Len Blavatnik Defends Boom-Era Merger of LyondellBasell

October 21 2016 - 6:18PM

Dow Jones News

By Patrick Fitzgerald

Billionaire deal maker Len Blavatnik defended his merger of

Lyondell Chemical and Basell AF as he took the witness stand Friday

in a $1.5 billion clawback lawsuit brought for the benefit of the

chemical giant's creditors.

Mr. Blavatnik, one of the richest people in America, told a New

York courtroom that he combined Lyondell with Basell "for the long

term" and not to turn a quick profit.

Looking at his business history, Mr. Blavatnik said during a

trial in U.S. Bankruptcy Court in Manhattan, he invests in

companies for the long term. "Lyondell is the proof of that," he

testified. "I have had many opportunities to sell, but I

haven't."

Lyondell's creditors are suing Mr. Blavatnik over a 2007 merger

that created what was then one of the largest chemical companies in

the world. Mr. Blavatnik's Basell paid $48 a share for Lyondell,

what the creditors call a "blowout price" that allowed the

Houston-based chemical company's shareholders to collect $12.5

billion from the merger.

The boom-era deal loaded the company up with more than $20

billion in debt just before global commodity markets tumbled amid

the global financial crisis. A little more than a year after the

merger, LyondellBasell filed for bankruptcy.

The creditors' lawsuit, filed more than seven years ago by a

trust created as part of the bankruptcy case, seeks to hold Mr.

Blavatnik and others accountable for a deal they claim essentially

doomed the combined company to failure by using unrealistic

financial projections and loading it up with too much debt.

Mr. Blavatnik and his fellow defendants deny wrongdoing and have

blamed the global recession for the company's financial

troubles.

LyondellBasell emerged from bankruptcy in 2010 after eliminating

about $5 billion from its debt load with Mr. Blavatnik's holding

company, Access Industries, as a significant backer.

The Ukrainian-born Mr. Blavatnik immigrated to the U.S. from the

Soviet Union in 1978. After becoming a U.S. citizen in 1981, he

returned to Russia in the early 1990s and joined a new class of

industrialists who shrewdly took advantage of the country's

privatization initiative to snap up state assets on the cheap.

Forbes magazine recently estimated his net worth at $18.6 billion,

making Mr. Blavatnik, who lives in London, the 22nd-wealthiest

American citizen.

Through Access Industries, Mr. Blavatnik has expanded his

business interests to include stakes in oil, coal, aluminum,

petrochemicals and plastics, telecommunications, media and real

estate.

Mr. Blavatnik also disputed what he called the "preposterous"

suggestion from creditors lawyer Sigmund Wissner-Gross that he

wasn't concerned about overpaying for LyondellBasell because he had

put up little of his own cash and always had the "option" of

putting the company into bankruptcy.

"In no way was [the merger] a play on optionality," he said in

response to a follow-up question from his lawyer, Susheel

Kirpalani.

"It would wipe out $10 billion of my equity," he said of a

LyondellBasell bankruptcy filing. "That would be a joke."

Bankruptcy, he said, wasn't a serious option for LyondellBasell

until the fall of 2008 when credit markets froze up following the

collapse of Lehman Brothers Holdings Inc.

Mr. Blavatnik bought Basell, a Dutch joint-venture between

German chemicals-maker BASF AG and Royal Dutch Shell PLC, in 2005

for EUR4.4 billion (about $6.1 billion at the time), a record for

the largest leveraged-buyout deal in the chemical industry at that

time.

The merger of the European-focused Basell with the North

American-based Lyonell was designed, he said, to give the combined

chemical company greater market access, greater marketing power and

access to cheaper feedstocks.

In many respects, Mr. Blavatnik said, LyondellBasell's

postrecession performance validates his belief in the combined

company. On Friday he said he "doubled down" on the company,

purchasing an additional stake in LyondellBasell after it emerged

from bankruptcy protection. He testified Friday that he has made a

profit of $4.5 billion on his bet on Lyondell following its

bankruptcy exit.

The trial, which began Oct. 17, is expected to run several more

weeks.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

October 21, 2016 18:03 ET (22:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

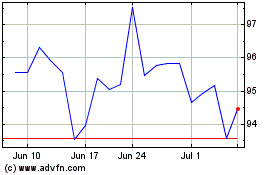

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

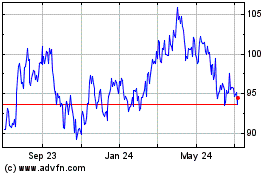

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024