low interest

rates eat into profitability. The bank said it was accelerating

current cost-reduction plans, while ratcheting back mortgage

lending as the U.K. buy-to-let mortgage market starts to cool.

Lloyds will review its three-year strategy, launched in 2014,

should it hit cost-saving targets ahead of time, said Chief

Financial Officer George Culmer.

Meanwhile the bank aimed to "continue to have a nice stable

profit as we move forward," Mr. Culmer said. The lender took a

GBP790 million hit buying back high interest paying bonds it issued

to investors during the crisis. This, however, helped improve the

bank's closely watched net interest margin, the difference between

its cost of borrowing and the price at which it lends, to 2.74%.

Market volatility also hit insurance income. No extra funds were

put aside to compensate customers who were sold insurance products

they didn't need.

Underlying profit, which strips out a series of one-off charges,

came to GBP2.1 billion, down 6% compared with the same period a

year earlier.

In January the U.K. government postponed a planned sale of its

shares in the 9% state-owned lender, citing ongoing turmoil in

financial markets. The shares continue to trade below the

government's average buy-in price. Mr. Culmer wouldn't speculate

what the government would do with the remaining stake. "What they

do is unto themselves," he said.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

April 28, 2016 03:45 ET (07:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

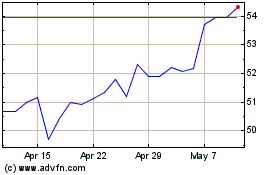

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024