Lenovo's Tough Road to Mobile Integration -- WSJ

May 27 2016 - 3:03AM

Dow Jones News

By Wayne Ma and Anjie Zheng

HONG KONG -- A year and a half ago, Lenovo Group Ltd. spent $5

billion to buy its way into growth sectors such as smartphones and

servers as the personal-computer market slowed. But return to

growth hasn't come easily.

The Chinese PC maker underestimated how difficult it would be to

integrate its 2014 acquisition of Motorola Mobility's handset

business, Lenovo Chief Executive Yang Yuanqing said in an interview

Thursday. Lenovo itself had grown to become the world's largest PC

maker by shipments through the acquisition of International

Business Machines Corp.'s computer business more than a decade

ago.

"We are definitely facing some challenges" in the mobile-phone

business, he said, after Lenovo reported its first annual loss in

six years.

The company attributed the weak performance to slowing PC demand

and costs related to integrating Motorola's handset business, which

it bought for $2.91 billion from Alphabet Inc.'s Google unit.

Mr. Yang said in the interview that he expects losses to

continue at the company's mobile unit in the "short-term" but added

he was optimistic he could turn it around and "pursue profitable

growth over time."

As part of its strategy, Lenovo will be pushing high-end

smartphones in the U.S. market. Mr. Yang said Lenovo plans to

launch on June 9 in Silicon Valley two new smartphones, one under

the Motorola brand and another device that uses Google's Tango

platform which comes with features such as motion tracking and

depth perception.

Lenovo has struggled to hold ground against Chinese smartphone

rivals such as Huawei Technologies Co. and Oppo Electronics Corp.,

which gained market share in the first calendar quarter, while

Lenovo fell out of the top-five rankings, according to

market-research firm Gartner.

In the U.S., Lenovo had little presence in the smartphone market

but through its acquisition of Motorola boosted its market share to

5.2% last year, according to market-research firm International

Data Corp. That compares with 22.7% for Samsung Electronics Co. and

16.2% for Apple Inc.

Lenovo said the company's world-wide smartphone shipments fell

13% in its fiscal year ended in March due to weaker demand in China

and the U.S.

It added that its world-wide market share for smartphones

dropped 1.1 percentage points to 4.6%. Meanwhile, its mobile

business booked a loss of $469 million in its latest fiscal

year.

In the competitive China market, Mr. Yang pointed to a shift in

the handset business model where smartphones that were once sold

solely through wireless carriers are now sold directly to

consumers. "The market is shifting from the operator's market to an

open market, and unfortunately we haven't built that solid

foundation," Mr. Yang said. Lenovo did meet its target to turn

Motorola profitable in its fiscal fourth quarter, but it came at

the price of steep cost cuts. The company said last August it would

cut $650 million from expenses at the unit over the second half of

the year, including staff reductions. Mr. Yang said that as long as

the smartphone market didn't deteriorate further, the company

wouldn't need more cost cuts.

Lenovo said its fiscal fourth-quarter profit rose to $180

million from $100 million a year earlier thanks to lower operating

expenses and employee-benefit costs. The company posted a net loss

of $128 million for the year ended March 31, which compared with a

profit of $829 million in the year-earlier period.

Operating costs dropped by 23% in the quarter, and

employee-benefit costs were lower because of the reduced head

count, the company said.

Revenue fell to $9.13 billion from $11.3 billion in the

year-earlier quarter, as sales fell across all regions.

Shortly after Lenovo's annual results were posted, Mr. Yang sent

out an email to his employees pledging not to accept any bonuses

offered to him because of the company's financial performance last

year, according to the company.

Lenovo's shares are down 37% since the start of the year.

"We all share in our success, and with our culture of commitment

and ownership, we must all understand that in tough times we share

the responsibility too," he wrote.

--Eva Dou contributed to this article.

Write to Wayne Ma at wayne.ma@wsj.com and Anjie Zheng at

Anjie.Zheng@wsj.com

(END) Dow Jones Newswires

May 27, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

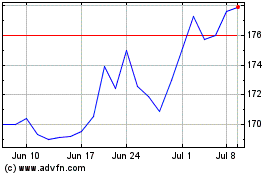

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

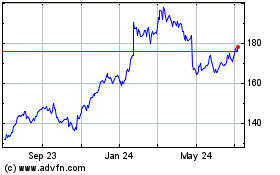

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024