Lattice Semiconductor & Canyon Bridge Capital Partners, LLC Announce Termination of Merger Agreement Following Decision from ...

September 13 2017 - 7:04PM

Business Wire

Lattice Semiconductor Corporation (NASDAQ:LSCC) today announced

the termination of the acquisition by Canyon Bridge Capital

Partners, LLC (“Canyon Bridge”) of Lattice Semiconductor following

an order from the President of the United States.

The Committee on Foreign Investment in the United States (CFIUS)

referred the transaction with Canyon Bridge to the U.S. President

for a decision, having been unable to come to an agreement with the

parties on mitigation measures. After consideration, the President

prohibited the proposed transaction on the recommendation of CFIUS

in an executive order dated September 13, 2017.

“The transaction with Canyon Bridge was in the best interests of

our shareholders, our customers, our employees and the United

States. We also believe our CFIUS mitigation proposal was the

single most comprehensive mitigation proposal ever proposed for a

foreign transaction in the semiconductor industry and would have

maximized United States national security protection while still

enabling Lattice to accept Canyon Bridge’s investment and double

American jobs. While it is disappointing that we were not able to

prevail, the Board and I would like to thank Canyon Bridge for

their support during this time.” said Darin G. Billerbeck, CEO of

Lattice Semiconductor.

“We will continue to focus on initiatives that will contribute

to Lattice’s long term success, specifically in areas where our

affordable, low power, small form factor devices create advantages.

Additionally, we remain committed to achieving profitable growth by

extending processing and connectivity solutions beyond our core

business. Lattice’s future remains bright.”

The full text of the order is accessible

under: [https://www.whitehouse.gov/briefing-room/presidential-actions].

Forward-Looking Statements Notice:

The foregoing paragraphs contain forward-looking statements that

involve estimates, assumptions, risks and uncertainties. Any

statements about our expectations, beliefs, plans, objectives,

assumptions or future events or performance are not historical

facts and may be forward-looking. Such forward-looking statements

include statements relating to: our expectation that we will

continue to focus on initiatives that will contribute to Lattice’s

long term success and our focus on achieving profitable growth.

Other forward-looking statements may be indicated by words such as

“will,” “could,” “should,” “would,” “may,” “expect,” “plan,”

“project,” “anticipate,” “intend,” “forecast,” “future,” “believe,”

“estimate,” “predict,” “propose,” “potential,” “continue” or the

negative of these terms or other comparable terminology; and our

expectation that we will remain focused on maximizing the leverage

of our operating model and reduce our outstanding debt balance.

Lattice believes the factors identified below could cause actual

results to differ materially from the forward-looking

statements.

Estimates of long term success and whether we achieve profitable

growth are inherently uncertain and are affected by such factors as

global economic conditions, which may affect customer demand,

pricing pressures, competitive actions, the demand for our Mature,

Mainstream and New products, and in particular our iCE40™ and

MachXO3L™ devices, the ability to supply products to customers in a

timely manner, changes in our distribution relationships, or the

volatility of our consumer business. Actual results could vary from

the estimates on the basis of, among other things, changes in

revenue levels, changes in product pricing and mix, changes in

wafer, assembly, test and other costs, including commodity costs,

variations in manufacturing yields, the failure to sustain

operational improvements, the actual amount of compensation charges

due to stock price changes. Any unanticipated declines in revenue

or gross margin, any unanticipated increases in our operating

expenses or unanticipated charges could adversely affect our

profitability.

In addition to the foregoing, other factors that may cause

actual results to differ materially from the forward-looking

statements in this press release include disruptions of our

business arising from the termination of our proposed acquisition

by Canyon Bridge Capital Partners, Inc., global economic

uncertainty, overall semiconductor market conditions, market

acceptance and demand for our new products, the Company's

dependencies on its silicon wafer suppliers, the impact of

competitive products and pricing, technological and product

development risks, the failure to achieve the anticipated benefits

and synergies of the Silicon Image transaction. In addition, actual

results are subject to other risks and uncertainties that relate

more broadly to our overall business, including those risks more

fully described in Lattice’s filings with the SEC including its

annual report on Form 10-K for the fiscal year ended December 31,

2016, and Lattice’s quarterly reports filed on Form 10-Q.

You should not unduly rely on forward-looking statements because

actual results could differ materially from those expressed in any

forward-looking statements. In addition, any forward-looking

statement applies only as of the date on which it is made. The

Company does not intend to update or revise any forward-looking

statements, whether as a result of events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170913006586/en/

Media:Brunswick GroupAlex Finnegan,

202-264-9544afinnegan@brunswickgroup.comorJennifer Sukawaty,

202-403-9492jsukawaty@brunswickgroup.comorInvestors:Global

IR PartnersDavid Pasquale,

914-337-8801lscc@globalirpartners.com

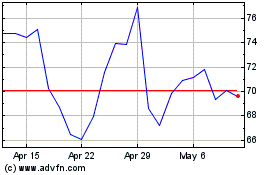

Lattice Semiconductor (NASDAQ:LSCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

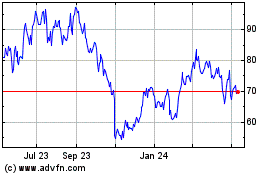

Lattice Semiconductor (NASDAQ:LSCC)

Historical Stock Chart

From Apr 2023 to Apr 2024