LVMH Moët Hennessy Louis Vuitton, the world’s leading luxury

products group, recorded a 4% increase in revenue, reaching €26.3

billion, for the first nine months of 2016. Organic revenue grew 5%

compared to the same period in 2015.

With organic revenue growth of 6%, the third quarter saw an

acceleration compared to the first half of the year. Asia,

excluding Japan, showed a significant improvement during the

quarter. The United States remains well positioned, as does Europe,

with the exception of France which continues to feel the impact of

a decline in the number of tourists.

Revenue by business group:

In million euros

9 months 9 months

Change 2016 / 2015

2016 2015

First 9 months

Reported

Organic* Wines & Spirits 3 281 3 129

+ 5 % + 7 % Fashion & Leather Goods 8 991

8 872 + 1 % + 2 % Perfumes & Cosmetics

3 578 3 371 + 6 % + 8 % Watches &

Jewelry 2 486 2 404 + 3 % + 4 %

Selective Retailing 8 283 7 878 + 5 % +

6 % Other activities & eliminations (293) (366)

ns ns Total

26 326 25 288

+ 4 % + 5 %

* With comparable structure and constant exchange rates.

The Wines & Spirits business group recorded organic

revenue growth of 7% in the first nine months of 2016. Champagne

volumes grew 3% over the period, with a particularly strong

performance in prestige cuvées. Hennessy cognac saw its volumes

increase by 9%. The United States continued to enjoy strong growth

and China showed improved momentum during the period, following the

destocking of distributors in 2015. Other spirits, Glenmorangie and

Belvedere continued their development.

The Fashion & Leather Goods business group recorded

organic revenue growth of 2% for the first nine months of 2016 with

an acceleration in the third quarter. Louis Vuitton maintained

strong momentum and ventured into a new territory with the launch

of the Louis Vuitton perfumes. The seven fragrances, created by

Master Perfumer Jacques Cavallier Belletrud, have made a very

promising start. The new Horizon luggage, conceived by Marc Newson,

was also among the major innovations of the last quarter. Fendi

generated significant revenue growth. Loro Piana inaugurated a

flagship store in Paris on Avenue Montaigne. Céline, Loewe and

Kenzo experienced good growth. Marc Jacobs continued the

repositioning of its collections. An agreement was announced for

the sale of the Donna Karan business. LVMH announced the

acquisition of a majority stake in the German Maison, Rimowa,

global leader in high quality luggage. The transaction, subject to

the approval of the competition authorities, is due to be completed

in January 2017.

The Perfumes & Cosmetics business group recorded

organic revenue growth of 8% for the first nine months of 2016,

outperforming the market. Parfums Christian Dior continued its

strong performance, gaining market share in all countries. The

continued momentum of its iconic fragrances, the great success of

Sauvage and its latest innovations in the makeup segment were the

main drivers of the growth of the brand. Guerlain successfully

expanded its perfume brand, La Petite Robe Noire, into the world of

makeup, a segment in which Givenchy saw strong growth. Supported by

a bold marketing campaign, the launch of the new perfume Kenzo

World, was a success. Benefit, Make Up For Ever, Fresh and Kat Von

D all delivered excellent performance.

The Watches & Jewelry business group recorded organic

revenue growth of 4% for the first nine months of 2016. Bvlgari

continued to gain market share and showed major creative momentum

by enriching its iconic product lines, notably with the recent

launch of Serpenti Seduttori. TAG Heuer made great progress in a

difficult market, benefiting particularly from the success of its

new collections and its smartwatch. Hublot continued the

development of its iconic lines, Classic Fusion and Big Bang.

Chaumet furthered its progress, driven by the success of its

Joséphine and Lien collections.

The Selective Retailing business group recorded organic

revenue growth of 6% for the first nine months of 2016. Sephora

continued to gain market share in all its markets and recorded

double-digit revenue growth. Online sales rapidly increased in all

regions and Sephora continued its store opening program. DFS

navigated a difficult tourist environment in Asia, particularly in

Macao and Hong Kong. After Cambodia in the first half, DFS opened

in September a new T Galleria in Europe, in Venice, thus expanding

its presence in major tourist destinations.

Outlook

In an uncertain geopolitical and currency environment, LVMH will

continue its strategy focused on innovation and targeted geographic

expansion in the most promising markets. LVMH will rely on the

power of its brands and the talent of its teams to further extend

its global leadership in the luxury market in 2016.

During the quarter and to-date, no events or changes have

occurred which could significantly modify the Group’s financial

structure.

