LONDON MARKETS: FTSE 100 Steady After Jobs Data, But Trump Concerns Limit Gains

May 17 2017 - 6:17AM

Dow Jones News

By Carla Mozee, MarketWatch

U.K. completes sale of Lloyds shares; wages adjusted for

inflation fall

U.K. blue-chip stocks wavered Wednesday, even as U.S. equity

futures and a broad European index lost ground on concerns about

U.S. President Donald Trump's ability to push through reforms

investors have been wanting.

Asian stocks also fell after The New York Times reported that

Trump in February asked then-Federal Bureau of Investigation

Director James Comey to stop his investigation into former National

Security Adviser Michael Flynn

(http://www.marketwatch.com/story/us-stock-futures-under-pressure-amid-fresh-concerns-over-trump-2017-05-17).

The report cited a memo from Comey.

The FTSE 100 index was down less than 1 point at 7,521.50 but

has flicked in and out of positive territory after opening down

about 0.4%. Tech and financial shares were losing the most, while

consumer-related and basic material stocks were higher.

Across the English Channel, the Stoxx Europe 600 index

(http://www.marketwatch.com/story/european-stocks-drop-as-trump-worries-rattle-markets-2017-05-17)

was down 0.3%. In the U.S., Dow Jones Industrial Average futures

(http://www.marketwatch.com/story/us-stock-futures-slide-as-concerns-over-trump-grow-2017-05-17)

fell more than 100 points.

"Talks around the FBI and Russia keep the risk appetite limited

and the U.S. political agenda on the backstage," said London

Capital Group's senior market analyst Ipek Ozkardeskaya, noting the

U.S. Dollar Index has fallen back to levels last seen around

November's U.S. presidential election.

Infrastructure and bank shares worldwide have been among those

that have gained on the prospect the Trump administration would

boost infrastructure spending, push tax cuts and reforms through

Congress and relax regulatory rules for the financial sector.

In London, shares of banking heavyweight HSBC PLC (HSBA.LN)

(HSBA.LN) fell 0.7% and engineering company Rolls-Royce Holdings

PLC (RR.LN) declined 0.7%.

"The [U.S.] government's inability to expand the fiscal policy

at the pace promised by Trump automatically reduces the inflation

expectations and gives the Fed more time for normalizing its rates

and its balance sheet," said Ozkardeskaya.

The pound was buying $1.2932, up from $1.2915 late Tuesday in

New York, as the dollar declined.

A weaker dollar helped most dollar-denominated metals prices

rise, including gold futures , which picked up 0.7%. In turn, that

buoyed most London-listed shares of metals producers. Fresnillo PLC

(FRES.LN) climbed 2.4% and Rio Tinto PLC (RIO) (RIO) (RIO) rose

1.1%.

The FTSE 100 on Tuesday finished above 7,500 for the first time

(http://www.marketwatch.com/story/ftse-100-clings-onto-record-high-ahead-of-inflation-report-2017-05-16).

Data: The pound held to gains after the release of jobs data

from the Office for National Statistics

(http://www.marketwatch.com/story/uk-unemployment-hits-4-decade-low-wages-fall-2017-05-17).

The U.K. unemployment rate fell to 4.6%. Weekly earnings excluding

bonuses rose 2.4% in three months to March, but adjusted for

inflation, they declined by 0.2% compared with a year ago. Headline

inflation released Tuesday rose to 2.7% in April.

(2.7%%20headline%20inflation%20rate%20released%20Tuesday.)

Wage figures are closely watched by the Bank of England. The

Monetary Policy Committee last week held the key interest rate at

0.25%.

"Rate hike on the way? The market could be surprised on how

early the BOE hikes," wrote Berenberg's senior U.K. economist

Kallum Pickering in a note, adding that the central bank doesn't

expect the weakness in wage growth to last.

"We expect the first hike in Q1 2018 with a 40% chance the BOE

hikes this year, versus somewhat scattered -- depending on the

measure - market expectations of a first hike around

late-2018/early-2019," he said.

The central bank appears unlikely to raise rates just before the

U.K. is expected to leave the European Union around March 2019, he

said.

"If the MPC sees an opportunity to raise rates soon, they may

take it."

Stock movers: Lloyds Banking Group PLC (LLOY.LN) (LLOY.LN)

jumped 2.2%. The lender is back in private ownership after the U.K.

government sold its remaining shares in the company

(http://www.marketwatch.com/story/lloyds-bank-returns-to-private-ownership-2017-05-17).

The government bailed out Lloyds during the financial crisis.

(END) Dow Jones Newswires

May 17, 2017 06:02 ET (10:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

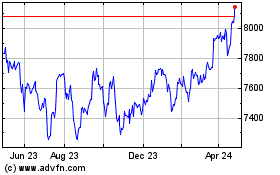

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

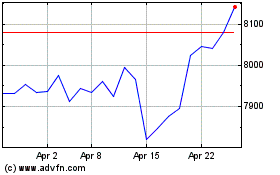

FTSE 100

Index Chart

From Apr 2023 to Apr 2024