- Revenue and earnings increase over

prior year’s second quarter

- Irrigation segment revenue increases on

solid growth from international markets

- Infrastructure segment revenue

increases with improved gross margin

Lindsay Corporation (NYSE: LNN), a leading provider of

irrigation systems and infrastructure products, today announced

results for its second quarter ended February 28, 2017.

Second Quarter Results

Second quarter fiscal 2017 revenues were $124.1 million compared

to revenues of $120.6 million in the prior year’s second quarter.

Net earnings for the quarter were $5.0 million or $0.47 per diluted

share compared with a net loss of $4.1 million or $0.37 per diluted

share in the second quarter of the prior year. The prior year

period included $13.0 million of environmental remediation expenses

which, on an after-tax basis, reduced net earnings by $8.5 million,

or $0.78 per diluted share.

Irrigation segment revenues for the second quarter increased

three percent to $106.2 million from $103.1 million in the prior

year’s second quarter. U.S. irrigation revenues of $61.5 million

declined 15 percent, as harsh winter weather conditions in the

Northwest resulted in lower irrigation equipment unit volume and

lower revenue from other irrigation businesses. International

irrigation revenues were $44.7 million, an increase of 46 percent

compared to the second quarter of the prior year, driven primarily

by improved demand and project activity in South America, Africa

and the Commonwealth of Independent States region. Infrastructure

segment revenues for the second quarter increased two percent to

$17.9 million, as increased demand for road safety products and

higher Road Zipper® system sales and lease revenue was offset in

part by a decline in sales volume for rail products.

Gross margin for the second quarter of fiscal 2017 was 26.5

percent of sales compared to 26.9 percent of sales in the prior

year’s second quarter. Improved margin in the infrastructure

segment was more than offset by lower margin in the irrigation

segment, as improved U.S. irrigation margin was offset by a higher

mix of international revenue at comparatively lower margins.

Improved infrastructure margin resulted from increased cost

absorption in Road Zipper® system production and volume leverage

from road safety product sales.

Operating expenses for the second quarter of fiscal 2017 were

$24.4 million, a decrease of $12.7 million compared to the second

quarter in the prior year. Excluding the impact of the

environmental remediation expenses in the prior year’s second

quarter, operating expenses were slightly higher in the current

year primarily due to increased new product development and testing

costs. Operating expenses were 19.7 percent of sales in the second

quarter of fiscal 2017 compared with 30.8 percent of sales in the

second quarter of the prior year. Operating margins were 6.9

percent in the second quarter of fiscal 2017, unchanged compared to

the second quarter of the prior year after excluding the

environmental expenses.

Cash and cash equivalents at the end of the second quarter were

$102.8 million compared to $101.2 million at the end of the prior

fiscal year and $89.5 million at the end of the prior year’s second

quarter. There were no share repurchases made during the second

quarter of fiscal 2017. A total of $63.7 million remains available

under the Company’s share repurchase program as of February 28,

2017.

The backlog of unshipped orders at February 28, 2017 was $62.3

million compared with $52.6 million at February 29, 2016. Order

backlogs were improved in both the irrigation and infrastructure in

comparison to the prior year.

Six Month Results

Total revenues for the six months ended February 28, 2017 were

$234.5 million, a decrease of three percent compared to $242.2

million in the same prior year period. Net earnings were $5.9

million or $0.55 per diluted share compared with $2.8 million or

$0.25 per diluted share in the prior year.

Irrigation segment revenues decreased four percent to $196.1

million for the six months ended February 28, 2017 from $204.4

million in the same prior year period, as U.S. irrigation revenues

of $111.8 million decreased 15 percent and international irrigation

revenues of $84.3 million increased 16 percent. Infrastructure

segment revenues increased two percent to $38.4 million for the six

months ended February 28, 2017, as increased demand for road safety

products was offset in part by a decline in sales volume for rail

products.

Outlook

Rick Parod, President and Chief Executive Officer, commented,

“In the irrigation segment, orders and project levels improved in

the second quarter after experiencing a slow start to the year in

the first quarter. Strong sales growth in international irrigation

reflects improving demand and increased project activity. I am

pleased with the U.S. irrigation gross margin improvement achieved,

especially in view of raw material inflation experienced in the

quarter. In the infrastructure segment, second quarter revenues

were modestly improved over the prior year in a seasonally lower

period, and we continue to see improved operating performance in

the segment.”