Regulated information related to this press release and

presentation is available on our internet site www.lvmh.com

ANNEX

LVMH – Revenue by business group and by quarter

2016 Revenue (Euro millions)

FY 2016

Wines &

Spirits

Fashion &

Leather Goods

Perfumes &

Cosmetics

Watches &

Jewelry

Selective

Retailing

Other activities

& eliminations

Total First Quarter 1 033

2 965 1 213 774 2

747 (112)

8 620 Second Quarter

1 023 2 920 1 124

835 2 733 (67)

8 568 Total First Half 2 056

5 885 2 337

1 609 5 480 (179)

17 188 Third Quarter 1 225

3 106 1 241 877

2 803 (114) 9 138

Nine

months 3 281 8 991

3 578 2 486

8 283 (293) 26 326

2016 Revenue (Organic growth versus same period of

2015)

FY 2016

Wines &

Spirits

Fashion &

Leather Goods

Perfumes &

Cosmetics

Watches &

Jewelry

Selective

Retailing

Other activities

& eliminations

Total First Quarter +6%

0% +9% +7% +4%

-

+3% Second Quarter

+13% +1% +6% +2%

+7% -

+4% Total

First Half +9% 0%

+8% +4%

+5% - +4% Third

Quarter + 4% +5% +10%

+2% +8% -

+6%

Nine months +7%

+2% +8% +4%

+6% - +5%

2015 Revenue (Euro millions)

FY 2015

Wines &

Spirits

Fashion &

Leather Goods

Perfumes &

Cosmetics*

Watches &

Jewelry

Selective

Retailing*

Other activities

& eliminations

Total First Quarter 992

2 975 1 129 723 2

648 (144)

8 323 Second Quarter

938 2 958 1 099

829 2 627 (67)

8 384 Total First Half 1 930

5 933 2 228

1 552 5 275 (211)

16 707 Third Quarter 1 199

2 939 1 143 852

2 603 (155) 8 581

Nine

months 3 129 8 872

3 371 2 404

7 878 (366) 25 288

* reclassification of the cosmetics business Kendo from

Selective Retailing to Perfumes & Cosmetics.

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in Wines and

Spirits by a portfolio of brands that includes Moët & Chandon,

Dom Pérignon, Veuve Clicquot Ponsardin, Krug, Ruinart, Mercier,

Château d’Yquem, Domaine du Clos des Lambrays, Château Cheval

Blanc, Hennessy, Glenmorangie, Ardbeg, Wenjun, Belvedere, Chandon,

Cloudy Bay, Terrazas de los Andes, Cheval des Andes, Cape Mentelle,

Newton, Bodega Numanthia and Ao Yun-Shangri-La. Its Fashion and

Leather Goods division includes Louis Vuitton, Céline, Loewe,

Kenzo, Givenchy, Thomas Pink, Fendi, Emilio Pucci, Donna Karan,

Marc Jacobs, Berluti, Nicholas Kirkwood and Loro Piana. LVMH is

present in the Perfumes and Cosmetics sector with Parfums Christian

Dior, Guerlain, Parfums Givenchy, Parfums Kenzo, Perfumes Loewe as

well as other promising cosmetic companies (BeneFit Cosmetics, Make

Up For Ever, Acqua di Parma and Fresh). LVMH is also active in

selective retailing as well as in other activities through DFS,

Sephora, Le Bon Marché, La Samaritaine, Royal Van Lent and Cheval

Blanc hotels. LVMH's Watches and Jewelry division comprises

Bulgari, TAG Heuer, Chaumet, Dior Watches, Zenith, Fred, Hublot and

De Beers Diamond Jewellers Ltd, a joint venture created with the

world’s leading diamond group.

"Certain information included in this release is forward looking

and is subject to important risks and uncertainties and factors

beyond our control or ability to predict, that could cause actual

results to differ materially from those anticipated, projected or

implied. It only reflects our views as of the date of this

presentation. No undue reliance should therefore be based on any

such information, it being also agreed that we undertake no

commitment to amend or update it after the date hereof.”

/4

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161010005936/en/

Analysts and investors:LVMHChris Hollis+ 33

1.4413.2122orMedia:France :DGM ConseilMichel

Calzaroni/Olivier Labesse/Sonia Fellmann/Hugues Schmitt+ 33

1.4070.1189orUK:Montfort CommunicationsHugh Morrison /

Charlotte McMullen+44 7921.881.800orItaly:SEC and

PartnersMichele Calcaterra/ Matteo Steinbach+39 02

6249991orUS:Kekst & CompanyJames Fingeroth/Molly

Morse/Anntal Silver+1 212.521.4800

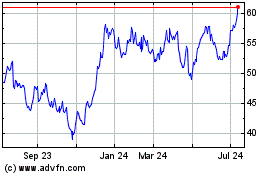

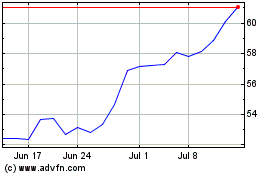

Moelis (NYSE:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moelis (NYSE:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024