LVMH Defies Economic Headwinds to Ease Investor Concerns -- Update

February 03 2016 - 1:40PM

Dow Jones News

By Jason Chow

PARIS-- LVMH Moët Hennessy Louis Vuitton SE is defying economic

headwinds in China and other parts of the world, easing investor

worries across the luxury industry.

Chief Executive Bernard Arnault's bullish take on Chinese

demand--supported by a 12% rise in fourth-quarter revenues--fueled

a rise in LVMH shares on Wednesday.

Shares closed at EUR151.75, off a morning peak but still 4.5%

higher than the previous day's close.

Chinese consumers are crucial to the luxury industry, with

experts estimating they account for more than a third of total

overall global luxury spending. China's mixed messages on currency

policy have investors worried over whether the world's

second-largest economy is slowing more sharply than expected.

Mr. Arnault brushed aside those concerns Tuesday night after

LVMH reported EUR10.38 billion ($11.3 billion) in sales during the

last three months of 2015.

"Analysts underestimate the Chinese economy," Mr. Arnault said.

"The fundamentals are good. Household spending is still increasing,

and that's important to us."

LVMH's status as a luxury bellwether--with businesses ranging

from jewelry and watches to the DFS duty-free chain and the Sephora

cosmetics label--helped stabilize share prices across the

industry.

Trading in Kering SA, which owns Gucci and Yves Saint Laurent

slipped 0.1% on Wednesday, while shares in Hermès International SCA

rose 2.2%. The Paris CAC-40 index ended the day down 1.3%.

Mario Ortelli, a luxury analyst at Sanford C. Bernstein, said he

was "encouraged by [Mr. Arnault's] confidence going into 2016

despite the volatile economic environment."

Strong demand for LVMH's fashion and leather goods as well as

its alcoholic drinks helped the luxury giant overcome headwinds

that have affected rivals.

The Nov. 13 attacks in Paris sapped demand in a city where many

tourists, particularly the Chinese, come to splurge on luxury

goods. China's anticorruption crackdown continues to hit demand in

other parts of the luxury sphere, most notably in watches.

Swatch Group AG, which owns high-end brands including Longines,

Breguet and Omega, said Wednesday that net profit fell to 1.09

billion Swiss francs from 1.38 billion francs, hurt by the strength

of the Swiss currency and weak demand for expensive timepieces. The

profit figure was also below analysts' expectations.

That news sent shares in the Swiss watch company down as much as

4% in early trading, before rebounding later in the day. Shares

closed at 334.80 Swiss francs, or about 1.2% lower than Tuesday's

close.

Shares fell despite the company's decision to buy back 1 billion

Swiss francs ($982 million) of its shares.

Analysts at Citi said there was "not much to cheer for" in the

latest results, which reflected "adverse macro and geopolitical

environment, global price gap distortion from [foreign-exchange]

volatility and further demand weakness for Swiss watches in Hong

Kong."

While associated by its namesake plastic watch brand, Swatch is

heavily reliant on the high-end brands. About 45% of its sales form

high-end brands like Omega, which retail for more than $7,000, and

20% from its upper end brands like Longines and Rado, which sell

from around $1,200.

Chinese shoppers' shifting tastes, as well as their

sensitivities to currency shifts and political tension, have many

questioning the sector's overall growth this year.

Luca Solca, luxury analyst at Exane BNP Paribas, predicts the

Chinese consumer in 2016 will spend "marginally more at home but

less abroad" if Beijing increases restrictions on capital outflows

and raises taxes.

Most luxury brands are straining to boost sales on mainland

China, Mr. Solca said, because consumers prefer to shop abroad.

That allows them to take advantage of currency arbitrage while

avoiding local import duties and luxury taxes.

Louis Vuitton, however, has bucked that trend, Mr. Solca said,

adding: "Louis Vuitton has the best momentum among soft luxury

megabrands."

John Revill in Zurich contributed to this article.

Write to Jason Chow at jason.chow@wsj.com

(END) Dow Jones Newswires

February 03, 2016 13:25 ET (18:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

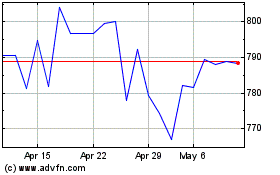

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

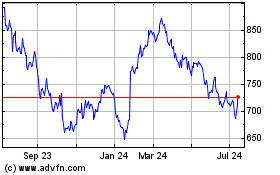

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024