Paris, 26 July 2017

LVMH Moët Hennessy Louis Vuitton,

the world's leading luxury products group, recorded revenue of

€19.7 billion in the first half of 2017, an increase of 15%.

Organic revenue growth was 12% compared to the same period in 2016.

All geographic areas continue to progress well. During the first

half of the year, the Group benefited from a favourable comparison

base, particularly in Asia but also in France, where activity was

impacted last year by a decline in tourism. The current trends

cannot reasonably be extrapolated for the full year.

In the second quarter, revenue

increased by 15% compared to the same period in 2016, with the

notable integration for the first time of Rimowa. Organic revenue

growth was 12%.

Profit from recurring operations

was €3 640 million for the first half of 2017, an increase of 23%.

Operating margin reached 18.5%, an increase of 1 percentage point.

Group share of net profit amounted to € 2 119 million, an increase

of 24%.

Bernard Arnault, Chairman and CEO

of LVMH, commented:

"LVMH has enjoyed an excellent

first half, to which all our businesses contributed. In the current

climate of geopolitical and economic instability, creativity and

quality, the founding values of our Group, have more than ever

become benchmarks for all. The increasing digitalization of our

activities furthermore reinforces the quality of the experience we

bring to our customers. In an environment that remains uncertain,

we approach the second half of the year with caution. We will

remain vigilant and rely on the entrepreneurial spirit and talent

of our teams to further increase our leadership in the world of

high quality products in 2017."

Highlights of the first half of

2017 include:

-

Double-digit increases in revenue and profit

from recurring operations;

-

Good growth in Europe, Asia and the United

States;

-

A good start to the year for Wines and

Spirits;

-

Outstanding momentum at Louis Vuitton;

profitability remains at an exceptional level;

-

LVMH's planned acquisition of Christian Dior

Couture, one of the world's most iconic brands, finalized on July

3;

-

Integration of Rimowa, a leader in premium-class

luggage;

-

Success of the new products at Christian

Dior;

-

Growth at Bvlgari and excellent response to TAG

Heuer's new products;

-

Continued strengthening of Sephora's omnichannel

strategy;

-

Cash from operations before changes in working

capital of €4.5 billion, an increase of 23%

-

Net debt to equity ratio of 14% as of the end of

June 2017.

Key figures

Euro millions |

First half 2016 |

First half 2017 |

% change |

Revenue

Profit from recurring operations

Group share of net profit

Cash from operations*

Net Financial Debt

Total Equity |

17 188

2 959

1 711

3 650

5 303

26 073 |

19 714

3 640

2 119

4 501

3 957

28 292 |

+ 15 %

+ 23 %

+ 24 %

+ 23 %

- 25 %

+ 9% |

* Before changes

in working capital.

Revenue by

business group:

|

Euro millions |

First half 2016 |

First half 2017 |

% change

Reported Organic* |

| Wines & Spirits |

2 056 |

2 294 |

+ 12 % |

+ 10 % |

| Fashion & Leather Goods |

5 885 |

6 899 |

+ 17 % |

+ 14 % |

| Perfumes & Cosmetics |

2 337 |

2 670 |

+ 14 % |

+ 12 % |

| Watches & Jewelry |

1 609 |

1 838 |

+ 14% |

+ 13 % |

| Selective Retailing |

5 480 |

6 280 |

+ 15% |

+ 12 % |

| Other activities and eliminations |

(179) |

(267) |

- |

- |

| Total LVMH |

17 188 |

19 714 |

+ 15 % |

+ 12 % |

* With comparable

structure and constant exchange rates. The exchange rate impact is

+2% and the structural impact is +1%.

Profit from recurring

operations by business group:

|

Euro millions |

First half 2016 |

First half

2017 |

% change |

| Wines & Spirits |

565 |

681 |

+ 21

% |

| Fashion & Leather Goods |

1 630 |

2 192 |

+ 34

% |

| Perfumes & Cosmetics |

272 |

292 |

+ 7

% |

| Watches & Jewelry |

205 |

234 |

+ 14

% |

| Selective Retailing |

410 |

441 |

+ 8 % |

| Other activities and eliminations |

(123) |

(200) |

- |

| Total LVMH |

2 959 |

3 640 |

+ 23 % |

Wines &

Spirits: good start to the year with solid growth in the United

States, and improved momentum in China

The Wines &

Spirits business group recorded organic revenue growth of 10%.

On a reported basis, revenue rose 12% and profit from recurring

operations increased by 21%. The business group reaffirmed its

commitment to innovation with many initiatives across the brands.

