Large money managers were bruised in the third quarter by market

declines and investor outflows, the latest sign of the ills

afflicting the U.S. mutual-fund industry.

A round of quarterly reports, released Thursday, included

Franklin Resources Inc.'s largest investor withdrawal in more than

a dozen years. But shares of the company and smaller rivals Janus

Capital Group Inc., T. Rowe Price Group Inc. and AllianceBernstein

Holding LP rose as much as 6%.

Short sellers, investors who borrow shares and sell them in a

bid to benefit from expected stock-price declines, likely helped

fuel the gains by covering their bearish bets amid a marketwide

rally driven by signs that the European Central Bank may expand

stimulus this year.

Even so, shares of many asset managers remain down for 2015, and

many analysts say the investor shifts that have hit results will

likely continue to hamper the firms. Short interest, reflecting

bets that share prices will fall, have risen this year at both

Franklin and T. Rowe Price.

All three firms manage mutual funds at a time when cheaper,

"passive" strategies such as index funds have been gaining ground.

Franklin was also hit by a sharp decline in the latest quarter in

emerging markets, an area where the firm has large exposure through

its Templeton Global Bond Fund.

Mutual-fund firms "will likely continue to be challenged" by

soft global growth and volatile markets, said Michael Kim, an

analyst at Sandler O'Neill + Partners. "You're going to see

investors continue to be very uncertain and lack conviction in

terms of risk appetite."

Franklin, the parent company of Franklin Templeton Investments,

said that assets under management were $770.9 billion at Sept. 30,

down $95.6 billion, or 11%, from the previous quarter. The figure

reflects asset-price declines and investor withdrawals.

Net income at the San Mateo, Calif., firm fell to $358.2

million, or 59 cents a diluted share, from the year-ago $640.6

million, or $1.02 a share. Revenue fell 13% to $1.87 billion.

During the quarter, the company's fiscal fourth period,

investors pulled $28.6 billion from Franklin's fixed-income and

stock mutual funds, the largest quarterly outflow since at least

2002, according to Mr. Kim.

In the 12 months ended Sept. 30, investors pulled $48.8 billion

from Franklin's funds.

"Fiscal 2015 was challenging in many respects," Greg Johnson,

Franklin's chairman and chief executive, said on a conference call

Thursday. "Risk aversion spiked alongside volatility, resulting in

underperformance of economically sensitive stocks, the continued

decline in emerging-markets equities and currencies, and one of the

longest commodity routs on record."

One investor who held a short position in Franklin said that the

decline in assets under management was higher than anticipated, and

that some investors had expected outflows as low as $16 billion for

the quarter.

Franklin's stock was up 6% to $40.19 in midafternoon

trading.

"There were a fair amount of investors that were short the stock

and some investors used the [earnings] opportunity to cover their

short positions," Mr. Kim said.

A Franklin spokesman declined to comment on the firm's stock

price movement.

The combination of soft results, outflows and rising shares was

repeated at Janus Capital Group and T. Rowe Price Group.

At Janus, the Denver-based money manager with $185 billion in

assets under management, investors pulled $3.3 billion in the

latest quarter. The firm reported third-quarter net income of $19.9

million, or 10 cents a share, down from $40.9 million, or 22 cents

a share, a year earlier. Revenue rose to $273.8 million from $237

million the year earlier.

Shares rose 7% to $15.28. A Janus spokeswoman declined to

comment on the stock movement.

Assets at T. Rowe Price sank $47.5 billion from the previous

quarter to $725.5 billion. Investors pulled $700 million during the

quarter. Net income for the quarter ended Sept. 30 fell to $277.1

million, or $1.06 a share, from the year-earlier $303.6 million, or

$1.12 a share.

Shares rose to $74.18 in afternoon trading, up 6.52%. A

spokesman did not immediately return a request for comment.

At AllianceBernstein, assets dropped 4.6% at Sept. 30 to $462.9

billion, as investors pulled $2.4 billion. Net income fell to $42.7

million, or 43 cents a share, in the third quarter from $44.1

million, or 45 cents a share, in the year-ago quarter. The

company's stock was up 4.5% to $27.58 in afternoon trading.

Many asset managers have been hit this year, in part because of

market volatility over the summer. Franklin's stock is down about

27% for 2015, while T. Rowe Price is down 13% and Janus is off

5.6%. AllianceBernstein is up 6.4% year to date.

Matt Wirz contributed to this article.

Write to Kirsten Grind at kirsten.grind@wsj.com

Access Investor Kit for "T. Rowe Price Group, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US74144T1088

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 22, 2015 16:25 ET (20:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

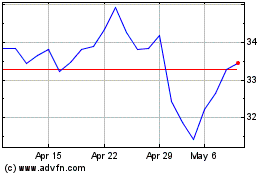

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024