LONDON MARKETS: FTSE 100 Seesaws After Returning To Pre-Brexit Level

June 30 2016 - 10:26AM

Dow Jones News

By Carla Mozee, MarketWatch

BOE's Mark Carney to speak ahead of close

U.K. stocks seesawed Thursday, searching for solid direction

after returning to pre-Brexit levels, as investors wait for a

policy update from Bank of England Governor Mark Carney later in

the day.

The FTSE 100 was up 0.3% at 6,377.78, as all but the financial

and consumer services sectors moved higher. But the blue-chips

index has been swinging between gains and losses throughout the

session. It's been down by as much 0.8%, and had risen by as much

as 0.6% intraday.

The benchmark on Wednesday shot up 3.6%

(http://www.marketwatch.com/story/ftse-100-pushes-higher-for-second-day-as-brexit-shudders-fade-2016-06-29),

erasing losses suffered after the U.K. last week voted for a

Brexit, or the U.K. to leave the European Union. The FTSE 100 also

finished higher Tuesday.

"All this week, the market has been trying to find a price for

stocks in the absence of much data about what's going to happen

from here on in, both in terms of how the Brexit is going to

proceed, what the political landscape is going to be and it's all

going to affect the economy," said Laith Khalaf, senior analyst at

Hargreaves Lansdown.

Read:Brexit fear drives negative-yielding debt to record $11.7

trillion

(http://www.marketwatch.com/story/brexit-fear-drives-negative-yielding-debt-to-record-117-trillion-2016-06-29)

In the wake of the Brexit vote, UBS said it now expects the FTSE

100 to reach 5,500 by the end of the year, compared with its

previous top-of-the-range forecast of 5,900 in the event of a

Brexit.

On the political front Thursday, Brexit backer and former London

Mayor Boris Johnson confounded widely held expectations by saying

he won't be in the running to become Britain's next prime minister

(http://www.marketwatch.com/story/former-london-mayor-boris-johnson-wont-seek-to-replace-british-prime-minister-2016-06-30).

Prime Minister David Cameron, who campaigned for the U.K. to stay

in the EU, said last week he's resigning.

The pound briefly flirted with $1.35 against the dollar after

Johnson's announcement because turning lower.

These are "part of the political eruptions we are seeing...that

need to play out," Khalaf added. "I don't think markets really are

going to take personalities of politicians into account. It's more

about just getting a handle on which way the government is

going...about someone being in charge or not being in charge rather

than actually who is in charge."

The FTSE 100 for the month was still heading for a gain of 2.2%,

which would mark the best monthly performance since October,

according to FactSet data.

Banks fall again: After a break from heavy selling, bank and

insurer stocks, which had been hit hard in the run-up to and after

the Brexit vote, were lower again Thursday. Royal Bank of Scotland

PLC (RBS.LN) shed 4.7%, Lloyds PLC (LLOY.LN) (LLOY.LN) fell 3.3%

and Barclays PLC (BCS) lost 1.2%. HSBC PLC (HSBA.LN) (HSBA.LN),

however, rose 1%.

Insurers also gave up ground, with Aviva PLC (AV.LN) and

Prudential PLC (PRU.LN) each down 1.7%.

Carney speaks: Investors will want to hear what BOE chief Carney

will say about monetary policy and the U.K. economy after the

Brexit vote and upheaval. He is scheduled to speak at 4 p.m. London

time, or 11 a.m. Eastern Time, half an hour before the end of

equity trading in London.

Earlier Thursday, the Office for National Statistics confirmed

that first-quarter U.K. gross domestic product grew 0.4%, meeting

expectations

(http://www.marketwatch.com/story/uk-business-investment-slow-even-ahead-of-brexit-2016-06-30).

While the current-account deficit narrowed to GBP32.6 billion

pounds ($43.38 billion) in the first quarter, that equates to 6.9%

of annual GDP, one of the largest deficits on record.

It "will be harder for the U.K. to bring the deficit down to

zero outside of the EU," wrote Nicholas Laser-Ebisch, FX analyst at

Caxton FX.

With a current-account deficit, the country earns less from

overseas than it spends at home and that gap must be bridged by

borrowing from abroad and pulling in foreign investment.

Read:Here's how a weak pound could wreck the U.K. economy

(http://www.marketwatch.com/story/heres-how-the-weak-pound-could-wreck-the-uks-economy-2016-06-28)

Other movers: 3i Group PLC (III.LN) climbed 6.1%, topping the

FTSE 100, after the venture capital company said it's planning to

increase investment in Action

(http://www.marketwatch.com/story/3i-to-increase-investment-in-retailer-action-2016-06-30),

a Dutch discount chain operator.

The pound was buying $1.3412 after changing hands at $1.3436

late Wednesday in New York.

(END) Dow Jones Newswires

June 30, 2016 10:11 ET (14:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

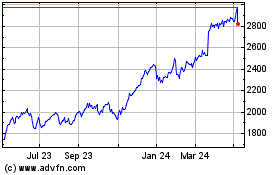

3i (LSE:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

3i (LSE:III)

Historical Stock Chart

From Apr 2023 to Apr 2024