Parod continued, “We are currently in the midst of the primary

selling season for irrigation equipment in North America where

overall market conditions, affected by lower commodity prices and

reduced farm incomes, are resulting in seasonal demand similar to

the prior year. I am encouraged by the improving activity levels we

are seeing in the international irrigation and infrastructure

markets. The longer-term drivers for our markets of population

growth, expanded food production and efficient water use, and

infrastructure upgrades and expansion support our expectations for

growth.”

Second-Quarter Conference Call

Lindsay’s fiscal 2017 second quarter investor conference call is

scheduled for 11:00 a.m. Eastern Time today. Interested investors

may participate in the call by dialing (888) 321-8161 in the U.S.,

or (706) 758-0065 internationally, and referring to conference ID #

90564253. Additionally, the conference call will be simulcast live

on the Internet, and can be accessed via the investor relations

section of the Company's Web site, www.lindsay.com. Replays of the

conference call will remain on our Web site through the next

quarterly earnings release. The Company will have a slide

presentation available to augment management's formal presentation,

which will also be accessible via the Company's Web site.

About the Company

Lindsay manufactures and markets irrigation equipment primarily

used in agricultural markets which increase or stabilize crop

production while conserving water, energy, and labor. The Company

also manufactures and markets infrastructure and road safety

products under the Lindsay Transportation Solutions trade name. At

February 28, 2017, Lindsay had approximately 10.7 million shares

outstanding, which are traded on the New York Stock Exchange under

the symbol LNN.

For more information regarding Lindsay Corporation, see the

Company’s Web site at www.lindsay.com.

Concerning Forward-looking Statements

This release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management’s

current beliefs and estimates of future economic circumstances,

industry conditions, company performance and financial results. You

can find a discussion of many of these risks and uncertainties in

the annual, quarterly and current reports that the Company files

with the Securities and Exchange Commission. Forward-looking

statements include information concerning possible or assumed

future results of operations and planned financing of the Company

and those statements preceded by, followed by or including the

words “anticipate,” “estimate,” “believe,” “intend,” "expect,"

"outlook," "could," "may," "should," “will,” or similar

expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The Company undertakes no obligation to update any forward-looking

information contained in this press release.

Lindsay Corporation and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited) Three months ended Six months

ended (in thousands, except per share amounts)

February 28,2017

February 29,2016

February 28,2017

February 29,2016

Operating revenues $ 124,125 $ 120,573 $ 234,515 $ 242,195

Cost of operating revenues 91,184 88,128

173,200 175,336 Gross profit

32,941 32,445 61,315

66,859 Operating expenses: Selling expense

10,132 10,363 20,114 20,355 General and administrative expense

10,230 23,028 21,585 32,043 Engineering and research expense

4,057 3,748 8,359 7,407

Total operating expenses 24,419 37,139

50,058 59,805 Operating

income (loss) 8,522 (4,694 ) 11,257 7,054 Interest expense

(1,201 ) (1,201 ) (2,410 ) (2,397 ) Interest income 171 229 336 393

Other income (expense), net

144 (527 ) (212 ) (847 )

Earnings (loss) before income taxes 7,636 (6,193 ) 8,971 4,203

Income tax expense (benefit) 2,624

(2,064 ) 3,086 1,388 Net

earnings (loss) $ 5,012 $ (4,129 ) $ 5,885 $ 2,815

Earnings (loss) per share: Basic $ 0.47 $ (0.37 ) $

0.55 $ 0.25 Diluted $ 0.47 $ (0.37 ) $ 0.55 $ 0.25 Shares

used in computing earnings (loss) per share: Basic 10,657 11,024

10,647 11,142 Diluted 10,674 11,024 10,670 11,163 Cash

dividends declared per share $

0.29

$

0.28

$

0.58

$

0.56

Lindsay

Corporation and Subsidiaries CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited) February 28,

February 29, August 31, (in thousands)

2017 2016 2016 ASSETS Current assets:

Cash and cash equivalents $ 102,825 $ 89,522 $ 101,246 Restricted

cash - 2,028 2,030 Receivables, net 78,828 79,225 80,610

Inventories, net 82,847 82,078 74,750 Prepaid expenses 5,208 4,418

3,671 Other current assets 15,968 12,802

14,468 Total current assets 285,676

270,073 276,775 Property,

plant and equipment, net 75,632 78,916 77,627 Intangibles, net

44,890 49,475 47,200 Goodwill 76,577 76,628 76,803 Deferred income

tax assets 3,094 3,108 4,225 Other noncurrent assets, net

4,747 5,070 4,885 Total assets $

490,616 $ 483,270 $ 487,515 LIABILITIES

AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $

44,254 $ 36,371 $ 32,268 Current portion of long-term debt 199 195

197 Other current liabilities 46,350 47,971

55,395 Total current liabilities 90,803

84,537 87,860 Pension

benefits liabilities 6,708 6,431 6,869 Long-term debt 116,876

117,075 116,976 Deferred income tax liabilities 1,678 1,020 1,223

Other noncurrent liabilities 20,995 22,588

23,020 Total liabilities 237,060

231,651 235,948 Shareholders'

equity: Preferred stock - - - Common stock 18,746 18,713 18,713

Capital in excess of stated value 59,002 55,908 57,338 Retained

earnings 466,630 455,535 466,926 Less treasury stock - at cost

(277,238 ) (261,118 ) (277,238 ) Accumulated other comprehensive

loss, net (13,584 ) (17,419 ) (14,172 ) Total

shareholders' equity 253,556 251,619

251,567 Total liabilities and shareholders' equity $

490,616 $ 483,270 $ 487,515

Lindsay Corporation and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited) (in thousands) Six months

ended

February 28,2017

February 29,2016

CASH FLOWS FROM OPERATING ACTIVITIES: Net earnings $ 5,885 $ 2,815

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization 8,120 8,536 Provision for

uncollectible accounts receivable (609 ) (1,103 ) Deferred income

taxes 1,707 (4,163 ) Share-based compensation expense 1,815 1,534

Other, net (594 ) 1,828 Changes in assets and liabilities:

Receivables 2,710 (5,220 ) Inventories (7,368 ) (8,094 ) Other

current assets 3,375 (1,779 ) Accounts payable 11,926 (2,247 )

Other current liabilities (8,135 ) (5,273 ) Current taxes payable

(5,987 ) (3,641 ) Other noncurrent assets and liabilities

(2,123 ) 11,833 Net cash provided by (used in)

operating activities 10,722 (4,974 )

CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property, plant

and equipment (4,194 ) (7,392 ) Proceeds from settlement of net

investment hedges 2,054 2,317 Payments for settlement of net

investment hedges (482 ) (512 ) Other investing activities, net

136 1,073 Net cash used in investing

activities (2,486 ) (4,514 ) CASH FLOWS FROM

FINANCING ACTIVITIES: Proceeds from exercise of stock options 647

113 Common stock withheld for payroll tax withholdings (635 ) (712

) Principal payments on long-term debt (98 ) (96 ) Repurchase of

common shares - (32,215 ) Dividends paid (6,181 )

(6,183 ) Net cash used in financing activities (6,267 )

(39,093 ) Effect of exchange rate changes on cash and

cash equivalents (390 ) (990 ) Net change in cash and

cash equivalents 1,579 (49,571 ) Cash and cash equivalents,

beginning of period 101,246 139,093

Cash and cash equivalents, end of period $ 102,825 $ 89,522

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170330005258/en/

Lindsay CorporationBrian Ketcham, 402-827-6579Vice

President & Chief Financial OfficerorHalliburton Investor

RelationsHala Elsherbini or Geralyn DeBusk, 972-458-8000

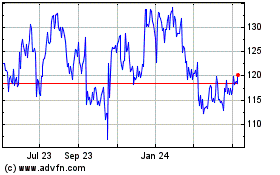

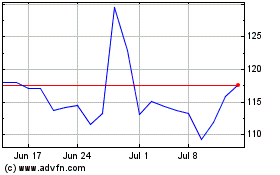

Lindsay (NYSE:LNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lindsay (NYSE:LNN)

Historical Stock Chart

From Apr 2023 to Apr 2024