All the champagne Houses have performed well. Europe and the United

States were particularly dynamic. Hennessy cognac continued to show

strong growth in the US market, while demand is recovering in

China. The second half of the year is expected to experience a

slowdown in volume growth given the existing supply

constraints.

Fashion &

Leather Goods: good creative momentum at Louis Vuitton and further

strengthening of other brands

The Fashion &

Leather Goods business group recorded organic revenue growth of

14%. On a reported basis, revenue increased 17% and profit from

recurring operations was up 34%. The momentum at Louis Vuitton,

driven by its exceptional creativity, was demonstrated across all

its product categories. The Cruise Collection presented at the Miho

Museum in Kyoto, Japan, was a great illustration of this. The

launch of new models resulting from the collaboration with the

artist Jeff Koons and the cult New York skatewear brand, Supreme,

were the highlights of the first half. Fendi continued its strong

growth and enriched its leather goods lines, notably with the new

Kan-I model. Loro Piana strengthened its

presence in Asia with several openings. Céline, Loewe and Kenzo

experienced good growth. Marc Jacobs strengthened its product

offering and continued its restructuring. Other brands continued to

grow. Rimowa, which joined the LVMH Group, is consolidated for the

first time in the first half-year accounts.

Perfumes &

Cosmetics: continuous innovation and strong growth in make

up

The Perfumes

& Cosmetics business group posted organic revenue growth of

12%. On a reported basis, revenue grew 14% and profit from

recurring operations was up 7%. Christian Dior showed strong growth

momentum, sustained by the vitality of its iconic fragrances

J'adore and Miss Dior,

the continued success of Sauvage and the

performance of its latest makeup creations. Guerlain enjoyed a

successful launch of its new perfume, Mon

Guerlain, represented by Angelina Jolie. Parfums Givenchy

experienced rapid growth in makeup, especially its line of

lipsticks. Benefit continued to roll out its Brow Collection.

Watches &

Jewelry: good first half for Bvlgari and

successful development of TAG Heuer in its core range

The Watches &

Jewelry business group recorded organic revenue growth of 13%.

On a reported basis, revenue growth was 14% and profit from

recurring operations was up 14%. Bvlgari enjoyed an excellent first

half and continued to gain market share. This dynamic is notable in

both jewelry and watchmaking, especially in China and Europe,

thanks to the success of the iconic Serpenti

and B-Zero 1 lines and the new Octo Finissimo watch. TAG Heuer experienced solid

revenue growth in a tough watch market. The new products created in

its flagship Carrera, Aquaracer and Formula 1 collections were very successful and a new

generation of the smart watch was launched. Hublot continued its

growth.

Selective

Retailing: growth at Sephora and improved momentum of DFS in

Asia

The Selective

Retailing business group posted organic revenue growth of 12%.

On a reported basis, sales growth was 15% and profit from recurring

operations was up 8%. Sephora continued to make progress and

reinforced its omnichannel strategy. While increasing its share of

online sales, Sephora continued to invest in extending its network

and renovating existing stores, particularly in New York and Dubai.

Le Bon Marché developed a new online shopping experience by

launching its digital platform 24 Sèvres. DFS experienced better

momentum in Asia, while the T Galleria, which opened in 2016 in

Cambodia and Italy, continued to develop.

Outlook

2017

Despite the context of

geopolitical and currency uncertainties, LVMH will continue to

pursue gains in market share through the numerous product launches

planned before the end of the year and its geographic expansion in

promising markets, while continuing to manage costs.

Our strategy of focusing on

quality across all our activities, combined with the dynamism and

unparalleled creativity of our teams, will enable us to reinforce,

once again in 2017, LVMH's global leadership position in luxury

goods.

An interim dividend of 1.60 Euro

will be paid on December 7th, 2017.

Regulated

information related to this press release, the half year results

presentation and the half year financial statement are available on

our internet site www.lvmh.com

Limited review

procedures have been carried out, the related report will be issued

following the Board meeting.

ANNEXE

LVMH - Revenue by

business group and by quarter

First Half

2017

| (Euro millions) |

Wines

& Spirits |

Fashion

& Leather Goods |

Perfumes

& Cosmetics |

Watches

& Jewelry |

Selective Retailing |

Other

activities & eliminations |

Total |

| First quarter |

1

196 |

3

405 |

1

395 |

879 |

3

154 |

(145) |

9 884 |

| Second quarter |

1 098 |

*3 494 |

1 275 |

959 |

3 126 |

(122) |

9 830 |

| Total revenue |

2 294 |

6 899 |

2 670 |

1 838 |

6 280 |

(267) |

19 714 |

* Including the entire revenue of

Rimowa of the first half of 2017.

