LVMH's Sales Rise, Aided by Perfumes

October 10 2016 - 3:40PM

Dow Jones News

French luxury giant LVMH Moë t Hennessy Louis Vuitton SE saw its

nine-month revenue rise 4% compared with the same period last year,

boosted by its Asian market and perfumes business, even as its core

fashion unit flagged.

LVMH, a bellwether for the industry and the first European

luxury player to release its earnings this season, said Monday that

revenue totaled €26.3 billion ($29.3 billion) in the first nine

months of the year.

The conglomerate's fashion and luxury-goods division—which

includes Celine, Christian Dior and Marc Jacobs and is LVMH's

largest unit—grew only 1% in the period to €9.0 billion. Its wines

and spirits business, including Moet & Chandon, posted 5%

revenue growth to €3.3 billion.

Perfumes and cosmetics were the strongest division in the

period, growing 6% on the year, the company said. Louis Vuitton,

the luxury giant's flagship brand, launched a new perfume.

Sales in Asia, excluding Japan, showed a significant improvement

during the third quarter, the company said. It added that the wines

and spirits division showed a strengthening result in China during

the first nine months of the year.

LVMH doesn't report quarterly profit figures. As a result,

investors will have to await full-year results to see what impact

the slowdown has had on profitability, given that many luxury-goods

companies are sinking more money into their retail networks and

digital channels to combat an industry slowdown.

While LVMH said that sales growth picked up over the course of

this year, the company is growing far more slowly than in recent

years. During the first nine months of 2015, its sales grew 18%

compared with the same period in 2014.

LVMH's slowdown reflects a shift in the global luxury market.

Weakening luxury-goods sales in China, whose shoppers represent one

third of the luxury market, according to advisory firm EY, changes

in customers' tastes and volatile currency and macroeconomic

conditions have erased the double-digit growth rates many luxury

goods houses enjoyed until recently.

LVMH's sales growth began to slow in 2013, prompting it to

refresh key brands such as Louis Vuitton, the conglomerate's profit

and sales powerhouse. Other brands such as Kering and Prada have

also seen similar slowdowns.

LVMH gave a positive outlook Monday for its U.S. and European

markets, with the exception of France, which continues to suffer a

decline in tourism after recent terror attacks. It also said the

company will pursue "targeted geographic expansion" in certain

market.

Write to Manuela Mesco at manuela.mesco@wsj.com

(END) Dow Jones Newswires

October 10, 2016 15:25 ET (19:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

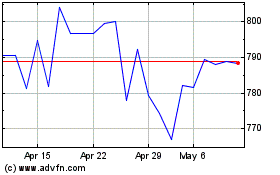

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

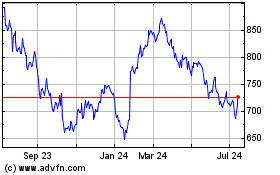

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024