LONDON MARKETS: FTSE 100 Pares Gains After Mixed GDP Data

February 22 2017 - 12:27PM

Dow Jones News

By Carla Mozee, MarketWatch

Shares of Lloyds and Unilever advance

U.K. stocks trimmed gains Wednesday as investors assessed a

mixed reading on U.K. economic growth, but Lloyds Banking Group PLC

and Unilever PLC held to higher ground after the lender posted a

profit surge and the Dove soap maker said it is launching a

strategic review.

The FTSE 100 finished up 0.3% to 7,302.25, off the day's highs

as losses among basic materials and oil and gas shares helped keep

overall gains in check. The London index on Tuesday shed 0.3%

(http://www.marketwatch.com/story/ftse-100-in-the-red-as-hsbc-slides-but-bhp-billiton-advances-2017-02-21).

The immediate reaction in equities was muted early Wednesday

after U.K. gross domestic product for the fourth quarter was

upwardly revised to 0.7%

(http://www.marketwatch.com/story/uk-economy-stronger-in-4th-quarter-than-thought-2017-02-22)

by the Office for National Statistics. But signs of weakness in the

report included a decline in business investment and slowing in

consumer spending during the last two months of 2016.

"The confirmation of strong overall growth momentum toward the

end of last year is, of course, encouraging. But we reckon that

headwinds to business and, in particular, household spending will

blow harder this year. And we question whether a sterling-related

boost to net trade completely offset these headwinds," said Chris

Hare, economist at Investec, in a note.

"For that reason, we maintain our view that the economy will

slow down, albeit modestly, over the next year or two."

Banks: Lloyds shares (LLOY.LN) (LLOY.LN) rose 4.3% after the

lender said pretax profit more than doubled to GBP4.2 billion ($5.2

billion), as it reduced the amount set aside to cover compensation

for customers sold payment-protection insurance (PPI) they didn't

need. Lloyds also carried out a program of cost cuts, including the

closure of branches.

Lloyds said it would pay a total ordinary dividend of 2.55 pence

a share, up 13% from a year ago. It will also issue a special

dividend of 5 pence per share.

On the heels of Lloyds report, HSBC shares (HSBA.LN) (HSBA.LN)

(HSBA.LN) added 2.1%. The shares on Tuesday dropped 6.5%, their

worst decline since March 2009, after the Asia-focused bank

reported a wider fourth-quarter net loss of $4.23 billion.

(http://www.marketwatch.com/story/hsbc-loss-widens-to-423b-plans-further-buyback-2017-02-21)

But other bank shares turned lower in afternoon trade, with

investors set to look for any indication that borrowing costs in

the U.S., the world's largest economy, are poised to be raised when

the Federal Reserve meets next month. Minutes from the Fed's most

recent meeting are due at 7 p.m. London time.

Shares of Barclays PLC (BCS) (BCS) , whose financial results are

due Thursday, fell 0.3%. Shares of Royal Bank of Scotland PLC

(RBS.LN) (RBS.LN) dipped 0.1%. Standard Chartered PLC (STAN.LN)

recovered at the close to finish up 0.3%.

See:What to expect in Barclays earnings

(http://www.marketwatch.com/story/what-to-expect-in-barclays-earnings-2017-02-20)

Movers: Unilever PLC (ULVR.LN) (ULVR.LN) soared 5.71% after the

consumer products heavyweight said it's conducting a

"comprehensive" review

(http://www.marketwatch.com/story/unilever-launches-strategic-review-of-operations-2017-02-22)to

pump out more value for shareholders. Just days before, Unilever

rejecting a $143 billion offer from Kraft Heinz Co. (KHC) .

Barratt Developments PLC shares (BDEV.LN) rose 0.5%. The home

builder posted an 8.8% rise in first-half pretax profit to GBP321

million

(http://www.marketwatch.com/story/barratt-to-increase-shareholder-returns-2017-02-22)

and said it would return a higher proportion of its earnings

through dividend payments.

The pound was buying $1.2460 compared with $1.2460 late Tuesday

in New York.

(END) Dow Jones Newswires

February 22, 2017 12:12 ET (17:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

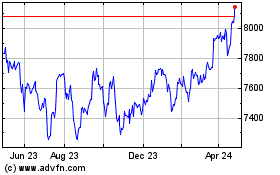

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

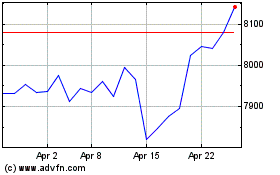

FTSE 100

Index Chart

From Apr 2023 to Apr 2024