First Half 2017

(organic growth compared to the first half 2016)

| |

Wines

& Spirits |

Fashion

& Leather Goods |

Perfumes

& Cosmetics |

Watches

& Jewelry |

Selective Retailing |

Other

activities & eliminations |

Total |

| First quarter |

+13% |

+15% |

+12% |

+11% |

+11% |

- |

+13% |

| Second quarter |

+6% |

+13% |

+13% |

+14% |

+12% |

- |

+12% |

| Total revenue |

+10% |

+14% |

+12% |

+13% |

+12% |

- |

+12% |

First Half

2016

| (Euro millions) |

Wines

& Spirits |

Fashion

& Leather Goods |

Perfumes

& Cosmetics |

Watches

& Jewelry |

Selective Retailing |

Other

activities & eliminations |

Total |

| First quarter |

1

033 |

2

965 |

1

213 |

774 |

2

747 |

(112) |

8 620 |

| Second quarter |

1 023 |

2 920 |

1 124 |

835 |

2 733 |

(67) |

8 568 |

| Total revenue |

2 056 |

5 885 |

2 337 |

1 609 |

5 480 |

(179) |

17 188 |

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in

Wines and Spirits by a portfolio of brands that includes Moët &

Chandon, Dom Pérignon, Veuve Clicquot Ponsardin, Krug, Ruinart,

Mercier, Château d'Yquem, Domaine du Clos des Lambrays, Château

Cheval Blanc, Hennessy, Glenmorangie, Ardbeg, Belvedere,

Woodinville, Chandon, Cloudy Bay, Terrazas de los Andes, Cheval des

Andes, Cape Mentelle, Newton, Bodega Numanthia and Ao Yun.

Its Fashion and Leather Goods division includes

Louis Vuitton, Christian Dior Couture, Céline, Loewe, Kenzo,

Givenchy, Thomas Pink, Fendi, Emilio Pucci, Marc Jacobs, Berluti,

Nicholas Kirkwood, Loro Piana and Rimowa. LVMH is present in the

Perfumes and Cosmetics sector with Parfums Christian Dior,

Guerlain, Parfums Givenchy, Kenzo Parfums, Perfumes Loewe, BeneFit

Cosmetics, Make Up For Ever, Acqua di Parma, Fresh, Kat Von D and

Maison Francis Kurkdjian. LVMH's Watches and Jewelry division

comprises Bvlgari, TAG Heuer, Chaumet, Dior Watches, Zenith, Fred

and Hublot. LVMH is also active in selective retailing as well as

in other activities through DFS, Sephora, Le Bon Marché, La

Samaritaine, Royal Van Lent and Cheval Blanc hotels.

"Certain

information included in this release is forward looking and is

subject to important risks and uncertainties and factors beyond our

control or ability to predict, that could cause actual results to

differ materially from those anticipated, projected or implied. It

only reflects our views as of the date of this presentation. No

undue reliance should therefore be based on any such information,

it being also agreed that we undertake no commitment to amend or

update it after the date hereof."

| Contacts: |

|

|

| Analysts

and investors: |

Chris

Hollis

LVMH |

+ 33 1.4413.2122 |

|

|

|

|

| Media: |

|

|

| |

Jean-Charles Tréhan |

+33 1 4413.2026 |

| |

LVMH |

|

| |

|

|

|

France : |

Michel

Calzaroni/Olivier Labesse/

Thomas Roborel de Climens/Hugues Schmitt |

+ 33 1.4070.1189 |

|

|

DGM Conseil |

|

| UK: |

Hugh

Morrison / Charlotte McMullen |

+44 7921.881.800 |

|

|

Montfort Communications |

|

|

Italy: |

Michele

Calcaterra/ Matteo Steinbach |

+39 02 6249991 |

|

|

SEC and Partners |

|

| US: |

James

Fingeroth/Molly Morse/

Anntal Silver |

+1 212.521.4800 |

|

|

Kekst & Company |

|

PDF Version

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: LVMH via Globenewswire

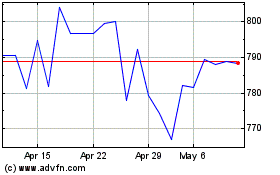

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

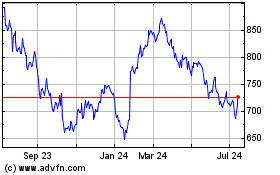

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024