LinkedIn Gives Positive Outlook

April 28 2016 - 5:00PM

Dow Jones News

LinkedIn Corp. said its loss widened in the first quarter, but

it gave favorable guidance for its second quarter and boosted its

full-year outlook, a contrast from its prior report when a downbeat

forecast cut the company's value nearly in half.

Shares added 8.8% after hours to $133.89.

The professional online network said revenue rose 35% to $860.7

million, from $637.7 million a year earlier. Analysts expected

LinkedIn to report first-quarter revenue of $828.5 million,

according to Thomson Reuters.

LinkedIn reported a loss of $45.8 million, or 35 cents per

share, compared with $42.5 million, or 34 cents per share, a year

ago.

Excluding stock-based compensation and some other expenses,

LinkedIn said it earned 74 cents per share, compared with 57 cents

per share on that basis a year earlier. Analysts expected LinkedIn

to report adjusted earnings of 60 cents.

For the second quarter, LinkedIn said it anticipates earnings of

74 cents to 77 cents a share, above analyst expectations for 71

cents. Revenue is expected to come in between $885 million and $890

million, straddling analyst estimates for $886 million.

The company also boosted its outlook for the full year, saying

it now expects revenue between $3.65 billion and $3.7 billion and

adjusted earnings of $3.30 to $3.40 a share. It had previously

forecast revenue of $3.6 billion to $3.65 billion and adjusted EPS

of $3.05 to $3.20 a share.

In February, LinkedIn issued a disappointing financial outlook

for 2016, sparking a 44% one-day share plunge that wiped out more

than three years of stock market gains. The projection reflected a

slowdown in its higher-margin online sales business, economic

pressures overseas and a decision to shelve an ad product,

executives said. LinkedIn shares are up slightly since then, but

remain down 45% for the year as of Thursday's close.

Roughly two-thirds of LinkedIn's revenue comes from its talent

solutions division, which helps recruiters identify job candidates.

The company generated $502.4 million in revenue from the unit,

which caters largely to corporate clients, compared with $396

million a year ago.

The disappointing outlook in February and sharp stock slide also

triggered investor concerns over LinkedIn's reliance on stock-based

compensation to recruit employees.

Over the past two years, LinkedIn's stock-based compensation has

accounted for 16% of revenue-less than Twitter Inc.'s 39%, but

about double Facebook Inc.'s 8%, according to RBC Capital Markets.

At a conference in February, LinkedIn Chief Financial Officer Steve

Sordello said LinkedIn's goal was to drive this ratio down to

10%.

One bright spot were native ads or "sponsored content" that

appears within users' LinkedIn feeds. This was one of the company's

fastest-growing ad products last year and is recorded within

LinkedIn's Marketing Solutions division, which focuses on

advertising.

LinkedIn said revenue in the marketing solutions unit rose to

$154.1 million, from $119 million a year ago.

At the company's third business unit, premium subscriptions,

revenue rose to $148.9 million, compared with $122 million last

year.

Write to Deepa Seetharaman at Deepa.Seetharaman@wsj.com

(END) Dow Jones Newswires

April 28, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

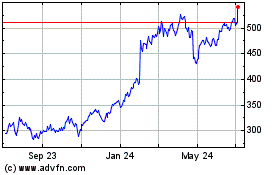

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

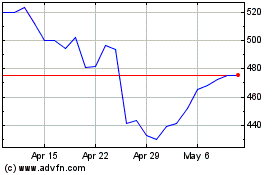

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024