LVMH's Revenue Shines Amid Weak Global Economic Growth

February 02 2016 - 5:10PM

Dow Jones News

By Jason Chow

PARIS-- LVMH Moët Hennessy Louis Vuitton SE's fourth-quarter

revenue rose 12% as the French luxury conglomerate showed signs of

resilience amid weak global economic growth and the Nov. 13

terrorist attack in Paris that curbed tourist flows to the shopping

hub.

The firm, which rang in EUR10.38 billion ($11.3 billion) in

sales during the last three months of 2015, was also optimistic

that it would continue to grow despite the unsteady economic

outlook and a major downturn in global stock markets. The company's

overall organic revenue growth, which strips out the effects of

currency, grew 5% in the fourth quarter.

Chief Executive Bernard Arnault said fears of a slowdown in

spending among Chinese consumers, a demographic that industry

experts estimate makes up over one-third of overall global luxury

purchases, were overblown.

"Analysts underestimate the Chinese economy," he said. "The

fundamentals are good. Household spending is still increasing, and

that's important to us."

LVMH, which owns a multitude of brands including flagship

fashion label Louis Vuitton, champagne house Moët & Chandon and

cognac label Hennessy, said its full-year 2015 profit fell 37% to

EUR3.57 billion. The drop was expected as the 2014 net income

figure was boosted by a sale of its stake in smaller luxury rival

Hermès International SA.

Removing the effect of the sale, full-year profit grew 20% as a

low euro and strong tourist spending boosted sales of its fashion

brands.

LVMH is often regarded as a bellwether for the entire luxury

sector as its portfolio includes brands that span fashion,

accessories, liquor, jewelry and watches as well as the DFS

duty-free chain and the Sephora cosmetics label. The results show

that LVMH was better able to weather the many challenges facing the

industry at the end of the year: The effect of terror attacks and

threats and slowing economic growth in emerging markets.

The group also benefits from the drop in the euro's exchange

rate against major currencies, which helps in two ways: Sales

abroad translate favorably when converted into euros, while the low

currency attracts tourist shoppers to splurge in Europe. Chinese

tourists, in particular, were driven to shop in Europe for most of

2015, taking advantage of the exchange rate.

That tourist flow was abruptly interrupted as international

visitors canceled their trips to Europe in the wake of the November

terrorist attack in Paris that killed 130 people and injured

hundreds more in a brutal onslaught on restaurants, a soccer

stadium and a concert venue.

Fourth-quarter organic sales in Europe grew at 6% in the fourth

quarter, slower than the 12% rise over the first nine months of the

year. The attacks hurt sales during the quarter, but Mr. Arnault

said revenue among Paris stores have "progressively" returned and

currently stand "about 4% to 5% lower than normal."

Sales in Japan remained strong in the fourth quarter, as the

country benefited from a strong flow of Chinese tourist shoppers.

Revenue rose 13% in the fourth quarter while sales in the rest of

Asia declined 2% in the quarter.

Mr. Arnault said sales in Hong Kong, a former favored shopping

hub for mainland Chinese consumers, remained depressed as the

region was hit by a negative effect on currency and a political

climate that discouraged visitors from mainland China. Hong Kong

has imposed new visa restrictions to restrict the number of

visitors from China, a reaction to local concerns that the city was

becoming overcrowded with tourists and shoppers from the

mainland.

"Hong Kong is cyclical," he said. "It has its highs and lows.

Now, it's at a low point."

Organic growth of sales at the firm's Fashion and Leather Goods

division, which includes juggernaut Louis Vuitton was at 3% $3.5

billion during the fourth quarter. Though the division trailed

other business lines--the Wines and Spirits division rose 4%

organically in the fourth quarter, for example--Mr. Arnault said

that sales were particularly strong at Louis Vuitton, which posted

record sales in December.

Under creative director Nicolas Ghesquière, who was appointed

more than two years ago, Louis Vuitton has moved to burnish its

reputation as one of the most prestigious brands and revive

sales.

Fourth-quarter organic sales growth in the U.S. was at 5%,

slower than the annual 9% increase for the entire year. LVMH said

sales of cognac were particularly strong.

The U.S. market is responsible for about a quarter of the

group's total revenue.

LVMH said it would increase its divided by 11% to EUR3.55 a

share.

Write to Jason Chow at jason.chow@wsj.com

(END) Dow Jones Newswires

February 02, 2016 16:55 ET (21:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

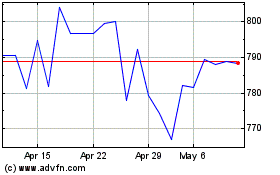

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

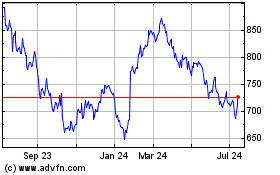

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024